Farm debt growth slowed in 2020 – appreciation falls below farm revenue

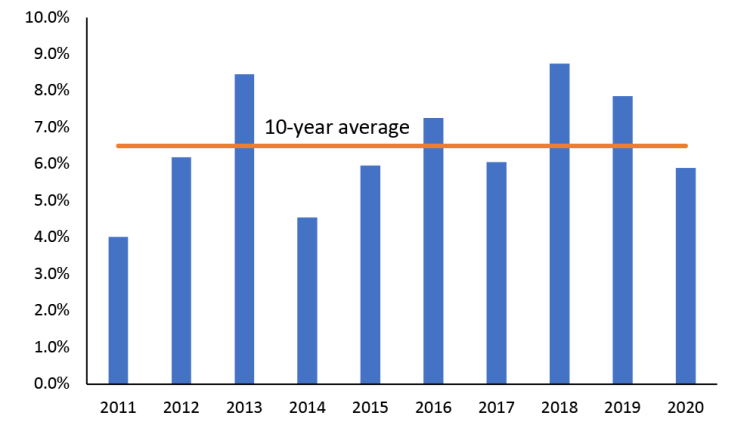

Canadian farm debt outstanding continued to increase in 2020 as producers invested in land, buildings and equipment. Overall farm debt rose 5.9% to $121.9 billion (Figure 1) – the lowest increase since 2014 and below the 10-year average of 6.5%.

Figure 1. Canadian farm debt growth

Source: Statistics Canada

Strong demand for agriculture commodities, notably grains and oilseeds and increased delivery opportunities supported growth in farm revenues of 8.1%, outpacing growth in farm debt for the first time in the past 6 years.

As a result, the overall financial picture of Canadian agriculture improved slightly, better positioning the agriculture industry to cover annual debt and interest payments, notably farmland ownership costs. It’s important to recognize that this isn’t consistent across all sectors and regions of Canadian agriculture - total livestock revenue decreased nearly 1% in 2020.

Looking forward, we project farm revenue to be record high in 2021 and outpacing expected growth in farm debt outstanding of around 6% in 2021. However, current drought conditions, high construction costs and other economic factors could impact farm revenue and debt forecasts.

Managing working capital and farm debt obligations remain top priority

The Bank of Canada (BoC) overnight rate is expected to remain unchanged in 2021 at 25 basis points. The economic recovery looks to be gaining momentum as vaccination rates increase in Canada and around the globe. Expectations are for the BoC to increase the overnight rate in the second half of 2022 as Canadian inflation is trending above 2%. However, we’ve already seen upward pressure for fixed interest rate products as long-term bond yields have increased through 2021.

It’s important to monitor what the BoC does, and longer-term bond yields as the bond market determines fixed rate lending. Nonetheless, interest rates are expected to increase in the future, increasing debt servicing requirements.

Implication of higher interest rates

The current Bank of Canada effective business interest rate of 2.29% would result in $2.8B in interest payments by farmers. Assuming no debt increases in 2021, it would only take an increase of approximately 50 basis points (0.5%) in interest rates to bring back farm interest payments to 2019 levels of $3.4 billion reported by Statistics Canada. The expectation, however, is that farm debt outstanding will increase approximately 6% in 2021. The combination of a 50-basis point increase in rates and 6% increase in debt would result in farm interest expenses rising over $200 million.

Understanding your financial risk exposure helps building economic resilience of your business. Stay informed on interest rate and other macro-economic trends through our quarterly FCC Economic & Financial Market Update.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.