From strawberries to lentils: Canada’s diversity in food production & the challenge of self-reliance

The COVID-19 pandemic has generated discussion around the supply source of food. For many agriculture products, Canada produces significantly more than we can eat - and we became a net exporter of food in 2019. But we’re also accustomed to eating fresh fruit and vegetables year-round. As a result, trade is and will continue to be an essential component of the Canadian agri-food supply chain.

Building an index to measure reliance on trade

A trade dependence ratio measures the Canadian agri-food industry’s dependence on trade using net imports and exports relative to overall consumption.

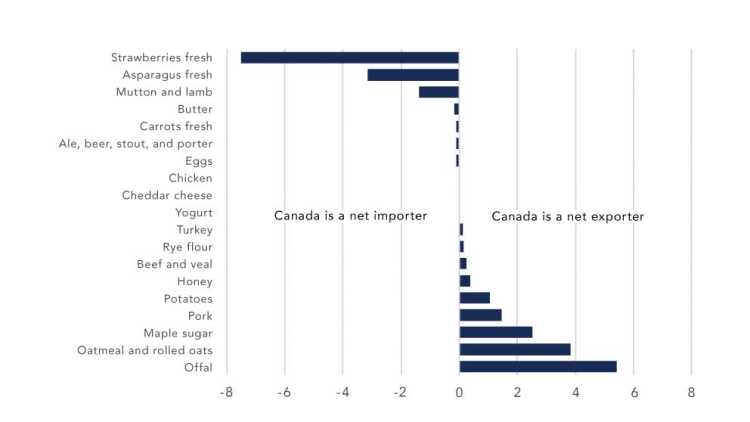

A value of 0 means Canada is self-reliant, as domestic production equals consumption (Figure 1). Negative values mean Canada is a net importer, while positive values record a net exporting position.

For example:

A value of -2 means that Canada’s net imports are two times larger than what it produces.

Conversely, a value of +2 means that Canada’s net exports are two times larger than what it consumes.

As expected, Canada is self-reliant in supply-managed sectors where the ratios are near 0.

Figure 1: Trade dependence ratio

Source: Statistics Canada

Strong net exports and a few dominant net imports

Canada’s production of fresh strawberries and asparagus does not meet the overall consumption needs with a trade ratio of -7.5 and -3.15, respectively.

We have an excess supply of pork, lentils and maple sugar as the ratio is much larger than the zero threshold.

Products under supply management have a ratio near zero, which is most often negative as we import products more than we export.

A net import position can represent an opportunity. Canada’s lamb and mutton sector have grown cash receipts 32% over the last ten years. The COVID-19 pandemic hit the sector's profitability hard, but Canada's overall demographic trends and food preferences are positive long-term trends for the industry. Net importing positions can also highlight difficulties challenging other producing countries’ dominant supplier positions given climate conditions and costs.

Net export positions cannot be taken for granted. Trade restrictions are a major risk, especially in current times of uncertainty. Food export restrictions implemented during the 2008-09 global recession or recently by Russia and Argentina can have unintended consequences. It can create significant commodity price spikes and lead import-dependent countries to promote their food systems at the expense of imports. Trade restrictions then have an overall negative impact on large food exporters like us.

The Canadian food supply chain is reliant on trade. A key risk to our exports and food affordability, is the potential that trade barriers impede the free flow of goods around the world. A strong global economic rebound should keep the demand for Canadian food vibrant globally.

James Bryan

Senior Relationship Manager

James joined FCC as an Agricultural Economics Analyst in 2011 and is now a Senior Relationship Manager in Thornton, Ontario. He also runs a small farm operation with his family. James completed a BSc in Environmental Science and a Masters of Agricultural Economics at the University of Guelph.