2023 Outlook for Canadian biofuels – opportunities and risks ahead

FCC Economics helps you make sense of the top economic trends and issues likely to affect your agri-business in 2023.

Biofuel industry in transition

The Canadian biofuel industry is changing. Efforts to reduce greenhouse gas (GHG) emissions have led to federal and provincial policy changes that are expected to increase the use of ethanol, biodiesel, and renewable diesel in Canada. Similar changes are also occurring globally. The Canadian biofuel industry is forecast to grow over the next decade as emission reduction mandates will increase ethanol, biodiesel and renewable diesel production.

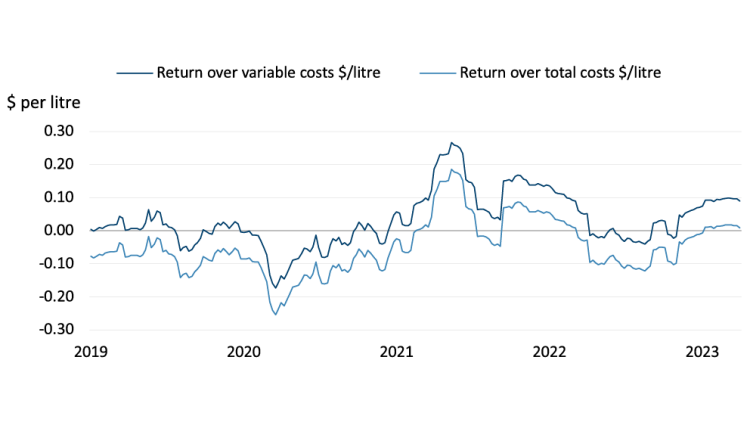

Profitability has been volatile

Ethanol profit margins have been volatile during the last several years, driven by the pandemic, inflation, war in Ukraine and its impact on prices of both feedstocks and fuel (Figure 1). According to U.S. trends, biodiesel profitability has also been pressured.

Figure 1: Canadian ethanol margins

Sources: Statistics Canada, CME Futures, and FCC calculations

Feedstock costs continue to trend lower

Crop prices for canola, soybeans, corn, and wheat, all feedstocks utilized in biofuel production, are all expected to trend lower as outlined in FCC Economics’ grains and oilseed outlook. Other feedstock production costs for biofuels have begun to decline, notably those for biodiesel (e.g. canola oil and soy oil), along with prices for diesel and bio-diesel that have trended lower from last year’s highs (Figure 2).

Figure 2: Prices of feedstock and fuel have trended lower

Sources: NRCAN, Iowa State University, Statistics Canada, and FCC calculations

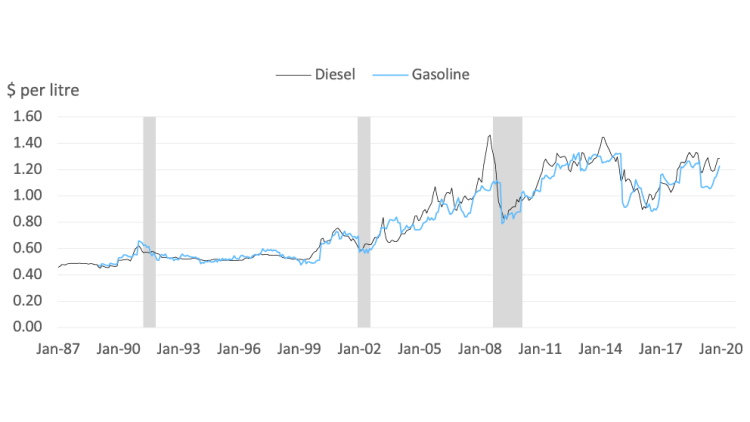

The growing chances of a recession in both the U.S. and Canada suggest weaker demand ahead for the biofuel sector. Fuel prices often decline during recessions (Figure 3); the exception was the 1990 recession, which overlapped with the Gulf War. The war in Ukraine and Russia’s threat to exit the Black Sea grain export agreement could again put upward pressure on global commodity markets, including agricultural feedstocks and energy.

Figure 3: Fuel prices often decline during recessions

Sources: NRCAN, FCC calculations

Short-term outlook

Increased emissions reduction mandates within Canada (e.g. Clean fuel regulations) and south of the border are expected to increase biofuel demand. The Canadian canola crush sector is currently undergoing expansion, with approx. 4.5 million tonnes of additional crush capacity is expected by the end of 2024, and 2+ million additional tonnes in the years following. The additional capacity represents 9.2 million acres or about 43% of the 5-year average of harvested acres. We estimate canola acre and yields will continue to increase to meet this demand. However, in the short term, the supply will likely come from what is currently moved to export markets. Much of the increased canola crush will supply the vegetable oil feedstocks for both biodiesel and renewable diesel plants. Canola has an advantage with its high oil content relative to soybean oil. The increased demand for canola is likely to increase premiums of canola oil relative to soybean oil. This is expected to increase canola prices and/or improve basis levels.

Recent U.S. tax credit policy changes (coming in 2025) will switch to a producer tax credit, meaning only U.S. biodiesel or renewable diesel production will be eligible. Historically, nearly 100% of Canadian biofuel for diesel has been exported to the U.S. to capture the credit. However, under the 2022 Inflation Reduction Act, this tax credit has been switched to a producer tax credit, meaning only U.S. biodiesel or renewable diesel production will be eligible starting in 2025.

While the policy change favours U.S.-based plant investment, Canada has an advantage with its canola crush industry. Domestic biodiesel and renewable diesel plants will compete against U.S. demand for canola oil, but Canada’s advantage is our proximity to the canola oil.

Long-term outlook

In the longer term, renewable diesel is expected to grow more rapidly than biodiesel since it is chemically identical with similar performance to petroleum diesel. As a result, renewable diesel is expected to capture a larger share of the diesel market relative to biodiesel, as it can be blended with petroleum diesel at any rate, with no cold weather-related viscosity issues. Biodiesel plants will likely face tighter margins in the longer term due to increased price pressure for vegetable oil feedstock from renewable diesel and global demand from the food sector. Overall, the longer-term outlook for renewable diesel looks more promising.

With the increased feedstock demand, the battle for crop acres could be fierce. If most of the proposed renewable diesel plants across North America are built, additional acres of soybean and canola will have to occur. Increased soybean and canola acres will shift acres from corn and wheat, ultimately impacting the ethanol market.

The ethanol market could face more headwinds longer term as global demand, largely driven by government initiatives, shift the automotive sector to electrification. Reduction in the internal combustion engine supply is expected to disrupt the demand for gasoline and ethanol fuel. Starting in 2026, a minimum of 20% of new light-duty vehicles sold in Canada must be zero emissions, and this increases annually to at least 60% by 2030 and 100% by 2035. However, the reduction in ethanol usage is not entirely known since the move will be gradual, and the requirement is on new vehicles. The reduction in ethanol usage will be gradual as the average age of all light vehicles in the U.S. has been trending higher. In 2022, the average was 12.2 years, meaning the automotive fleet could still largely depend on gasoline beyond 2040. Export opportunities may also emerge as countries, including China, increase the number of cars driven and move toward biofuel mandates.

Bottom line

The growth in biofuel demand has opportunities for Canadian biofuel producers and the producers that provide the feedstock. Risks will also be apparent and largely depend on how biofuel mandates evolve. Preparing and implementing risk mitigation strategies for both the short and long term may assist in a vibrant Canadian biofuel sector.

Article by: Leigh Anderson, Senior Economist and Justin Shepherd, Senior Economist