2023 Grains, oilseeds and pulses outlook update: Sector facing uncertain weather and global conflict as crops mature

This is the second quarterly update to our 2023 Outlook for major crops published in January. Over the next two weeks, we’ll update our Outlooks for dairy and cattle and hogs.

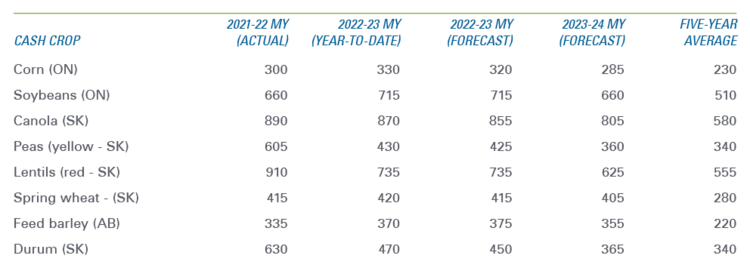

Prices for the 2022-23 crop have continued to drop from our last outlook in some commodities (canola, yellow peas and spring wheat), prolonging a general downward trend witnessed since January (Table 1).

However, some crops appear to have benefitted from strengthening prices thus far in 2023 (corn, soybeans and red lentils) although these are expected to drop or flatten throughout the remainder of the marketing year (MY). The good news is that while prices are trending down, they should remain elevated well above their respective five-year averages.

Table 1: Crop prices fall again while remaining well above their five-year averages

Sources: Statistics Canada, AAFC, USDA, PDQ, CanFax, CME, MGEX and ICE Futures, and FCC calculations.

Marketing Year for corn and soybeans: September 1 – August 31

Marketing Year for wheat, canola, barley, peas and lentils: August 1 – July 31

Profitability is a complicated story right now. Crop margins (for a winter wheat/corn/soybean rotation) in eastern Canada are expected to fall year-over-year (YoY) but remain positive throughout the outlook period. Also facing a YoY decline, western profitability will be in the black for most crops (barley, canola, spring wheat, durum and red lentils) but will be pressured for yellow peas. That’s the bird’s eye view. Digging deeper, however, we’ll likely see wide variation in margins, given the noted volatility in both crop and farm input prices this year. Margins will be subject to more pressures if producers bought inputs last fall for this crop year (a common practice) or happened to contract large portions of their crops when prices were trending down. At the same time, more timely purchases or contracting will likely result in excellent margins.

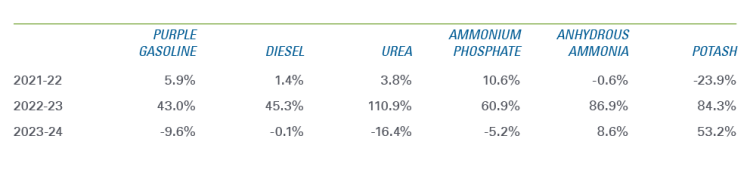

Input prices continue to fall throughout 2023 while some global supplies start to loosen

Our January Outlook identified low global supplies and high input costs as two influential factors to monitor in 2023. We’re happy to report input prices have continued to fall since our May Outlook update. Their declines in the past three months have sped up the 2023 reversal of the upward trend of YoY input prices for last year’s crop (2022-23) for purple fuel, diesel and urea. At the same time, fertilizer costs have either reversed (phosphate) or their growth rate has slowed (ammonia and potash) for the 2023-24 crops (Table 2).

Table 2: Farm input prices to ease in 2023 as supply-demand balance regains stability

Sources: Alberta Farm Inputs, World Bank, FCC calculations (* rolling average)

The other major trend impacting grain and oilseed markets is the tightness of global supplies. With the way they’re trending, North American growing conditions in 2023 aren’t going to be the ticket to bolster them. The latest USDA grain stocks report showed continuing tightness in U.S. corn, wheat and soybean stocks as of June 1. All three are down YoY. According to the June WASDE report, global stocks forecasts for 2023-24 are up YoY for all three crops, but tightness remains in wheat ending stocks, with a forecast of 6% less than the prior five-year average (2018-19 – 2022-23). On the other hand, world corn ending stocks are expected to reach levels not seen since 2018-19 this year thanks to corn acreage in the U.S. that is the third highest since 1944. Soybean stocks will be the highest in five years based on Brazil’s record production. Total global demand (domestic use plus exports) for wheat is expected to remain steady YoY in the 2023-24 MY. Utilization of both corn and soybeans is expected to increase but global production of each is expected to grow more.Two other factors of note weighing on the crop sectors as we settle into summer: developments in the Russia-Ukraine conflict have again inserted uncertainty into markets while North American producers wait for moisture levels to even out.

The Russia-Ukraine conflict, an aborted coup and the likely suspension of the UN-brokered export deal

The Russia-Ukraine export treaty is, as of Monday, July 17, suspended after Moscow walked away from the deal that allowed for safe passage of Ukrainian exports of grains and oilseeds through their Black Sea ports. This comes on the heels of a short-lived mercenary effort to destabilize Russia’s top military brass the weekend of June 23-24. The offensive had set in motion serious speculation about the likelihood of disruptions to the global supply of grains, which appeared to be realized in early Monday morning trading. However, the price rally quickly dissipated, suggesting markets had already factored in President Vladimir Putin’s decision to forego re-signing the treaty.

Given the deal’s disappearance is arguably counterproductive - because it serves to uphold Ukrainian and Russian interests – the pull-back may be short-lived. In the interim, concerns for global food security are mounting as buyers, particularly those in developing countries, look to source ag commodities away from Ukraine.

Weather, weather, weather

While it’s always an issue, challenging weather to this point in many parts of North America dominates discussions of production and marketing risk. The Canadian prairies have turned dry – June was extremely dry and hot, producing a crop that’s one to two weeks ahead of normal in most areas. Alberta conditions were worse than their five-year and 10-year averages (as of June 30), with 45% rated good/excellent, down from 75% in 2022. Four Alberta counties have declared agricultural emergencies to date.

Elsewhere, there’s been very good vegetative growth in Saskatchewan to this point, and mixed growth in Manitoba. In the U.S., half of soybean and corn acres were rated good/excellent as of July 2, also down significantly from trending averages, with declining crop conditions in some regions despite scattered rains.

But there’s a possible bright spot amidst the challenging news. A comparison of early U.S. growing conditions and eventual yield outcomes suggests there may still be some hope for this year’s crop. Yields weren’t always below trend in an analysis of 10 years’ worth of data showing less than a rating of 60% good/excellent at roughly the same time of the crop year. While yields will almost certainly fall in many areas without significant improvement in moisture levels, the fate of the overall 2023 crop has not yet been sealed.

Bottom line

With global stocks of key ag commodities expected to grow in the 2023-24 MY, prices may continue to decline, pressuring margins over the outlook period. But there’s bullish news too. Geopolitical tensions and an unfavourable weather outlook could support prices as farm input prices continue their decline. And we may be in for another break too. Interest rates are now close to peaking after the latest Bank of Canada increase to 5.00%. Amid the tightening financial conditions and darkening economic outlook, FCC Economics expects rates to start falling by next year.* With these factors combined and given the wild swings in 2023 pricing, effective risk management is key to managing profitability.

* For more information, see the Economic and Financial Market Update.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.