A first look at the 2024 crop input market

As the 2023 crop harvest is nearing the halfway point across Canada, attention has already turned to next year. This is our preliminary estimate for the 2024 crop input market.

Fertilizer market outlook

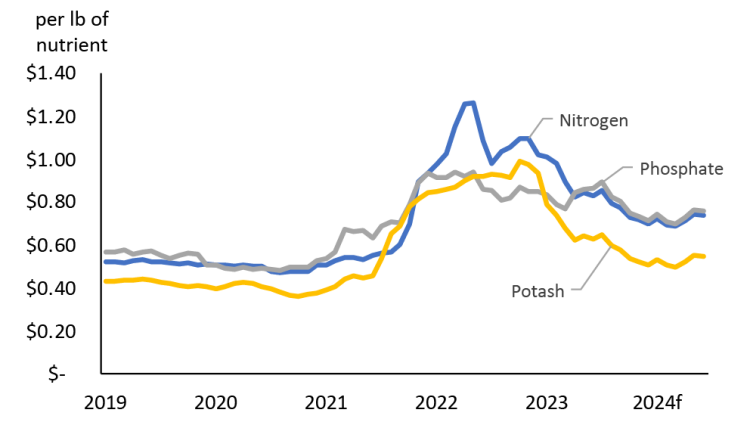

Fertilizer prices reached record highs in 2022 as the world faced supply issues following Russia’s war against Ukraine. This resulted in Europe curtailing production due to high natural gas prices. However, the global marketplace was resilient in increasing fertilizer supplies, and high prices resulted in demand contraction in many of the world’s poorest agriculture regions. As a result, fertilizer prices have continued to soften over the past year (Figure 1).

European natural gas prices will continue to be on the radar for 2024, but there seems to be less uncertainty regarding global fertilizer nitrogen capacity. For one, China has re-entered the urea export market, and global potash prices remain soft.

Our preliminary assessment indicates that fertilizer prices are expected to remain under pressure into early 2024 but recover as seeding in North America approaches. Given current drought conditions in Western Canada and the U.S. mid-west, volume in the fall application period is expected to be weak.

Figure 1: Canadian fertilizer price trend and forecast

Source: Alberta farm input prices and FCC calculations

The drought in western Canada and the excessive moisture levels in eastern Canada will impact fertilizer demand in 2024. Farm input retailers have an opportunity to continue growing their soil sampling business (e.g. 4R’s) as they work with their customers to determine the optimal fertilizer application levels and any fertilizer residuals left in the soil from the drought.

Fuel

Slowing global economic growth is expected to result in diesel prices trending lower in 2024. Our preliminary estimate indicates that farm diesel prices will be 2.8% lower in 2024. However, continued global uncertainty, including Russia’s war against Ukraine, OPEC+ supply cuts, and relatively low levels of U.S. distillate (e.g. diesel), could keep prices elevated.

Chemical and seed

Continued recovery in global production of agrochemicals and softer demand has led to increased global supplies. Overall, global prices have moderated for both glyphosate and glufosinate. The Canadian market will largely depend on domestic supplies and demand.

The commercial seed market uncertainty remains concerning the impact of the 2023 drought on seed for the 2024 growing season, including production costs. Particularly for canola seed, it will largely depend on the ability for growing seed supplies in South America during the off-season this winter.

We anticipate that the Canadian crop input market will grow modestly in 2024, and several factors might impact pricing and sales in 2024.

El Nino and drought monitor

El Nino is expected to continue into early 2024 and bring warmer temperatures. In anticipation of another year of dry and hot weather, Canadian producers may look to early maturing varieties if moisture issues persist for the 2024 growing season. Crop-input retailers promoting early maturing varieties may see an increased benefit from customers.Farm revenue trends

Canadian crop receipts for the first half of 2023 were up 19.8%, driven by strong sales of canola and wheat. The drought is expected to reduce Canadian grain, oilseed and pulse production by 13%, which could weigh on year-end crop receipts for 2023 and into the first half of 2024, particularly in regions that experienced exceptional drought. Strong farm cash flow remains key to crop input sales. Pre-purchase trends for the remainder of 2023 may provide an early indication of what the sector can expect for 2024.Economic slowdown and interest rates

Interest rates may have peaked already, as noted by the Bank of Canada’s decision last week to hold their policy rate constant. We expect interest rates to decrease by the second half of 2024 as the global and Canadian economies weaken. Interest rate spreads between Canada and the U.S. will be important to monitor as it impacts the value of the Canadian dollar. See the Economic and Financial Market Update for continued monitoring of macro-economic issues.

Bottom line

Preliminary estimates indicate that the 2023 drought in North America will negatively impact the crop input market in 2024. The biggest wild card for farm input providers is the demand for fall fertilizer application and pre-pay business for the upcoming growing season. Expectations that El Nino will last longer into 2024 will continue to drive business decisions on the farm, including soil testing, spray decisions and what varieties to plant.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.