What’s your beef? A comment on beef trade dynamics

Teenagers growing up in English Canada in the 1990s are likely to fondly remember Street Cents, a newsmagazine TV series directed at adolescents that aired on CBC on weekday afternoons. The show – which won several Gemini Awards – was aimed at promoting consumer and media awareness for young people and featured several reoccurring segments to achieve their aims. One of these segments was called ‘What’s your beef?’, where viewers could submit complaints – or ‘beefs’ – about products or services to be investigated by the Street Cents team.

Were the show to still exist today, it’s likely modern viewers would be submitting their beefs about beef itself. Last month, CTV national news ran a story entitled What’s behind the high price of Canadian beef? Amongst other things, the story cites statistics about the fall in U.S. beef imports and the rise of non-American beef imports. The impetus behind CTV’s story appears to be driven by recent developments in the U.S. where President Trump announced plans to quadruple the volume of low-tariff Argentinian beef imports, ruffling U.S. ranchers’ feathers in the process. The policy change, Trump claims, aims to lower retail prices for U.S. consumers who are – like Canadian consumers – seeing eye-watering retail beef prices that only continue to increase.

Let’s take a closer look at Canadian beef trade dynamics.

A deeper dive into beef import data

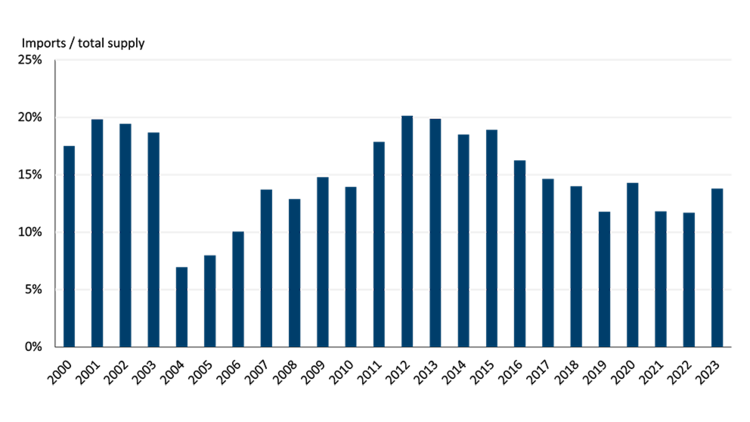

Is Canada importing more beef? The answer depends on your point of reference. As a percentage of Canada’s total beef supply, imports of beef are relatively low by historical standards (Figure 1). Prior to the BSE crisis in 2003, imports made up 19% of the total amount of beef available in Canada on average. This dramatically fell in 2003 (down to 7%) but over the years, as borders reopened and beef trade resumed, this number increased and peaked at 20% in 2012 and 2013. However, since then, the percentage has trended downward, although in 2023 – the last year of data available for this particular dataset – the number rose from 12% to 14%. So, when looking at the long run, the data suggests beef imports are relatively low.

Figure 1: Beef imports as a percentage of total supply is currently low by historical standards

Sources: Statistics Canada, FCC Economics

However, we do acknowledge that other more recent sources of data are showing a rise in beef imports this year. So far in 2025, total beef imports are up 11% compared to 2024. Imports from the U.S. are indeed down -22% with imports from other countries up 35%, with notable increases this year from New Zealand, Australia, Paraguay and Argentina.

Imports from the U.S. are likely down due to the same factors at play for Canadian ranchers: successive years of drought leading to herd downsizing. Recall that the U.S. beef herd is currently at the lowest level it’s been since 1951. At the same time, there has been an ever-resilient demand for beef, even in the face of increasing retail prices. Put another way, there is simply less incentive in the U.S. to export what is available, including to Canada. The USDA is essentially confirming this with their estimates for the year: they are expecting total U.S. beef production to decline -1.1% but total exports to fall -10.6% as more beef stays within their own borders.

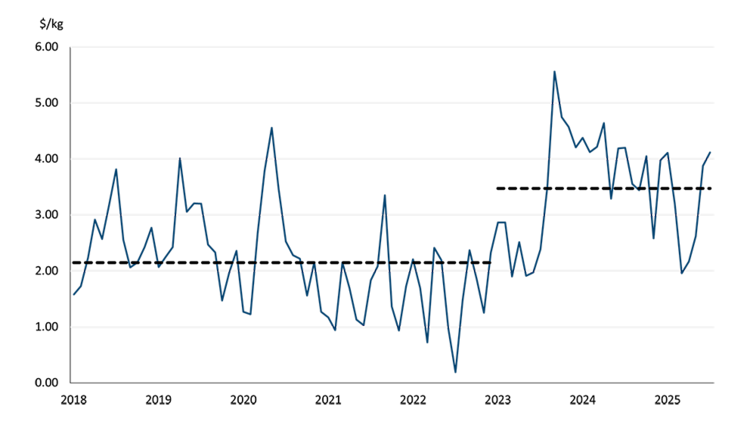

We can also see this playing out in Canadian trade data. Since 2023, imports of U.S. beef have become more and more expensive relative to the price of non-U.S. beef imports (Figure 2). Between 2018 and 2022 this U.S. premium averaged $2.15, but since 2023, it has averaged $3.48.

