2023 Outlook for the crop input market

FCC Economics helps you make sense of the top economic trends and issues likely to affect your agri-business in 2023.

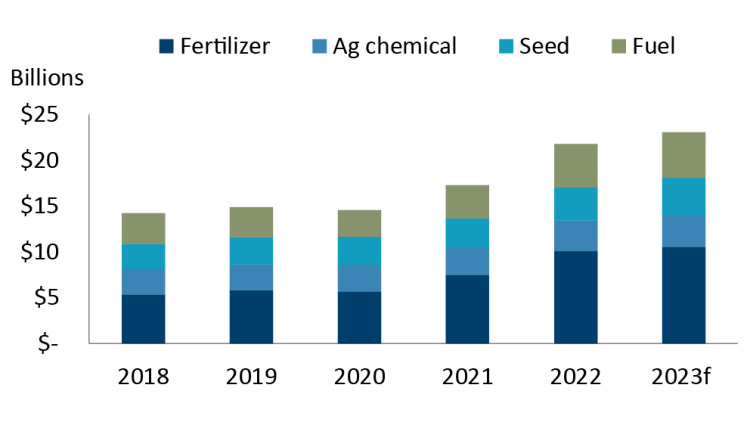

The Canadian crop input market (fertilizer, chemical, seed, and fuel) is projected to have grown 26.1% in 2022, reaching an estimated record $21.8B in sales. Most of this growth was driven by increases in fertilizer and fuel prices stemming from global supply chain disruptions and the war in Ukraine. We are projecting a further 5.9% increase in 2023 to $23.1B. Overall, demand for crop inputs remains robust, supported by strong farm cash receipts, even if commodity prices soften from peak levels. The 2023 crop will be the most expensive ever planted.

Figure 1. Canadian crop input sales

Source: Statistics Canada, FCC calculations

Fertilizer market

We estimate total fertilizer sales grew 35.1% in 2022 to $10.1B and will increase 5.3% in 2023 to $10.6B. High European natural gas prices forced curtailment in European fertilizer production in the fall of 2021. Russia’s invasion of Ukraine further increased European energy prices, leading to 70% of EU ammonia production being idled in the fall of 2022. Fertilizer prices have come off recent highs yet remain historically elevated, given uncertainties in global nitrogen capacity.

Fertilizer availability in North America appears adequate for the 2023 planting season, with many retailers having already secured supplies. Eastern Canada has been able to diversify nearly all its fertilizer requirements away from Russian suppliers with increased imports from North Africa and other countries. However, prices are expected to remain volatile through 2023, and export opportunities may again arise for North American fertilizer manufacturers due to ongoing EU production issues.

Fuel

Rising global diesel prices in 2022 led to several U.S. refineries permanently closing during the pandemic or reducing refining capacity. The EU banned Russian diesel on February 5, 2023, which will continue to create volatility in global diesel markets.

FCC Economics is projecting farm diesel prices to rise 7.8% in 2023. However, given the volatility in the global diesel market, prices could trend higher throughout the year. Conversely, a global economic slowdown could limit demand and thus put downward pressure on the price of diesel. Total farm fuel usage changes very little regardless of diesel prices, and cost uncertainty will exist.

Unusually warm weather in the EU this winter has been a good thing for the global diesel market, as reduced demand will rebuild inventories and help to relieve price pressures. North American diesel exporters will increase diesel shipments to the EU in 2023 as they stockpile for winter 2024. The EU’s ability to stockpile diesel and heating oil over the summer and fall of 2023 will be crucial to where diesel prices trend for harvest 2023 and into 2024.

Chemical and seed

Farm input wholesalers and retail distributors faced challenges securing seed and herbicide supplies in the fall of 2021 and the first half of 2022. Retailers were forced to ration availability and sales, ensuring all customers had access for immediate use. Recovery in global production and supply chains has resulted in glyphosate prices moderating. We estimate that chemical sales totalled $3.3B in 2022, while seed sales were $3.7B. We are projecting that chemical sales will increase 5% in 2023 and seed sales will grow 10%.

Overall, incomes for Canadian grain, oilseed and pulse producers will continue to rise in the 2023-2024 season, but crop input prices may not retreat much from their highs. The expectation is for farmer margins to be tighter, putting pressure on cash flow.

