2023 Foodservice and grocery update: Tightening budgets influencing consumer preferences

On an individual level, consumers have been reducing spending in the face of higher inflation and interest rates. This will continue to be the case so long as both remain elevated. In the aggregate, population growth has supported sales. As more residential mortgage borrowers renew their terms in 2024 at higher interest rates, household budgets will be further pressured, limiting restaurant spending and forcing consumers to rethink what and how much they purchase at the grocery store.

Foodservices bending but not breaking

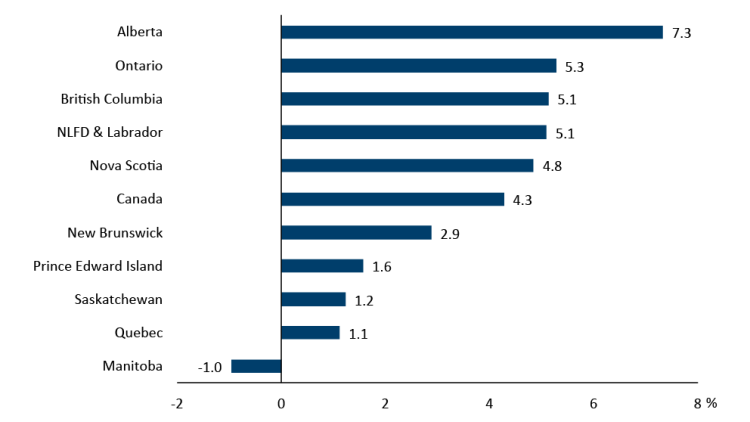

So far in 2023, real foodservice sales (that is, sales adjusted for inflation) have been steady compared to 2022. Except for Manitoba, all provinces have recorded an increase. Alberta leads the country in growth, followed by Ontario and British Columbia. Population growth is responsible for some (but not all) of this growth. For example, when adjusted for population increases Canadian sales growth was only 1.3%.

Figure 1: Real foodservice sales growth steady, varies across the country

Sources: Statistics Canada, FCC Economics

Data are as of July 2023 and real (inflation-adjusted).

The growth rates in Figure 1 are more a reflection of the lower sales volumes of 2022 (the so called ‘base year’ effect when calculating percentage changes) than of strong sales this year. To that point, and despite the rebound, 2023 sales are now back to pre-pandemic levels but still well below the pre-pandemic trend. And the prospect of sales continuing to improve is not overly positive. In the Q3 Bank of Canada (BoC) Survey of Consumer Expectations, over 58% of respondents stated they are reducing spending due to high inflation. 55% of respondents also expect a recession in the next year, which impacts consumption choices today. For most households, foodservice spending is a discretionary item, so these survey results do not bode well for foodservice sales in 2024.

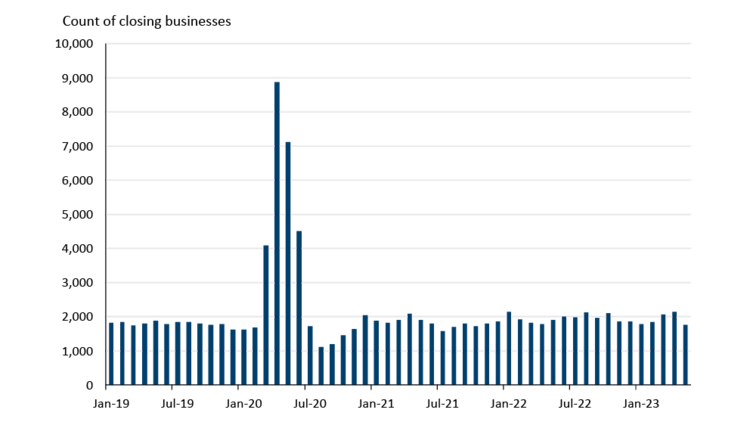

According to Restaurant Canada’s most recent Outlook Survey (July 2023), 33% of restaurant businesses are operating at a loss in 2023; in 2019, that number was only 7%. Data from Statistics Canada (Figure 2) suggest a steady trend in food and beverage service business closures this year. The dataset is silent about why businesses closed their doors, yet Restaurants Canada reports a sizable increase in bankruptcies for the first five months of 2023.

Figure 2: Restaurants keeping their doors open despite recent struggles

Sources: Statistics Canada, FCC Economics

Foodservice operators more reliant on alcohol sales will find it difficult to grow sales because of the long-term trend of declining per capita alcohol consumption. In the 12 months ending June 2023, real sales of alcoholic beverage services were 0.1% lower than in the same period ending June 2003. In essence, total alcohol sales in bars and restaurants have been flat over the last 20 years despite the population increasing by 8 million during that time. With changing demographics and preferences (e.g., young adults drinking less than previous generations), we expect this to remain the case moving forward.

