3 takeaways from the Bank of Canada report

The Bank of Canada (BoC) left its overnight rate target unchanged at 0.25% as expected. More importantly, its economic guidance matters for agriculture and food markets.

1. Look beyond the aggregate GDP numbers. Focus on what the economic recovery looks like for the buyers in your markets

The current recession is unprecedented, so assessments about the economy at the onset of the pandemic mostly focused on an alphabet of possible economic situations:

Government intervention was necessary to avoid structural damages to the economy or a so-called L-type recession. Otherwise, the long-term pattern of economic growth remains systematically lower than before the recession.

Confinement measures once lifted could trigger a V-shaped recovery (a steep decline followed by a robust rebound); or

The recovery could be a long ascent, with GDP following a U-type pattern.

There’s now evidence that the recovery is uneven and a new letter emerged in the last few weeks: a K-shaped recovery. Different subsets of the labour force experience various economic hardships or expansion of employment and income.

The IMF recently projected a decline of 7.1% in Canadian real GDP for 2020, followed by a 5.2% rebound in 2021. This 2020 projection appears too large based on the analysis of the Bank of Canada which pegs the anticipated decline at 5.7%. The recent BoC business outlook survey points to a slow recovery, with a 2021 gain slightly over 4%.

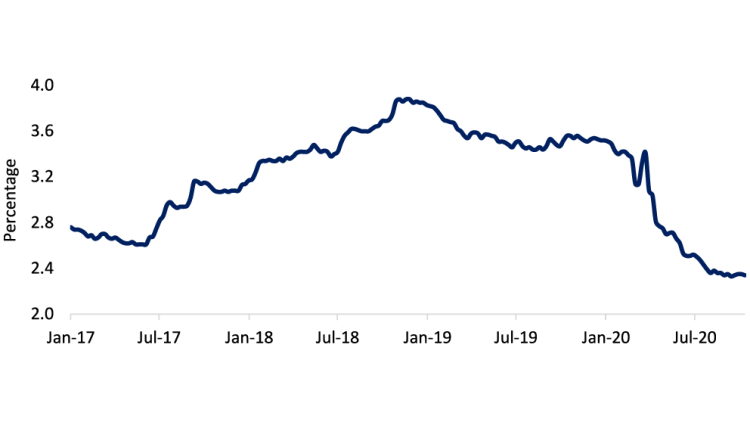

2. Average borrowing costs have bottomed out

When it comes to interest rates, the motto is low for a long time. Cuts in the BoC policy rate by 150 basis points in less than one month brought the average business interest rates down by a proportional amount (Figure 1). It’s not just the short-term rates that have gone lower. The entire yield curve has shifted down, lowering average borrowing costs for businesses. The BoC recalibration of its quantitative easing program is not expected to influence interest rates.

Figure 1. Average business interest rates reach record low

Source: Bank of Canada

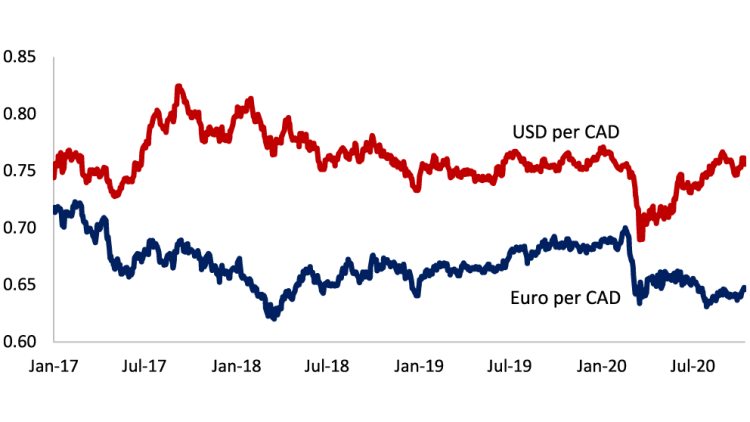

3. Low interest rates and a muted rebound in the oil price make the loonie hover around USD 0.75, heading towards 2021

There was a steady climb in Canadian dollar value against the USD between mid-March and early September (Figure 2). A weaker U.S. currency has mostly driven this upward trend, and the loonie stayed relatively flat relative to the Euro.

Figure 2. Loonie’s rebound against the USD loses steam

Source: Bank of Canada

The outlook for the Canadian economy is still cloudy. The second wave of COVID-19 will make it hard for the economy to gain the last few percentage points needed to get back to the level of economic activity recorded before the pandemic. We should expect more price swings in markets fueled by global economic and political risks.

Jean-Philippe (J.P.) Gervais

Executive Vice President, Strategy and Impact and Chief Economist

J.P. Gervais is Executive Vice President, Strategy and Impact and Chief Economist at FCC. His insights help guide FCC strategy, monitor risks and identify opportunities in the economic environment. In addition to acting as an FCC spokesperson on economic matters, J.P. provides commentary on the agriculture and food industry through videos and the FCC Economics blog.

Prior to joining FCC in 2010, J.P. was a professor of agricultural economics at North Carolina State University and Laval University. J.P. is a Fellow of the Canadian Agricultural Economics Society. He obtained his PhD in economics from Iowa State University in 1999.