4 economic topics generating discussion across the agri-food industry

One of the most enjoyable parts of being an economist at FCC is delivering our economic outlook at industry events. It allows us to hear directly from farm operations, food processors, and agribusinesses from across the country during the Q&A portion of the events.

I always learn a ton of relevant information from the conference discussions. Perhaps we could aggregate these insights into a barometer that measures the industry’s economic health? Until we convert the information into meaningful indicators, here’s a summary of the top four topics of interest that our team heard at conferences throughout the summer, along with our assessment.

1. Inflation and interest rates are joined at the hip

Unequivocally the number one topic of concern. Inflation has come down to 7.6% in July (from 8.1% in June), almost entirely due to a decline in gasoline prices. Food inflation stands at 9.2%. The Bank of Canada decided to frontload the increases in its overnight rate because of persistent inflationary pressures. But is the economy on a path towards 2% inflation? Yes, we do expect inflation to start subsiding. The Bank of Canada estimates it will take all of 2023 for this to happen. Higher interest rates take time before they can temper demand and curtail inflation. But we should see improvement in the 2nd half of 2022 if energy prices come down.

Our assessment? We expect another 100 bps increase in the overnight rate before the end of the year. Canadian agriculture should remain financially healthy given the strength of 2022 cash receipts projections.

2. A recession isn’t inevitable

It’s fair to say that the risks of a recession have risen in the last few months, but the consensus is that it’s not inevitable. Of course, inflation and higher interest rates lower households’ purchasing power – that’s weighing on the economy. And the yield curve is indicative of a future slowdown: short-term rates are above long-term rates. But the labour market is hot, with the July unemployment rate at 4.9% and wage growth strengthening. The two consecutive quarters of negative GDP growth in the U.S. fuel the conversations around a possible recession. But this GDP contraction is a result of declines in government spending and weaker exports, while fundamental economic indicators look much better than during previous recessions.

Our assessment? We still believe a soft landing of the economy can be engineered. And if a recession develops, it will be unlike what we’ve ever seen, given the state of the labour market. A global recession is perhaps what we should fear most. It would weaken commodity demand and potentially lead to lower agricultural commodity prices. Europe and China appear most at risk of a significant slowdown.

3. Profitability pressures are real, but relief is on the horizon

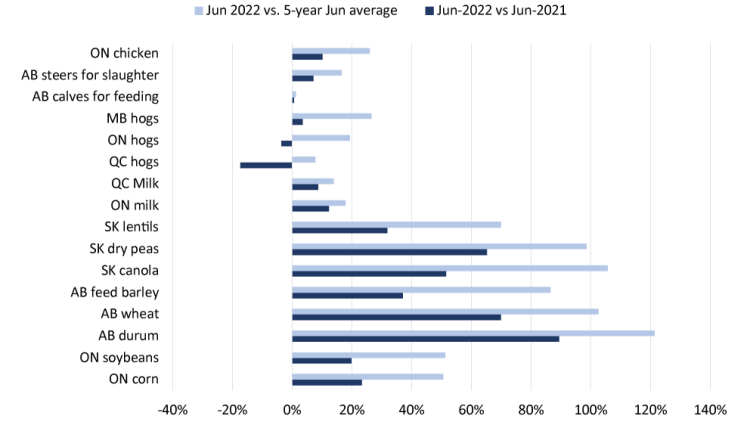

Food demand faced by Canadian producers and processors remains strong given the tight supply of commodities and food. That bodes well for gross income projections at almost all levels of the supply chain. But I’m often reminded that profitability matters more. Grain and oilseed prices started to decline in June but remained elevated relative to last year and their 5-year average (Figure 1). Yes, crop inputs are elevated but moved off their peaks (e.g., fertilizer). The decline in feed prices will bring some relief to livestock producers. Gross margins of food manufacturers have been about 10% lower on average in the first half of the year relative to 2021. But declines in raw material prices send positive signals for the second half of 2022. Labour costs remain challenging to profitability and will lead more businesses to seek automation solutions.

Figure 1: June 2022 monthly average prices relative to last year and 5-year averages

Source: Statistics Canada

Our assessment? The war in Ukraine will likely continue to insert volatility, but stocks-to-use ratios for crops and livestock inventories are low. This should support pricing going forward until we obtain more certainty about the size of the 2022 crops. Long term? The OECD/FAO offers some optimistic projections.

4. Cryptocurrencies are not for the faint of heart

I’ve never had as many inquiries about the future of cryptocurrencies as over the summer. Full disclosure - this is the question I dislike most. Perhaps because I have no satisfactory answers. Many currencies found themselves in the news, often not for positive reasons. In the last 12 months, the Bloomberg galaxy crypto index went from a high of nearly 4,000 to a low of around 850.

Our assessment? Currencies serve two main purposes: a medium of exchange and store of value. You can buy goods and services with crypto, but they are accepted in only a few outlets, thus apparently meeting the first criterion. Can crypto store value? Yes, but crypto markets are relatively thin, which makes them volatile. Not great then for storing value.

Hope to catch up soon

Hearing first-hand from savvy farm, agri-business and food entrepreneurs at conferences is rewarding, and our team looks forward to attending a few industry events in the Fall. If we ever cross paths, please introduce yourself. There’s nothing I like more than a lively economic conversation.

Executive Vice President, Strategy and Impact and Chief Economist

J.P. Gervais is Executive Vice President, Strategy and Impact and Chief Economist at FCC. His insights help guide FCC strategy, monitor risks and identify opportunities in the economic environment. In addition to acting as an FCC spokesperson on economic matters, J.P. provides commentary on the agriculture and food industry through videos and the FCC Economics blog.

Prior to joining FCC in 2010, J.P. was a professor of agricultural economics at North Carolina State University and Laval University. J.P. is a Fellow of the Canadian Agricultural Economics Society. He obtained his PhD in economics from Iowa State University in 1999.