Figure 2: US beef imports have been fetching a larger price premium since 2023

Average price per kilogram of U.S. imported beef less the average price of non-U.S. imported beef.

Sources: CIMTD, FCC Economics

What about non-U.S. beef imports? As with most complex issues in life, the devil is in the details. Imports from countries that are not part of CUSMA (that is, other than the U.S. and Mexico) are shipping cheaper, frozen cuts of beef, most of which are classified in the ‘all other’ category, an indication of lower quality (Table 1). The exception would be Japan who is presumably shipping Kobe (Wagyu) beef, a premium niche product (note that Japanese beef imports represent only 0.3% of total beef imports so far in 2025). Meanwhile the U.S. and Mexico are often shipping fresh, more expensive beef. Considering logistics and costs, the data below are all perfectly rational.

Table 1: Characteristics of imported beef in 2025

Region | Average price per kg | Percentage of beef imports frozen |

|---|---|---|

North America | $ 14.23 | 8% |

All other (excluding Japan) | $ 9.21 | 86% |

Japan | $ 20.30 | 1% |

January to July. Top four HS 10 codes by value, accounting for 60% of imports.

Sources: CIMTD, FCC Economics

Exports – the flipside of the trade coin

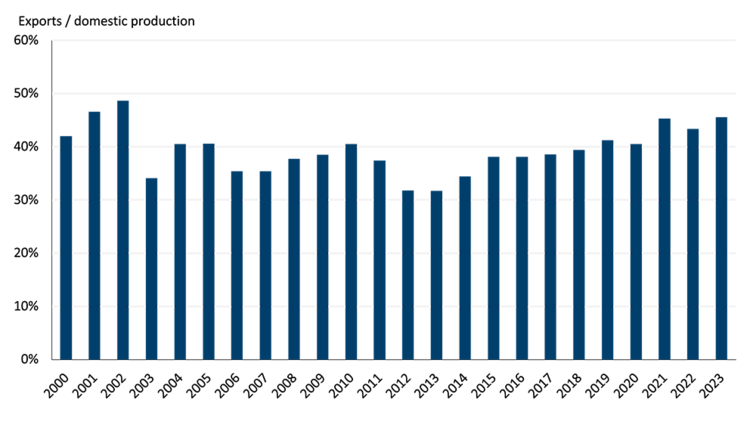

In order to provide a better, more complete picture of the beef trade, we must also look at exports. Here we find some interesting insights. Canada’s beef exports (as a percentage of total domestic production) reached 46% in 2023, the highest recorded percentage in the post-BSE era (Figure 3). Even as the herd has contracted over time, more of our total production has left the country.

Figure 3: Canada has been exporting more of its beef production since 2013

Sources: Statistics Canada, FCC Economics

So far in 2025, our beef exports are down -2.6% (relative to the same time last year) and are also down -9.7% from recent highs seen in 2021 when drought ravaged the prairies and producers culled their herds more aggressively. Given the Canadian beef herd is at the lowest level in 35 years, this recent export data should not be a surprise.

In terms of destinations of our beef exports and marketshare, the U.S. is still very clearly our number one customer and, as noted above, is willing to pay for it. Given the shrinking herd size and the Chinese ban on Canadian beef imports that began in 2021 (and remains in place) analyzing the shifts in marketshare are difficult. However, there have been noteworthy gains Mexico, South Korea, and Vietnam (Table 2). Even Japan – which lost market share over the six-year period reported below – is still importing the same amount of beef it was in 2018; we’re just sending more to other parts of the world.

Table 2: Change in beef export marketshare, 2018 vs 2024

2018 | 2024 | |

|---|---|---|

U.S. | 77.2% | 82.5% |

Japan | 7.6% | 5.7% |

Hong Kong* | 5.6% | 0.5% |

Mexico | 3.5% | 4.2% |

China* | 2.9% | 0.0% |

South Korea | 1.2% | 3.1% |

Taiwan | 0.8% | 0.3% |

Philippines | 0.2% | 0.1% |

Vietnam | 0.3% | 1.9% |

*China instituted a ban on Canadian beef imports in 2021.

Sources: CIMTD, FCC Economics

Despite the decrease in quantity, the sector is raking in a record amount of money from its exports. By value, Canadian beef exports have already surpassed the $3 billion mark as of August, a 10% bump from the same period in 2024 and nearly double the total value of beef exports at the same point in 2018.

Bottom line

Beef imports (as a percentage of Canada’s total beef supply) remain low by historical standards, and meanwhile, beef exports (as a percentage of our domestic production) are high by historical standards. Yes, there has been an increase in beef imports this year from non-North American countries; however, this is a normal market response to a price signal - the high price of beef - indicating a shortage and/or rise in demand.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) entered into force in December 2018. Amongst the signatories are some major beef producing countries, a few of which are mentioned in the data above. Trade is a two-way street. If Canada wants access to markets for its products, other countries are going to want the same for their products. Indeed, this is the main point of trade agreements. So, while imports are up this year relative to last year, over the longer-term Canadian beef exports have grown in some key markets such as Mexico, South Korea, and Vietnam.

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.

Topics: Global economy, economic trends relevant to agriculture, agribusinesses and food processing