2024 FCC Food and Beverage Report: Margins to improve slightly this year

The annual FCC Food and Beverage Report reviews last year’s economic environment and highlights opportunities and risks for Canadian food and beverage manufacturers for 2024. The report includes projections of annual industry sales and gross margin index forecasts by sector.

Industries featured in the report are:

Grain and oilseed milling

Sugar and confectionery products

Fruit, vegetable preserving and specialty food

Dairy product manufacturing

Meat product manufacturing

Seafood preparation

Bakery and tortilla products

Beverage manufacturing

Key takeaways

The high inflation of the last two years and the corresponding interest rate increases meant to combat it are stretching household budgets. As food prices rose in 2022 and 2023, consumers began purchasing more sale items, purchasing less expensive brands, shopping more often at low-cost retailers, and yes, cutting back on the amount of food purchased. Many consumers say the impact of high interest rates is just beginning to affect their spending, so expect these trends to continue in 2024.

Changing shopping habits doesn’t necessarily mean fewer opportunities for food and beverage manufacturers. Canada’s growing and increasingly diverse population is providing additional opportunities to serve niche—but growing—market segments while providing a level of support to overall sales. Healthiness, convenience, and sustainability are growing considerations consumers make when purchasing food. Innovating to meet these consumer demands can help boost sales in 2024.

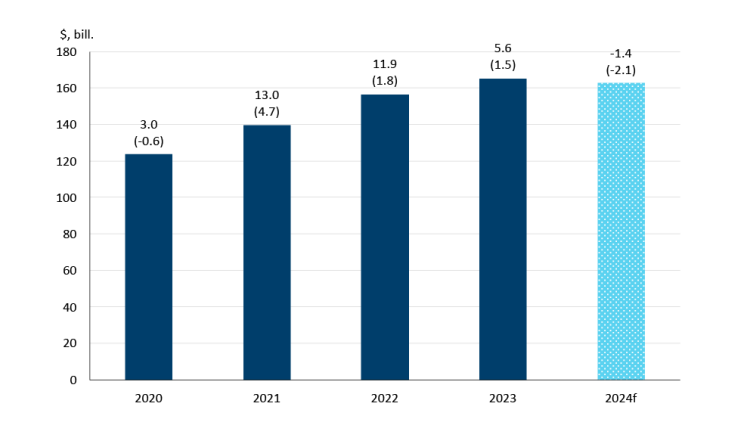

Sales, volumes forecast to moderately decline in 2024

FCC Economics projects that food and beverage manufacturing sales will fall -1.4% in 2024, from $164.9 billion to $162.6 billion, with volumes forecast to fall -2.1% (Figure 1). One wildcard in our forecasts is the U.S. economy's resiliency, given that the bulk of Canada’s food and beverage exports goes to the U.S. market. Should the U.S. economy continue outperforming expectations, export growth could surprise to the upside and turn the projected sales contraction into growth.

Figure 1: Sales, volumes forecast to decline slightly in 2024

Total sales (in $, billions) are on the y-axis. The top number above each bar is the year-over-year growth in sales measured in dollars. The bottom number above each bar (in parenthesis) is the year-over-year growth in volume sold. Volumes are reported sales deflated by a price index (January 2020 = 100).

Sources: Statistics Canada, FCC Economics

Many raw commodity prices today are significantly lower than in the last two years. This is causing our sales forecasts to be slightly lower than last year. For example, FCC Economics is forecasting grain and oilseed milling sales to fall -11.3% this year because of lower raw commodities (wheat, canola and soybeans) but volumes are forecast to increase 1.1%. Put another way, the double-digit growth rates of 2021 and 2022 (13.0% and 11.9%, respectively) were fuelled by inflation; but, with inflation inching ever closer toward the Bank of Canada’s 2% target, its effect on nominal food and beverage sales is lessening.

