A wrap of the decade that was 2020 (July to December)

The first half of 2020 was nothing but a once-a-century seismic shock. By July, across all Canadian ag, food and agribusiness sectors, we knew “the new normal” was simply code for much that was abnormal. Nonetheless, news of COVID-19 faded somewhat as crop progress and meat processing dominated headlines in July and August. News of successful vaccine development spurred hope everywhere. September and October also held much promise, despite mounting evidence of COVID-19’s return. November was filled with uncertainty following the U.S. election, while December’s rising commodity prices pointed to a much-needed recovery.

July

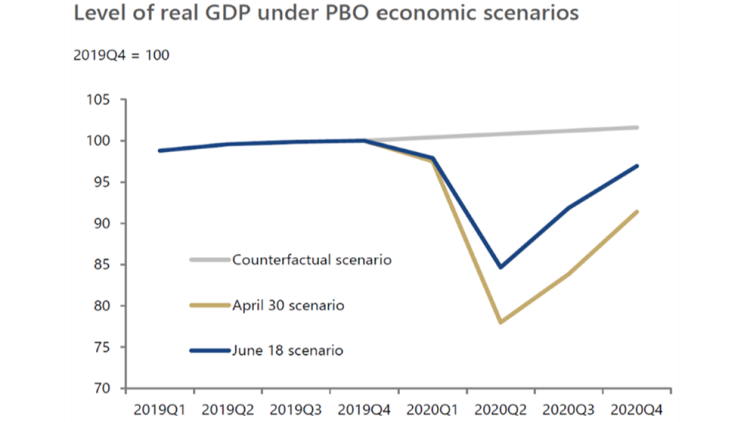

The Parliamentary Budget Officer’s (PBO) update of its COVID-19 economic scenarios suggested the 2020 recession would be deep (Figure 1). However, by July, Canada’s economy was on a better track than many had assumed it would be a couple of months prior.

Figure 1. A glimmer of hope for a V-type economic rebound

Source: Parliamentary Budget Officer.

However, two fiscal indicators stood out. The budget deficit for 2020-21 was projected at 11.8% of GDP, well above the 1984-85 record peak of 8.0%. And the federal debt-to-GDP ratio was projected at 44.4% at the end of the 2020-21 fiscal year, the highest in almost 20 years. It would take several more months to realize these mid-year estimates were too optimistic. The Bank of Canada held its benchmark interest rate steady at 0.25, indicating inflation would likely be below the 2% target for the next two years.

On the bright side, CUSMA went into force July 1, helping ease any worries about the health of North American supply chains. The powerful agreement outlined challenges facing supply-managed sectors. Simultaneously, it enhanced trade stability (among other benefits) with a partner accounting for over 55% of Canadian agriculture and agri-food exports and nearly 50% of imports in 2019.

August

If the early summer months of June and July showed a break in the relentless stream of worrying news, August brought even better news. Major weather events in the U.S. reduced expectations of the 20-21 marketing year’s crop size for both corn and soybeans. Better prices and an excellent harvest would do wonders for growth in Canadian producers’ crop receipts for 2020. Data for the second quarter had already shown an increase in those receipts.

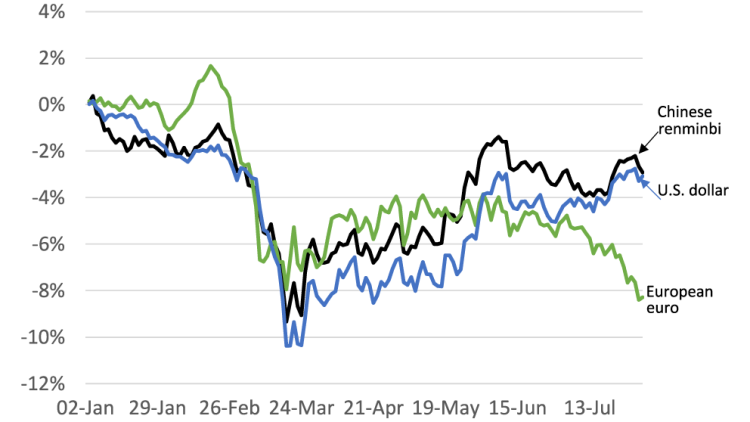

The beef packing plants that had closed in spring and early summer were once again running at full capacity, their return prompting McDonalds to resume purchases of Canadian beef. And while the weakened CAD had helped boost exports to China and the U.S. in the early days of the pandemic, the loonie’s growing strength relative to a declining USD (Figure 2) throughout the summer boded well for importers of food, equipment, and inputs. Such strength didn’t show up everywhere. The CAD continued to decline against the Euro, with Canada enjoying a competitive edge against European exporters to China.

Figure 2: % change in CAD exchange rates since January 1 shows growing strength against USD; declines against the Euro

Source: Statistics Canada.

September

More good news arrived in September. Hog prices surged after the discovery of African Swine Flu in Germany. Elsewhere, expected Canadian production was estimated to be higher for most crops than previous estimates – and in the case of wheat, the 2020 harvest was forecast to be the second-largest on record.

Production growth pushed expected revenues up for canola, dry peas, lentils, durum and spring wheat. Corn and soybean futures continued to trend up, as did estimates of their Canadian prices. U.S. export commitments to China in 2020-21, if adhered to, would be four times the actual volume of exports between the two superpowers in 2019-20.

Some news was mixed or pointed to uncertain outcomes. For instance, although global economic output recovered swiftly after the first shock caused by the pandemic, it had lost momentum shortly after.

