2024 crop input outlook update: expenses softened but remain elevated

As spring approaches many producers are still strategizing and finalizing their seeding plans, which means it’s time for an update on the 2024 crop input market. At the farm level, we expect that expenses will come back down from their highs of 2023 but will remain elevated.

Fertilizer market outlook

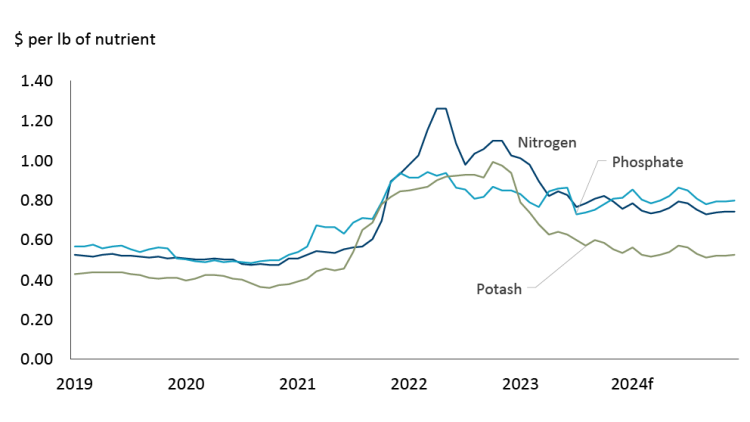

Fertilizer prices have continued to drift lower, as global supplies improved and tighter global farm margins reduce demand. However, as seeding in North America approaches, we expect prices to trend slightly higher as producers finalize and secure their fertilizer needs (Figure 1).

Figure 1: Canadian fertilizer price trend and forecast

Source: Alberta farm input prices and FCC calculations

Fuel and chemicals

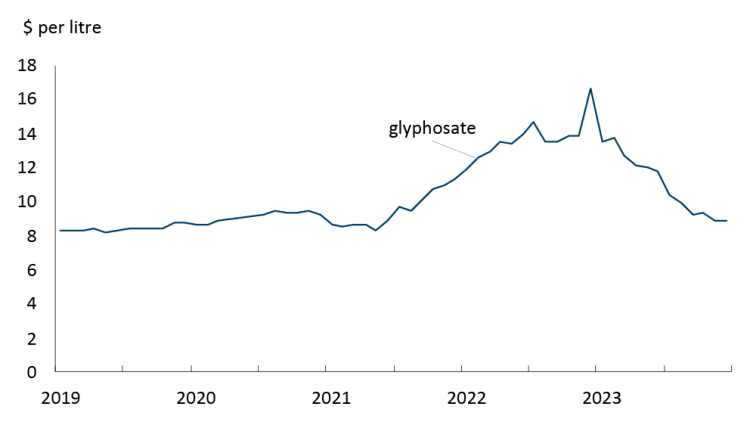

A continued slowdown in global economic growth is expected to result in diesel costs at the farm level being 3.2% lower for 2024. Agrochemical supplies have increased for most products as global production, particularly in China, has recovered and increased following pandemic-related supply chain issues. Increased supplies have resulted in declining prices for glyphosate (figure 2).

Figure 2: Chemical prices such as glyphosate have declined

Source: Alberta farm input prices

Issues to monitor:

1. Commodity prices

Declining crop prices and corresponding tighter profit margins are likely to influence crop input decisions. Unlike past years, global supplies of most commodities reached levels which markets seem comfortable with, and prices don’t have to trend higher to incent more acres. Choices on when and what to spray, as well as fertilizer applications rates, will continue to be factors producers put an increased focus on in a tightening margin environment. Tighter farm margins will mean increased focus on management decisions including fertilizer application rates (4R practices).

