Relatively young fleet may allow farmers to delay equipment purchases amid tariffs

Global trade disruptions have caused significant challenges for Canadian agriculture. Businesses prefer stability, but constant tariff changes create confusion, making it difficult to plan. Additionally, there's widespread uncertainty about the full impact of tariffs. The CUSMA exemption from the 10% blanket tariffs, and the 90-day delay in U.S. reciprocal tariffs, have given some relief to the agriculture industry.

However, farm equipment manufacturers still face a lot of uncertainty. Outside the automotive sector, it's less known that steel and aluminum tariffs are already in effect. Also, following CUSMA rules can be complicated for parts and components used in manufacturing.

Canada has a strong, primarily niche agriculture equipment manufacturing sector, but most equipment is sourced from the U.S. The U.S.–China trade war has significantly increased the cost of components from China, creating uncertainty in the farm equipment industry. This raises concerns about the availability and cost of equipment needed this year and beyond.

Steel and Aluminum tariffs

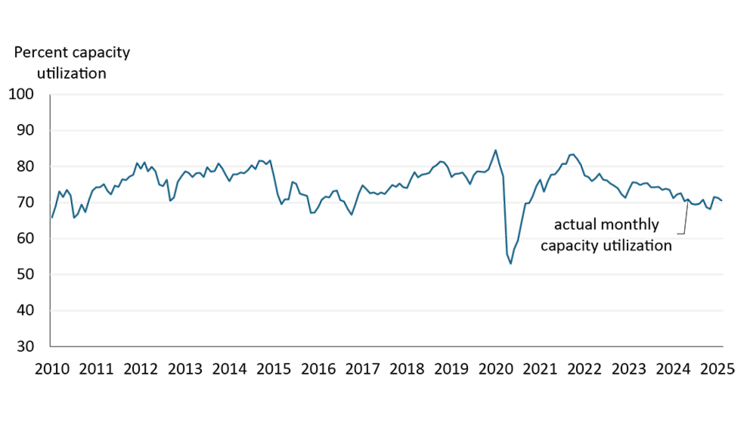

The primary reason for implementing the U.S. steel and aluminum tariffs was to boost domestic U.S. steel production, aiming to increase capacity utilization to over 80% (Figure 1). These tariffs have significant consequences for the farm equipment industry. When tariffs raise costs on raw materials like steel and aluminum, the price of new equipment also rises. This impacts demand for farm equipment and has broader implications for farmers and manufacturers.

Figure 1: U.S. iron and steel capacity utilization remains below target

Source: US FRED

The good news is that the impact on equipment prices might not be immediate for most of the equipment required this crop year, as manufacturers have raw materials already sourced and typically buy steel under fixed-price contracts. However, they will eventually need to negotiate new steel price contracts. Currently, equipment manufacturers are adopting a wait-and-see approach, causing some production slowdowns in hopes of a trade deal. They are reducing production to avoid excess equipment inventory and managing production costs. The steel and aluminum tariffs are likely to impact the various equipment categories differently, depending on where various steel and components are sourced from.

Navigating CUSMA compliance amidst global component complexity

Manufacturers must provide a certification of origin to claim preferential tariff treatment. This involves detailed documentation proving the equipment meets CUSMA's rules of origin. For the majority of parts, it’s not possible to be CUSMA compliant.

Newly manufactured farm equipment often includes components such as semiconductors or other electrical components imported from other countries including China. The U.S.– China trade war has significantly increased the cost of these components. Many parts, like hydraulic systems, belts, and bearings, are sourced internationally.

Tariffs, whether related to steel, non-CUSMA compliance, or the U.S. – China trade war, will raise the costs for manufacturers even for equipment being finalized for delivery and used this year. The Canadian farm equipment industry was already facing declining demand due to high equipment prices and reduced farm profitability. The current environment of tariffs and trade disruptions will further impede the farm equipment market and pressure pre-orders for 2026.

Decline in new orders and a shift towards used equipment

Farmers were already focused on per acre equipment costs before trade disruptions added to their concerns. U.S. farm equipment manufacturing sales declined by -18.4% in the first two months of this year, while Canadian sales fell by -5.7%. Uncertainty is deterring Canadian farmers from buying new equipment, leading to reduced pre-orders. Instead, farmers are maintaining existing equipment and investing in used machinery. New equipment purchases are likely to be delayed until tariff issues are resolved, driving demand and prices for used farm machinery.

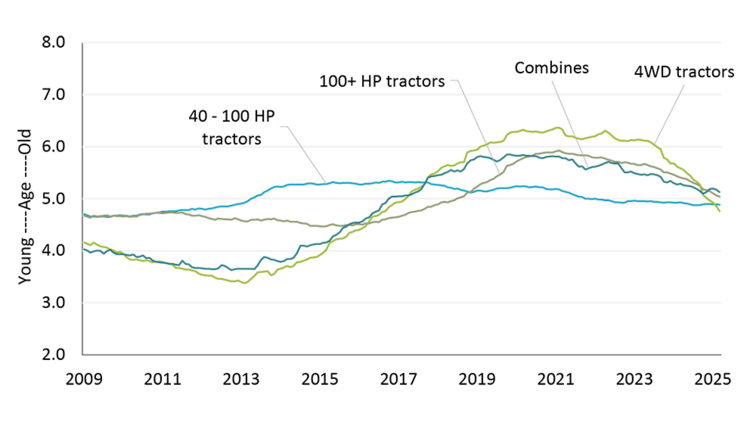

Age of Canadian farm equipment fleet

Rising farm equipment prices due to trade disruptions will alter farmers' replacement decisions. Reduced demand for farm equipment will impact the age of the Canadian fleet. However, the fleet can likely withstand reduced sales in the short term as the estimated age of the fleet is now at a multi-year low for most equipment types (Figure 2). In the longer term, investment upgrades to the Canadian equipment fleet will be necessary.

Figure 2: Proxy age of new farm equipment replacement cycle

*The proxy for farm equipment age is calculated using a rolling average of 5-year sales relative to 10-year sales to estimate the replacement cycle age.

Sources: AEM, and FCC Economics

Trends to monitor

1. Outlook for tariffs and potential trade deals

Monitoring the duration of tariffs, especially after the 90-day pause, is crucial. A trade agreement by July 9, 2025, is not guaranteed, particularly for steel and aluminum. The 2018 U.S. tariffs on steel and aluminum lasted 11 months before being scrapped.

2. Farm revenue

Crop prices and revenue so far this year have been difficult to predict. Profitability is getting tighter due to ongoing trade disruptions, impacting both commodity prices and costs. Even without tariffs, profitability projections for the year are already looking tight. Price volatility will continue as long as trade disruptions last. This year, prices are influenced more by geopolitical policies than by supply and demand, and these policies can change quickly. The good news is with this volatility there will be opportunities for farmers to secure higher prices.

3. Strategic replacement decisions – a made in Canada focus

Annual equipment upgrades in some operations could face long-term issues if disrupted. Canadian dealers and manufacturers might benefit by promoting Canadian-made equipment, which could be less affected by tariffs if more domestic steel and components are utilized. Farmers need to strategically assess their unique equipment needs to minimize disruptions to their replacement cycle. Dealers can help identify equipment with the least manufacturing cost increases for replacement this year.

Bottom line

Equipment currently being manufactured and used this crop year may have higher costs due to tariffs on components impacting overall manufacturing expenses. However, the 2026 equipment models face the most uncertainty right now. The entire industry is eagerly waiting for a resolution to the uncertainty and trade disruptions.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.