2023 farmland values: Where are we at mid-year?

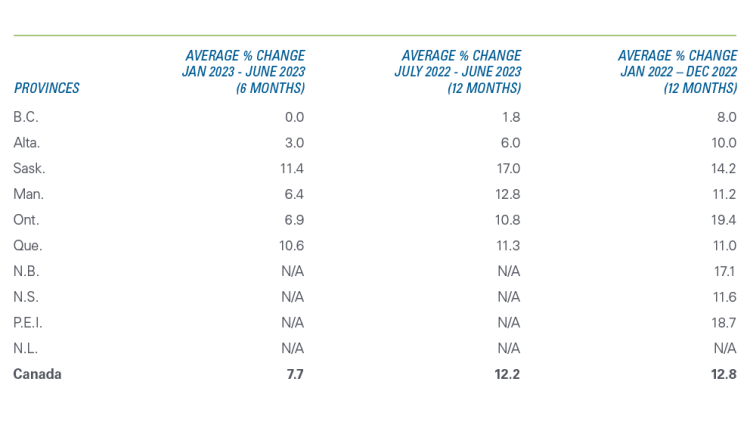

There hasn’t been a noticeable shift in the underlying trend of farmland values in the first half of 2023. Even if higher interest rates are slowly eroding buyers' purchasing power, limited availability of farmland for sale is generally still pushing prices higher. The national average growth rate in dryland farmland values for the first six months of 2023 stands at 7.7% (Table 1). The most recent 12-month annual increase is slightly lower than the preceding 12-month growth.

However, there is a high degree of variability across the country. Saskatchewan and Quebec farmland values recorded the highest average 6-month increases in the country, with 11.4% and 10.6%, respectively (Table 1). Ontario and Manitoba’s average increases were nearly identical at 6.9% and 6.4%. Alberta recorded a 3.0% average growth, and British Columbia rounds out the available estimates with an even 0.0%. We can’t provide average estimates for the Atlantic provinces since fewer sales were available at mid-year; we expect to provide reliable estimates at year-end.

Table 1: Average farmland values changes in the first half of 2023 by province

Source: FCC calculations

Farm cash receipts growth slows down while borrowing costs have trended higher

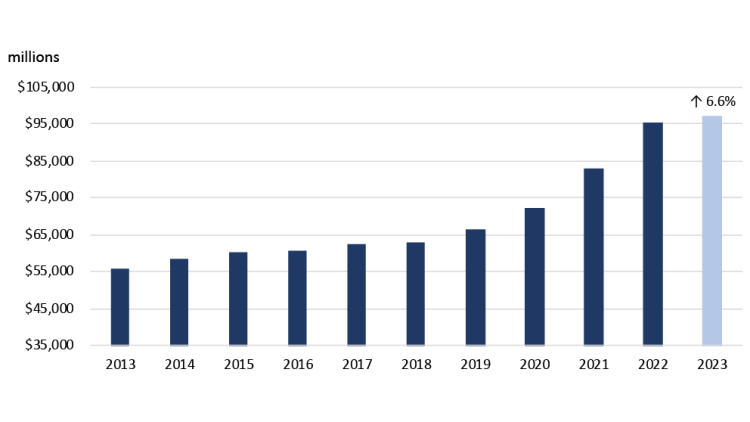

A series of policy rate increases by the Bank of Canada lifted borrowing costs much higher than businesses have faced on average in the last ten years (Figure 1). Yet farm cash receipts were resilient amid downward pressure on agriculture commodity prices. FCC Economics’ most recent projections call for farm cash receipts to increase 6.6% in 2023 (Figure 2). On the one hand, higher borrowing costs and pressures on the Canadian and global economies have made farm operations cautious regarding capital expenditures and investment. On the other hand, a limited supply of farmland available for sale and robust farm income have contributed to higher land values in the first 6 months of 2023.

Figure 1: Effective average business interest rate climbed by 4 percentage points since beginning of 2022

Source: Bank of Canada

Figure 2: Farm cash receipts projected to increase 6.6% in 2023

Sources: StatsCan for observed amounts and FCC Economics for the forecasted figures

Provincial trends

In British Columbia, on average, the province recorded no change in farmland values, with some growth in one region offset by small declines in another. There’s evidence that elevated land prices coupled with higher interest rates are leading to a slowdown in sales. The South Coast, British Columbia’s most expensive region, has been experiencing a small pullback in land values, whereas other regions have recorded steady or slightly increasing land values.

Farmland values in Alberta have increased at an average moderate rate in the first 6 months (3%), resulting in a year-over-year increase of 6.0%. It’s important to note that this increase applies to dryland, and the most recent 12-month increase is lower than the previous 12-month increase from January 2022 to December 2022. The availability of farmland for sale remains low in this province.

Saskatchewan leads the country in the average farmland value increases for this first half of the year at 11.4%. Most regions saw increases in the 7-11% range, indicating relatively steady demand province-wide. The North East region stood out with the strongest demand, leading to above-average growth relative to the rest of the province. Low precipitation has led lately to an increased demand in heavy clay soils, where moisture retention has been rewarded with higher prices.

In Manitoba, we are seeing a shift in growth away from the higher-priced land. The Eastman and Central Plains – Pembina Valley regions have the highest average prices and the lowest growth recorded in the last 6 months and the last 12 months.

For Ontario, our internal database of farmland transactions indicates a considerable decline in the number of sales in the Southern region. This area has recorded some of the strongest growth over the last 6 months and the last 12 months. Crop yields were above average this past year, leading to robust gross revenues and strong demand for farmland. The situation thus far in 2023 for both western and southern Ontario is different, with high volumes of rain, which raises questions about the expected yield for this year and the outlook for farmland demand in the second half of the year. There remains a wide range of pricing across the province, with South West, Central West and South East regions leading in price per acre.

Quebec’s farmland sales seem to be undeterred by higher interest rates. The province recorded the second highest growth rate in Canada over the last 6 months, combined with a slightly accelerating pace of increase over the last 12 months compared to the preceding 12-month period. A high degree of variability was observed across regions, with little to no increase in some regions and higher-than-average increases in others. For example, we recorded high growth rates in the regions of Lac St-Jean and Chaudière-Appalaches and smaller increases in the Montérégie and Laurentide-Lanaudière regions (even if the latter two areas remain leaders in terms of price per acre).

A limited number of sales in the Atlantic region limits our ability to report an average rate. However, we expect to be able to leverage sales data for New Brunswick, Nova Scotia and Prince Edward Island in our annual report. The sparse data we have for the first six months of the year nonetheless suggests moderate increases across all three Atlantic provinces aforementioned.

The path forward

High interest rates, elevated farm input costs, and uncertainty regarding future commodity prices characterize the current environment. It’s no surprise to have farm operations exercise caution. Yet the balance of demand for farmland relative to the supply available is pushing land prices higher. It would be prudent to expect farmland value appreciation to slow until the uncertainty over the economic environment vanishes.

Article by: Corbin Chau, Data Analyst, Valuations