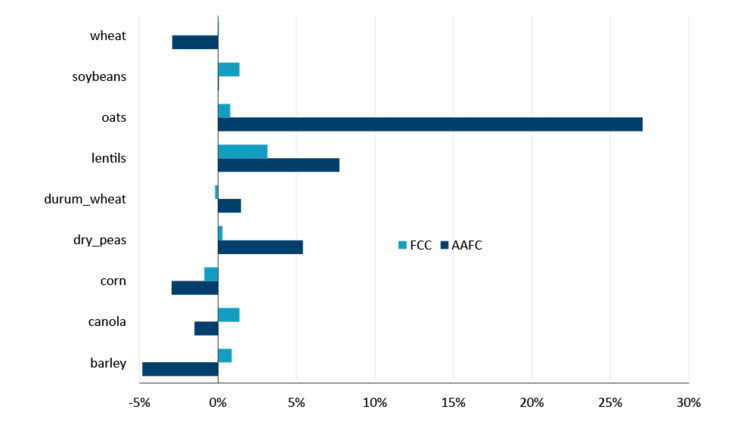

2. Seeding intentions

First estimates of 2024 by Agriculture and Agri-Food Canada (AAFC) and FCC Economics highlight potential acreage shifts (Figure 3). Statistics Canada is scheduled to release their first estimates on March 11 which is a survey of producer intentions. The two sets of forecasts show some variation, but generally trend together directionally. AAFC sees acres falling for corn, canola, barley, and wheat overall, despite a small increase in durum acres, while FCC expects these to either remain the same or change marginally (within 1%). Both AAFC and FCC Economics forecast growth in oats, lentils, and dry peas, with those forecasts varying in magnitude. AAFC is projecting a large rebound in oat acres of 27%, after declining -36% in 2023. With respect to lentils, FCC projects a 3% increase, while AAFC projects an 8% increase. Better price outlooks and low fertilizer requirements for lentils and peas will likely drive increased acreage. Lentils, peas and wheat are also several crops that maybe more drought tolerant while oats have a lower input cost.

Figure 3: AAFC 2024 seeded acre model forecasts higher YoY variation than FCC model

Source: AAFC, FCC calculations

Current market conditions are not favoring corn acres. Preliminary estimates from the United States Department of Agriculture (USDA) long-term projections indicate U.S. farmers will plant 91 million acres of corn, a decline of 4.1% from 2023. The decline in corn acres is mainly driven by an increase to soybean acres at 87 million acres. U.S. wheat acres are also expected to decline 3.2% after reaching 49.6 million acres in 2023. The U.S. corn versus soybean acreage estimate is an indicator to monitor as any deviation from market expectations could impact fertilizer prices. The U.S. prospective plantings report comes out March 28, 2024.

3. Geopolitical events

There are several geopolitical events around the globe that continue to be on our radar. The war in Gaza, and the Red Sea conflict, which if it spreads to the broader middle east region, would increase both energy and fertilizer prices. The conflict on the Red Sea has resulted in the rerouting of vessels around Africa adding up to 2-3 weeks to a ship’s journey. The longer the Red Sea conflict lasts the higher the likelihood of global shipping costs rising as a reduction in global shipping capacity occurs.

4. El Nino and drought monitor

El Nino has resulted in a mild winter across most of the Northern hemisphere, reducing natural gas use and lowering global natural gas prices including in the EU which could entice additional ammonia plants to restart. Higher EU natural gas prices the last several years resulted in reduced global nitrogen supplies.

Reduced snowfall and the current mild winter are likely to result in both an early spring and early seeding. That could impact seeding decisions (e.g. moisture levels) but also spreads out the rush for crop inputs given a larger seeding window. Drought conditions across the U.S. mid-west have shown early signs of improvement, although weather remains a major watch item across North America as we head into spring.

Bottom line

Crop input demand will be impacted by seeding decisions as producers adjust to weaker crop prices, tighter margins, and dry conditions. The biggest wild card for crop inputs is global logistical challenges including Red Sea navigation that could increase global shipping rates, adding costs for crop inputs and resulting in lower demand at the farm level. A focus on farm management including farm input decisions will be key for a successful 2024 under a tight margin environment.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.