2023 FCC Food and Beverage Industry Report: Manufacturing margins under pressure

The annual FCC Food and Beverage Report reviews last year’s economic environment and highlights opportunities and risks for Canadian food and beverage manufacturers for 2023. It includes projections of annual industry sales and new gross margin index forecasts by sector.

Industries featured in the report are:

Grain and oilseed milling

Sugar and confectionery products

Fruit, vegetable preserving and specialty food

Dairy products

Meat products

Seafood preparation

Bakery and tortilla products

Soft drinks and alcoholic beverages

Key takeaways

Inflationary pressures hit the Canadian economy in 2022, and the food sector was not immune to their effects. Significant increases in commodity prices amid pressures on supply chains and labour shortages led to higher input costs and wage increases. In response to inflation, the Bank of Canada raised its benchmark interest rate numerous times, applying further pressures on profit margins in 2023; many of these challenges persist while demand challenges emerge.

Here are three key observations from this year’s report.

Sales growth was strong in 2022; projected to grow modestly in 2023

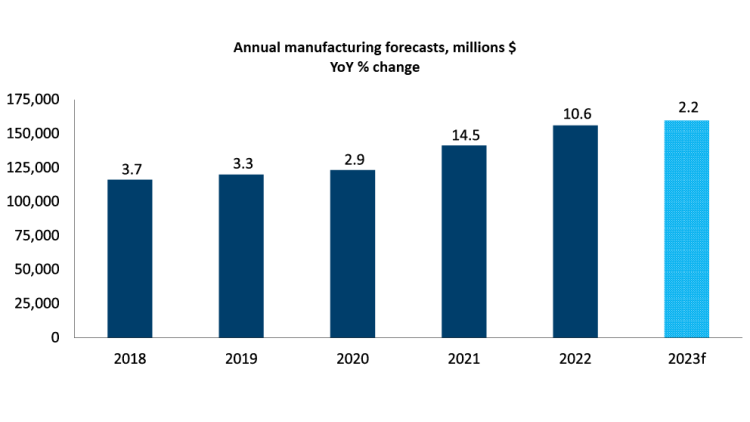

Food and beverage manufacturing sales rose 10.6% to $156 billion in 2022 (Figure 1). Growth largely resulted from selling price inflation in the face of higher costs, but we did see healthy volume trends in certain industries. Meat product sales growth is estimated to have come primarily from higher foodservice volumes. Baked goods were one of the only categories to see volume growth at the grocery store despite elevated retail prices.

Sales growth decelerated in Q4 2022, with several categories reporting sales declines YoY in December. This deterioration in growth is injecting uncertainty into our projections. FCC Economics forecasts food manufacturing sales to increase 2.2% YoY in 2023 to $160B. Any rebound in the deceleration observed at the end of 2022 could lift these projections. We expect the larger industries covered in this report, like grain and oilseed milling and meat product manufacturing, to outperform, while animal food, plant-based protein products, seasonings/dressings and snack products (not covered) to record declines.

Figure 1: Food and beverage manufacturing sales increased over 10% in 2022

Sources: FCC Economics, Barchart, Statistics Canada, Moody’s Analytics

Margins have deteriorated in the face of higher input and labour costs

Higher costs pressured food and beverage manufacturing margins. Gross margins as a percent of sales fell to their lowest level in over 20 years in 2022 (Figure 2). Manufacturers have always struggled to pass on higher costs in 2022. FCC Economics is forecasting gross margins to improve slightly in 2023. Important to note that trends in margins differ widely across different industries.

Figure 2: Gross margins declined to record lows in 2022; they’re forecasted to see small gains in 2023

Sources: Statistics Canada, FCC Economics

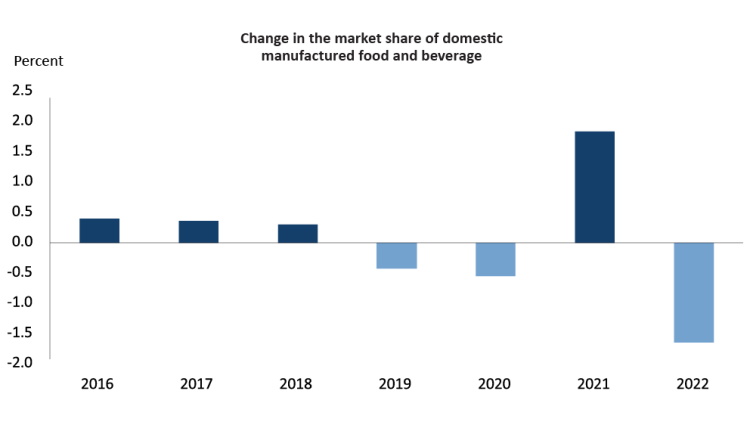

Food imports gained market share in Canada in 2022

As the year progressed, higher food prices and declining savings led consumers to cut back on discretionary spending. This meant fewer purchases of premium-priced foods, including smaller-batch and locally-made foods for which manufacturers couldn’t lower costs and control prices. Consumption of Canadian-made food in 2022 (measured in dollars relative to total consumption) reverted to the trend observed before the pandemic. A larger percentage of food dollars spent in Canada was allocated toward imported foods (Figure 3). Several economic and demographic factors dictated consumer food purchases. As the Canadian population becomes more diversified, food purchases are also diversifying, which could be an opportunity for domestic food manufacturers. FCC Economics estimates that, had Canadian manufacturers been able to meet the same level of domestic demand as in 2021, total sales would have been over $2.3 billion higher in 2022.

Figure 3: Canadians consumed more imported manufactured food in 2022

Sources: FCC Economics, Statistics Canada

Bottom line: Let’s not lose sight of opportunities

Despite these recent challenges and weaker margins, the food and beverage manufacturing sector remains healthy and has a positive long-term outlook. We are seeing promising innovations and technology implemented in food manufacturing plants, and global demand for Canadian-produced food is growing rapidly. Canada is uniquely positioned to expand its reach into new, growing and very profitable food industries.

Kyle Burak

Senior Data Scientist

Kyle joined FCC in 2020 and is a Senior Data Scientist, specializing in monitoring and analyzing FCC’s agri-food and agribusiness portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the procurement and marketing department of a Canadian food retailer. He holds a master of economics from the University of Victoria.