Key trends to monitor in 2023

1. Seeded acreages

Input prices, demand for commodities and interest rates will influence the seeding decisions of farm operators. High input prices may lead producers to plant less input-intensive crops.

FCC Economics is projecting Canadian wheat acres to increase by 7.3% in 2023. Our projection is driven by strong wheat future prices, increased winter wheat acres in Ontario, and the U.S. drought’s impact on the U.S. winter wheat crop. Our large increase in Canadian wheat acres will result in both canola and corn acres declining by 1.3%, respectively. We also anticipate that durum acres will decline by 2.8% while soybean acres will remain flat at a 0.2% increase from 2022.

Preliminary estimates from the United States Department of Agriculture (USDA) long-term projections currently peg the 2023 U.S. corn crop at 92 million acres, up 3.8% from 2022. Corn acres above 90 million acres will be supportive of nitrogen fertilizer prices. USDA pegs the 2023 soybean planting area at 87 million acres, down 0.6% from 2022. Total U.S. wheat acres are estimated at 47.5 million acres, up 3.9%. Strong wheat future prices encouraged increased winter wheat plantings, and wheat requires less fertilizer than corn.

U.S. prospective plantings of corn, soybeans and wheat will be released on March 31, 2023, so expect prices to fluctuate further.

2. Market fundamentals

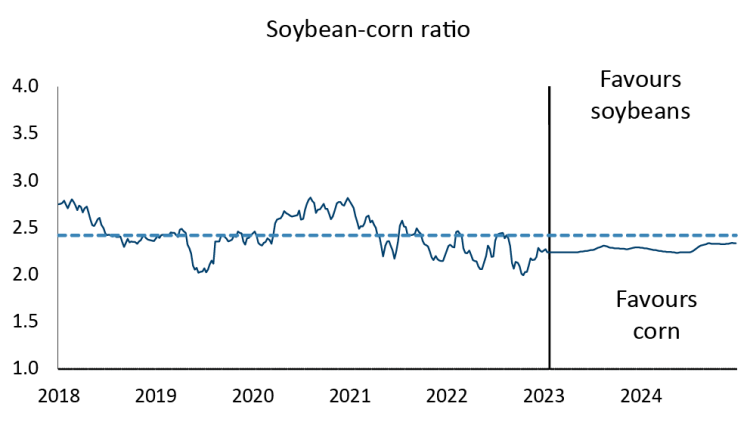

Interestingly, market fundamentals are currently telling a diverging story on initial Canadian and U.S.-seeded acreage estimates. The soybean-corn ratio of futures prices for the new crop is 2.28 (Figure 2) and signals profitability to be higher for corn than soybeans. Historically the soybean-corn ratio has averaged 2.4. A ratio favouring corn will likely support the demand for nitrogen fertilizer and ag chemical products associated with increased corn production. Corn and soybean basis levels in Canada will drive divergence in seeded acreage between Canada and the U.S.

Figure 2. Soybean-corn ratio favours corn plantings

Source: CME, FCC calculations

The debate around seeded acreage estimates will intensify as spring approaches. U.S. drought spillovers from 2022 may impact market indications as soybeans do better in drought than corn. Depending on how moisture levels improve from now until planting, the market may have to attempt to buy more corn acres if drought concerns persist.

Crop input industry in transition

Producers have always strived to maximize crop yields while minimizing the number of crop inputs used. The industry is transitioning to further push the envelope on maximizing yields to feed our growing global population. New products are being formulated to meet specific crop nutritional requirements (e.g., micronutrients) and advancements in fertilizer technology (e.g., ESN, a slow controlled release fertilizer). Value-added services, including knowledge and agronomics, are continuing to grow. Soil sampling and plant tissue testing are becoming more mainstream, and the adoption of 4R practices continues to expand.

Retail margins can be tight and volatile on crop inputs. Farm input retailers will continue to face competition as farms buying directly from wholesalers grows. Revenue opportunities for Canadian farm input retailers will continue to expand from providing additional services, and knowledge producers are seeking. The competitive landscape for farm input businesses will reward those that can capitalize on a service-oriented mindset.

Bottom line

The 2023 farm input market will be characterized by high input prices and increased sales. Strong farm cash receipts are a positive development for 2023 and will help to offset high input costs at the farm level. However, as margins become tighter, revenue growth for Canadian farm input providers will continue to expand from services and knowledge offerings.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.