Grocery sales continue to stagnate

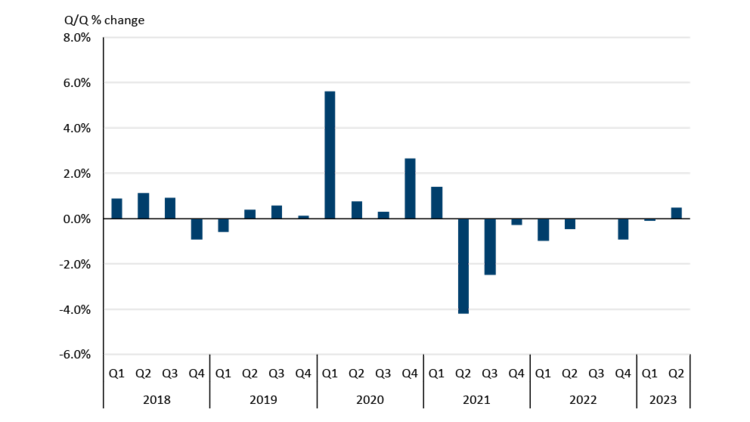

Q2 2023 was the first quarter in over two years that real sales at grocery stores increased quarter-over-quarter (Figure 3). The same phenomena we highlighted last year are still playing out at the grocery store: consumers are purchasing lower-priced substitutes, purchasing cheaper private-label products, wasting less food and, yes, purchasing less food in total.

Figure 3: Real grocery sales rebound in Q2 2023 after two years of declines

Sources: Statistics Canada, FCC Economics

Like foodservice sales, population growth has supported grocery sales because it kept them from contracting further than they did over the previous eight quarters.

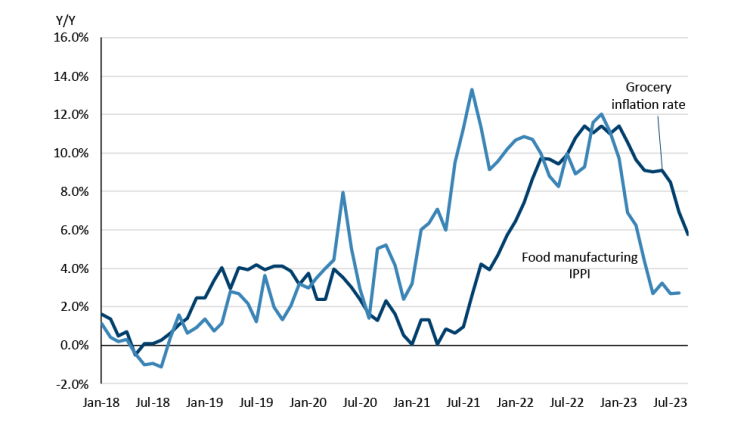

There are multiple factors to consider when evaluating retailers’ profit margins. One is the price at which domestic manufacturers sell their products, which is a cost of goods sold (COGS) for grocers. Since May, the average price that domestic manufacturers have sold their products (as measured by the Industrial Product Price Index [IPPI]) has increased between 2-3% Y/Y, a much lower pace of growth than the previous two years (Figure 4). This is slowly translating into lower price inflation at the grocery store, which grew by 5.8% in September, the slowest pace of growth since December 2021.

Figure 4: Food manufacturing price inflation stabilizing, grocery price inflation decelerating

Sources: Statistics Canada, FCC Economics

Trends to watch in 2024

Mortgage renewals and disposable income

The strain on household disposable income may only be beginning. A reported 20% of residential mortgage borrowers at three of Canada’s largest banks are in a state of negative amortization, meaning variable rate mortgages with a fixed payment no longer cover the interest owed at all. The difference between the interest owed and the interest paid is added to the loan balance. At renewal, these mortgages must be reset to their original amortization schedule but at a much higher interest rate and with a larger loan balance.

This isn’t just a variable rate mortgage story, though. The BoC estimates that in 2023, roughly 19% of all mortgage borrowers renewed their mortgage, and another 18% of borrowers are set to renew in 2024. All else being equal, borrowers renewing in 2024 will find a smaller share of disposable income to spend on discretionary purchases, including restaurant meals. Record high rental rates are having the same effect. Grocery demand is less elastic than discretionary items but, as noted above, can still be exposed to changes in consumer purchasing power.

Food inflation and profitability

Grocer margins have been in the news for over a year now. There has been no shortage of recent analysis on the topic*. A lack of publicly available, disaggregated financial data makes determining grocer margins derived strictly from food sales impossible. The good news, however, is that food price inflation is slowing, with prices of farm and food products and key farm inputs stabilizing or trending lower.

*Additional resources on grocer margins:

Job vacancies and wage growth

Though the pressure is easing, foodservice operators are still struggling to fill vacant positions, which should help reduce wage pressures in the industry. The job vacancy rate in Q2 2023 was 8.1%, higher than the pre-pandemic average of 4.9% but lower than the peak of 13.4% in 2021. Over the last two years, the average offered hourly wage rate has increased from $14.75 to $16.45, an increase of 11.5%.

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.