The 2019 FCC Farmland Values Report published in April had shown a decline in farmland’s affordability – 2019’s growth in farm income hadn’t kept pace with the growth in land values. While the first six months of 2020 didn’t reveal much impact from COVID-19 on land values, the second half may. The low and falling commodity prices we saw during the early months of the pandemic may have weakened farmland demand between January and June. But higher prices and crop revenues in the second half, along with the low interest rates COVID-19 has produced, should increase demand for the rest of the year.

October

Sure enough, the good news of the summer waned in October when, as expected, COVID-19 cases gained momentum. While the ag and food supply chains had proven remarkably resilient in the first nine months, we started to again watch some of the most critical trends and factors to understand their re-emerging impacts on those chains:

Changes to both production and consumption of animal proteins

Measures implemented in packing plants to control the spread of COVID

Analysis conducted this month showed the year’s growth in Canadian ag and food exports between January and September had done little to alleviate concerns about the effectiveness of CETA, Canada’s trade agreement with the EU. Those concerns still exist. Instead, our exports’ gains had been largely attributed to challenging EU weather, biodiesel demand and a weaker CAD compared to the Euro – not the trade agreement.

But there was still good news. Western Canadian grain harvest was exceptionally quick this year, leading to strong producer deliveries to meet robust demand. Simultaneously, the USDA’s quarterly grain stocks report lowered stock estimates for corn, soybeans and wheat, pushing futures prices up again. U.S. hog prices were strong in October, with optimism growing around U.S. exports to China.

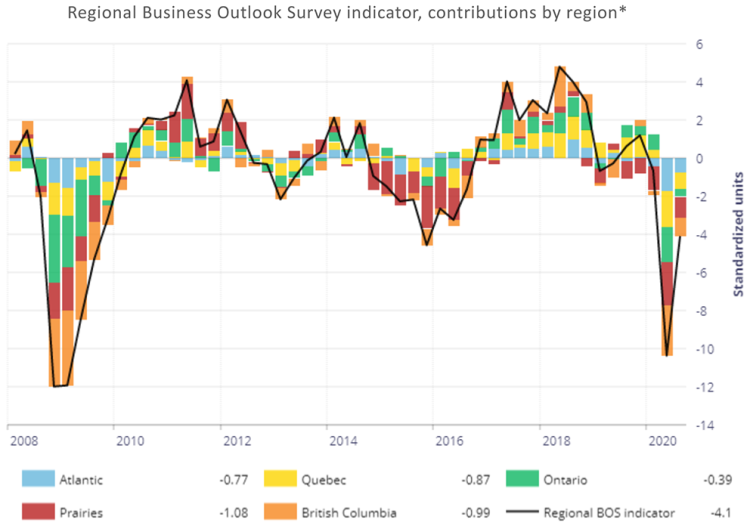

And the business sentiment that was strong in January, but that had fallen dramatically since showed improvement (Figure 3). In October, it was still negative but climbing.

Figure 3: Canadian business sentiment has improved across all regions

Source: Bank of Canada.

November

The month ushered in a hugely anticipated U.S. presidential election that read a lot like a high schooler’s play about treason, corruption, and U.S. pluck. Now in the middle of December, we’re still not sure how its results will play out for Canadian agriculture, food manufacturers and agri-business in the years ahead. Trade relations, especially with China, are arguably the #1 issue to watch with a new U.S. administration.

November’s other major trade news was also significant for Canadian exporters. First, fifteen Asia-Pacific economies signed the Regional Comprehensive Economic Partnership. The deal ensures greater competition from Australia for Canada’s beef and grains exports once it comes into effect. On the upside, Canada and the United Kingdom reached an interim post-Brexit trade agreement. Extending the terms of CETA, 98% of Canadian products exported to the UK will remain tariff free.

Finally, the ag sector was spared some of the worst business outcomes of COVID-19 during the fall months. For one thing, Canada’s backlog of fed cattle was down by roughly 50,000 head between June and October, boosted by an even faster decline in the U.S. And new StatsCan/AAFC pricing forecasted revenues for some of the largest grains and oilseeds crops in 2020 to increase year over year by almost two billion dollars – a rather astonishing 7.5% gain.

December

Local and global supply chains were both robust and fragile this year. For example, the strength in demand from China and production concerns in Europe, the Black Sea region and South America led to higher grain, oilseed and pulse prices. Canola futures neared $600 per tonne in mid-December, a sharp contrast from the 2020 low of $446 recorded in February. U.S. soybean futures flirted with US$12 per bushel at the beginning of the month, quite different than the US$8.22 recorded in mid-March. U.S. corn futures at the beginning of the month were 30% higher than in April. Cattle prices remain below their 5-year average, but hog prices have rebounded from the summer lows.

Most of these economic signals point to a recovery. But although we’re ending an incredibly difficult year, we’re not through the challenges that shaped so much of it. Three forces – the geopolitical tensions, negative weather events induced by climate change and the deadly global virus – that exposed risks for agri-food supply chains in 2020 will return in 2021. We’ll dig into these three in our first two posts in January.

So, as vaccine approvals climb globally amid strengthening hope for eased lockdowns, we’d like to take a moment to acknowledge Canadian ag, food and agri-business. We’ve survived, and some have thrived in, a year of devastating losses, unmitigated uncertainty, and a persistently murky vision of the horizon ahead. That success is due to nothing other than the strength and resilience of the industries we at Farm Credit Canada serve. To all, a Merry Christmas and a happy New Year.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.