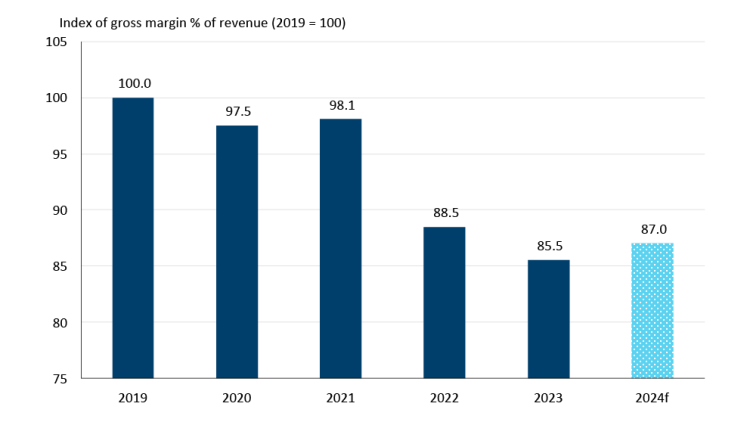

Gross margins forecast to marginally improve in 2024

In 2023, input costs began to stabilize and, in some cases (such as crop prices) outright declined. Fuel and transportation costs are lower relative to the previous two years and packaging cost growth has slowed. We expect these trends to hold in 2024. Wage growth has remained hot, although the falling job vacancy rate suggests a moderation is in the cards later this year. All told the decline in the cost of goods sold will be larger than the decline in sales, providing a small boost to our margin index this year, up 1.5 percentage points on average (Figure 2).

Figure 2: Gross margins to improve slightly in 2024, but are still tight

Sources: Statistics Canada, FCC Economics

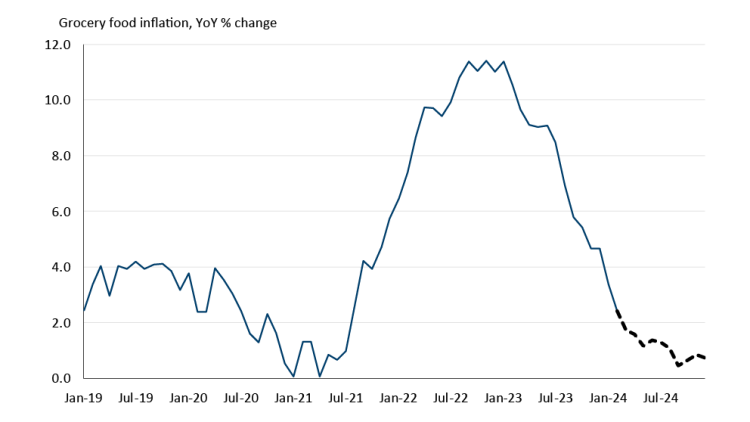

Relief at the grocery store

On the consumer front, there is welcome news. Grocery price inflation has already slowed from its peak of late 2022 and early 2023, with February’s Consumer Price Index release showing grocery prices increased 2.4% YoY, the lowest since July 2021. FCC Economics forecasts that the inflation rate for food purchased at the grocery store will fall below 2.0% by spring and stay roughly between the 1.0% to 2.0% range for the remainder of the year (Figure 3). We expect food price increases beyond this year to stabilize around its pre-pandemic level. This doesn’t mean groceries will be cheaper; it just means we won’t see the significant increases we’ve seen over the last three years.

Figure 3: Grocery food inflation rate will continue to decelerate in 2024

Sources: Statistics Canada, FCC Economics

Bottom line

Changing consumer behaviour and high population growth will present challenges and opportunities to food and beverage manufacturers in 2024. While sales may decline slightly in nominal terms, many input costs have stabilized and expected interest rate cuts in the latter half of 2024 will provide some debt servicing relief; collectively, this should provide a small boost to margins this year. While still weak compared to the period of 2019 to 2021, our forecast margins are certainly a pivot in the right direction. Should the US economy (and, therefore, Canadian food and beverage exports) outperform expectations, margins may improve more than our forecasts currently show.

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.