2020 mid-year farmland values – affordability improves with growth in farm revenue

Demand for Canadian farmland remains strong; however, tighter farm profitability contributed to a slower appreciation rate in all provinces but Alberta and Saskatchewan. Through the first six-month of 2020, Canadian farmland values increased by 3.7% on average. Plenty of factors explain the strong demand for farmland: healthy balance sheets and historically strong returns on farmland, low interest rates, and grains, oilseeds and pulse receipts that increased 6.3% in the first six months of 2020 despite several challenges including trade restrictions, weather challenges, a rail strike and COVID-19.

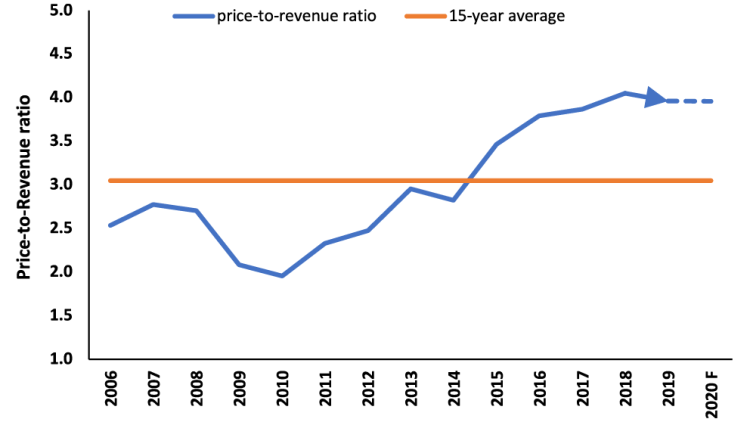

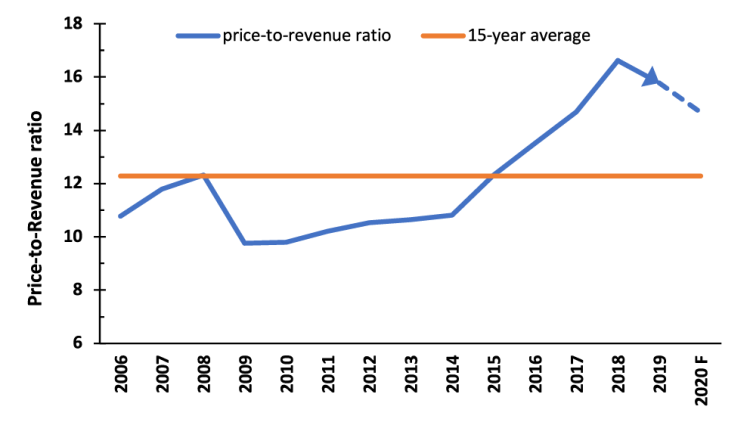

With the growth in grains, oilseeds, and pulse receipts outpacing the appreciation in farmland values, the affordability of land improved for Canadian farm operations. However, this trend is not consistent across all provinces. One tool to gauge farmland’s affordability is to compare the average per acre land value divided by average expected returns per acre (price to revenue ratio). The 2020 price-to-revenue ratio estimate assumes the mid-year increase is reflective of the entire year. To forecast revenue, we use actual producer prices through August as well as futures market prices and industry yield expectations.

In Saskatchewan (Figure 1), strong increases in farmland values are matched with equally strong projected yields and prices, resulting in the price to revenue ratio expected to remain stable in 2020. In Ontario (Figure 2), the price to revenue is expected to trend down because of stronger crop revenues. Overall, affordability is expected to improve or remain flat in all provinces. The exception is Alberta, where farmland values increased 4.9% through the first 6 months and revenue is projected to increase by 3.8% based on current market prices and production estimates.

Figure 1. Average expected 2020 price-to-revenue ratio in Saskatchewan

Source: FCC calculations.

Figure 2. Average expected 2020 price-to-revenue ratio in Ontario

Source: FCC calculations.

Expectations for the remainder of 2020:

1. Interest rates will remain near record lows

The Bank of Canada will not raise its key interest rate until unemployment approaches pre-COVID-19 levels, and inflation returns sustainably to its 2% target. So, rate increases and removing quantitative easing are not options for the foreseeable future. Historically low interest rates are a key reason the price-to-revenue ratio is expected to remain elevated in 2020 and will possibly remain so over the next couple of years. When interest rates begin to increase, the Bank of Canada will likely move cautiously and borrowing costs will remain supportive of the farmland market.

2. Strength in crop receipts

Strong export demand for Canadian grains, oilseeds, and pulses will continue to create marketing opportunities for producers through the remainder of 2020. Timely rains in Eastern Canada and generally good growing conditions in Western Canada are expected to support higher production volumes, while weather challenges in the U.S. and strong global demand will be supportive of prices.

3. Robust demand for farmland

Demand for farmland remains stronger than supply as producers continue to grow their operation, striving for greater economies of scale by expanding their cropland acreage. The pandemic created liquidity challenges for several operations, especially in the livestock sector. This could weaken the demand for land in areas with a strong concentration of livestock activities. It is important to note that different regional trends exist. In markets that have experienced strong growth in recent years, we expect land values to remain flat.

Farmland is expected to stay relatively expensive when compared to gross farm revenues. Higher prices of grains, oilseeds and pulses, as well as strong export demand, could alleviate some of this pressure. Check back with us in April 2021, for the 2020 FCC Farmland Value Report results.

Senior Economist

Leigh Anderson is a Senior Economist at FCC with experience in agricultural markets and risk. He specializes in monitoring and analyzing FCC’s portfolio, industry health and providing industry risk analysis. In addition to his speaking engagements on agriculture and economics, Leigh is a regular contributor to the FCC Economics blog.

Leigh came to FCC in 2015, joining the Economics team. Prior to FCC, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.