Demand for harvest equipment remains robust

This outlook highlights opportunities and risks for Canadian agricultural equipment dealers, manufacturers and industry stakeholders for the 2023 harvest equipment season.

Key observations

New combine sales are projected to rise 40% in 2023 as manufacturers deliver on pre-orders.

New combine inventories have rebounded and are projected to exceed the five-year average.

Used combine prices may pull back.

High demand for headers for which pre-orders are outpacing combine pre-orders.

Grain cart inventories remain tight.

New and used 4WD tractor inventories are projected to remain low, and prices to remain elevated.

Harvest equipment market update

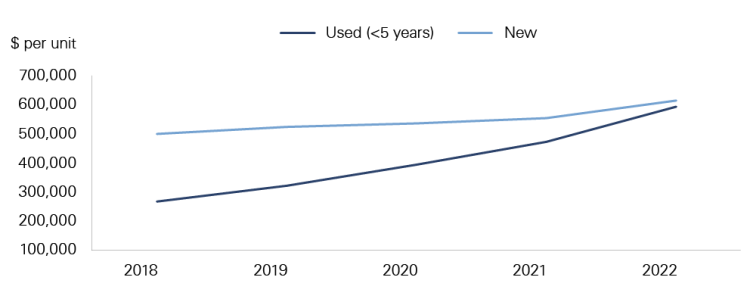

FCC Economics predicts used combine prices to potentially pull back as we head into harvest and throughout the remainder of 2023. Over the last two years, supply chain constraints have led to delayed deliveries of new combines from manufacturers, leading to decline in sales of new combines and inventory levels. The tight supply of new and used combines led to higher prices, with the spread between used and new combines becoming very narrow in 2022 (Figure 1).

Figure 1. Supply chain disruptions raised Canadian used combine prices

Sources: Alberta agriculture, Iron Solutions and FCC calculations (class 7 combine)

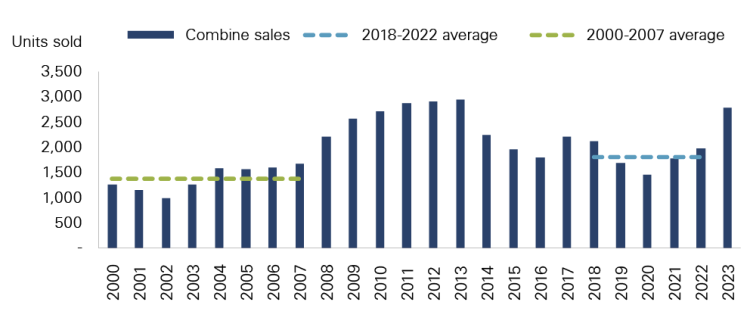

Combine manufacturers’ deliveries year-to-date have increased year-over-year (YoY) by over 100%. The high manufacturer deliveries of new combines to dealers (mainly pre-sold) result in our projection of combine sales rising 40% in 2023 (Figure 2).

Figure 2. Manufacturers increased deliveries of new combines

Sources: AEM and FCC calculations

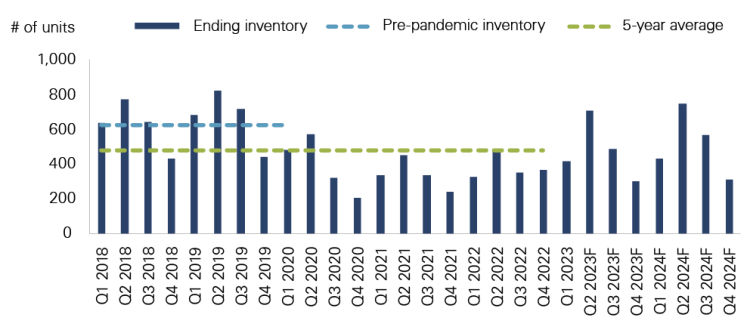

Combine trade activity has increased. For every new pre-order delivered, additional trades occur. We project that new combine inventory levels will trend above the five-year average for the remainder of 2023 and into 2024 (Figure 3). As new inventory levels improve, used combine prices may drop.

Figure 3. New combine inventory expected to rise above the five-year average

Sources: AEM and FCC calculations

Supply chains continue to impact headers, grain carts and 4WD tractors

Supply chain constraints continue to impact the delivery of headers, grain carts and large-horsepower tractors. Manufacturers faced delays in component sourcing issues, so many new 4WD tractors did not arrive in time for spring seeding. This kept the used market strong. According to surveyed equipment dealers, combine headers remain in high demand as pre-order sales currently outpace combines.

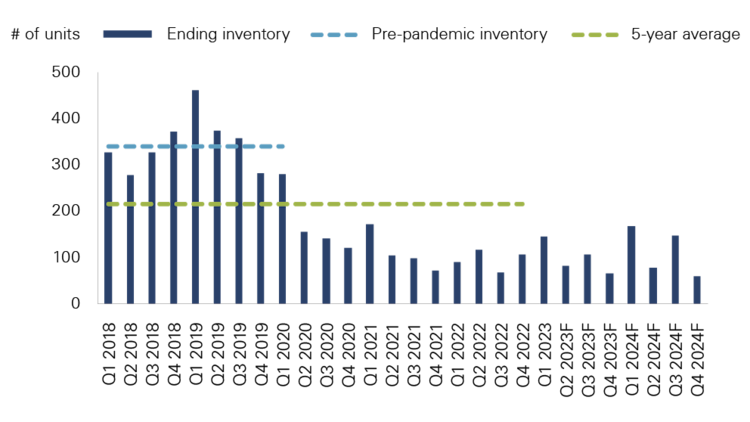

Dealers have indicated that inventory remains tight on used 4WD tractors. Manufacturer deliveries of high-horsepower 4WD tractors are expected to increase through the summer months, resulting in increased trade activities for dealers, auctions and farm-to-farm sales. Despite increased sales through the summer, we forecast new 4WD tractor inventory levels to remain limited through 2024 (Figure 4), keeping 4WD tractor prices elevated.

Figure 4. New 4WD tractor inventory expected to remain tight

Sources: AEM and FCC calculations

Macroeconomic trends to monitor

Higher interest rates

Rising Canadian dollar

The value of the Canadian dollar and interest rates are two macroeconomic variables that directly impact the farm equipment market.

FCC Economics expects the Bank of Canada’s overnight rate to peak soon, before rates are cut in the second half of 2024. We’re projecting fixed rates to decline in the second half of 2023 and early 2024 as bond rates start to fall and economic growth and inflation slow.

FCC Economics is projecting the Canadian dollar to hover around 0.74 to 0.76 for the remainder of 2023 and to average 0.77 in 2024. The loonie impacts both the used and new equipment markets. A rising Canadian dollar will offset higher prices on new equipment imported from the U.S. It will also mean dealers may have to adjust their USD sticker price. More information on interest rates and the value of the Canadian dollar are detailed in our quarterly macroeconomic snapshot.

Bottom line

As the harvest season approaches, watch for used combine prices to potentially fall. The good news: Combine inventory levels may climb as deliveries rebound, and demand for farm harvest equipment is projected to remain strong, given expectations of a profitable grain and oilseed sector. Managing pre-orders and trade-in values remains key for navigating the new and used equipment markets.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.