Did COVID-19 disrupt trends in Canada ag and food trade?

The economic impacts of the COVID-19 pandemic extend to all sectors of the economy. For ag and food trade, the long-term effects could be important as the COVID-19 pandemic has exemplified the fragility of food supplies that depend on imports. In response, several countries are developing their ag and food sectors to become more self-reliant.

Recent data from Statistics Canada gives us a glimpse into the impacts of COVID-19, which could hint toward permanent changes in trade patterns. We examined recent events and trends for selected ag and food products and discuss COVID-19 impacts for April 2020.

Canada became a net food exporter in 2019

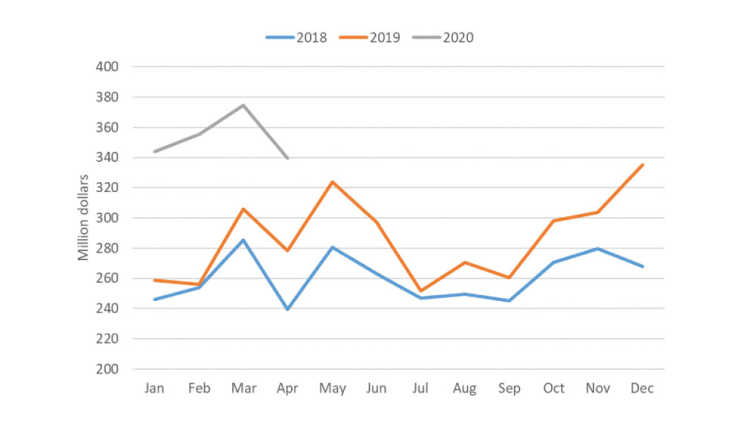

The COVID-19 pandemic also raised issues about food self-reliance in Canada. Interestingly, Canada now has a trade surplus dollar-wise for food products. But this does not mean that Canada is self-reliant, because the baskets of goods produced and consumed are different, and Canada relies on imports for several food products.

In 2016, Canada had an annual trade deficit for food of more than $2.8 billion. That deficit was reduced in 2017 and 2018 and turned into a $100 million surplus in 2019. In Q1 of 2020, Canada had a trade surplus for food of $578 million. This is partly due to seasonality as the trade balance for food tends to be more positive in the winter. From March to April, exports of food dropped by $550 million while imports decreased by $184 million, causing the trade balance to become negative. The COVID-19 pandemic may erase our net food exporter position in 2020 if the April trend continues.

Figure 1: Monthly Canada trade balance for food

Source: Statistics Canada, HS chapters 2, 4, 9, 11 and 15-22.

Pork exports on the rise

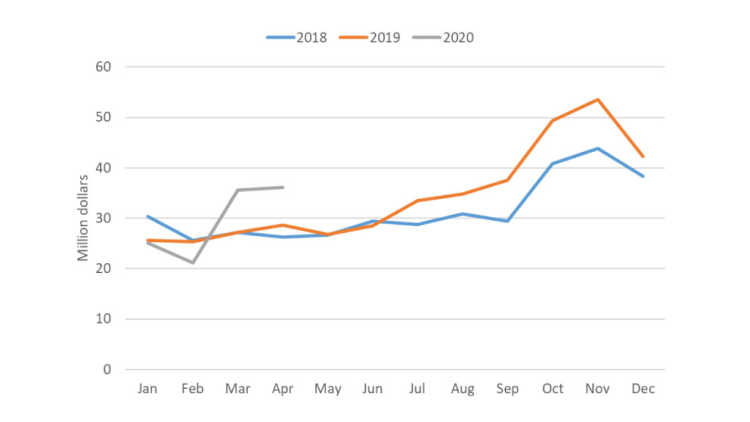

Since the beginning of the COVID-19 pandemic, we’ve not heard as much about the African Swine Fever (ASF) outbreak in China. Hog production is still significantly down, keeping pork prices high in that country. Throughout much of 2019, Canadian pork exporters did not benefit from China’s pork shortage due to China’s import ban.

Pork exports to China resumed in November 2019. In Q1 of 2020, exports to China caused Canadian total pork exports to increase by more than $70 million per month compared to Q1 2019. COVID-19 did not put the break on pork exports to China as total pork exports in April exceeded those for the same month in 2019 by $61 million.

Figure 2: Monthly total of Canada pork exports

Source: Statistics Canada, HS code 0203.

Two strong months for canola exports

Starting in March 2019, China customs suspended the licenses of Canadian companies exporting canola to China. The loss of access to the Chinese market was a major blowback to the canola industry, as 40% of canola seed exports in 2018 were to China. But Canadian exporters were able to find new buyers. Nonetheless, exports of canola declined by $1.55 billion from 2018 to 2019.

Although the licenses of the two major companies who exported canola to China are still suspended, canola exports to China recovered. In March 2020, total canola exports were about $650 million, a level not observed in more than a year and a half. In April, canola exports were still strong, with $590 million in shipments despite the slow-down of port activities because of COVID-19.

Figure 3: Monthly total of Canada canola exports

Source: Statistics Canada, HS code 1205.

Imports of cheese steady in April

The Canada-European Union Comprehensive Economic and Trade Agreement (CETA) has been in force since 2017. The agreement increased access to Canada’s dairy market to European products, notably cheese, for which the import quota will rise to 16 million kg in 2022.

Since the adoption of CETA, cheese imports have steadily increased, and have been particularly strong in the second half of the year. And while starting off slow, they climbed in March and April. Cheese imports were strong in April even though the total demand for cheese in Canada declined from the closure of food services. The robust import volumes may reflect earlier commitments or that the demand for the types of cheese imported was not affected by COVID-19.

Figure 4: Monthly total of Canada cheese imports

Source: Statistics Canada, HS code 0406.

Traditional markets may not always be there

Along with the trade dispute between the U.S. and China, increasing pressures for self-reliance will alter the international trade landscape. We are likely to see more trade disruptions linked to COVID-19. In the longer term, a concern is that countries who were traditional buyers or sellers of a commodity may no longer be reliable. Market diversification domestically and abroad becomes paramount to reduce the risk of the disappearance of markets.

Article by: Sébastien Pouliot, Principal Economist