Top 10 charts to monitor in 2023

As we start the new year amid elevated inflation and the threat of a recession, FCC Economics is highlighting ten charts that help make sense of the economic environment for farm operations, agribusinesses and food processors.

Inflation

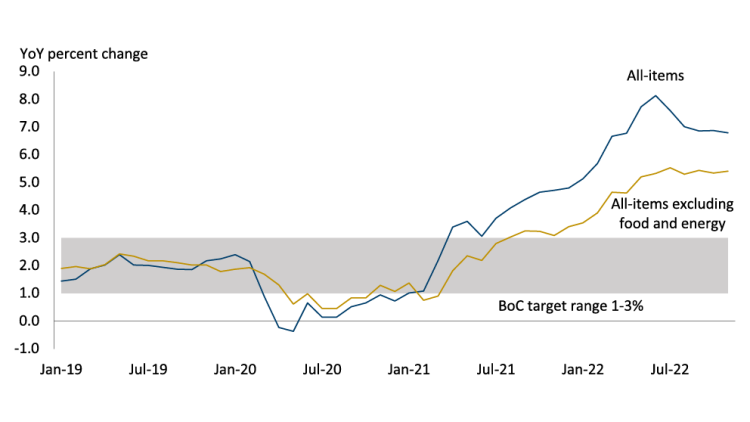

This should surprise nobody. Last year’s inflation hit monthly highs not seen in decades, with headline inflation at 6.8% year-over-year (YoY) in November. Excluding food and energy, prices rose 5.4% over the same timeframe. Higher prices for food and gasoline (which rose 11.4% and 13.7% year-over-year, respectively) drove much of the overall inflation as of March 2021 and throughout 2022 (Figure 1).

Figure 1: Energy and food price gains leads Canadian inflation

Source: Statistics Canada

FCC Economics forecasts inflation to moderate throughout 2023, although prices are still expected to remain high. Keep an eye on the Bank of Canada (BoC) as it attempts to wrest inflation under control and bring it to the midpoint of its 1 – 3% target range. The BoC is expected to keep the overnight interest rate (OIR) above 4.0% and evaluate how the economy and inflation react before considering its next move. Any further upward or sideways movement in inflation could be met by further rate increases.

Interest rates

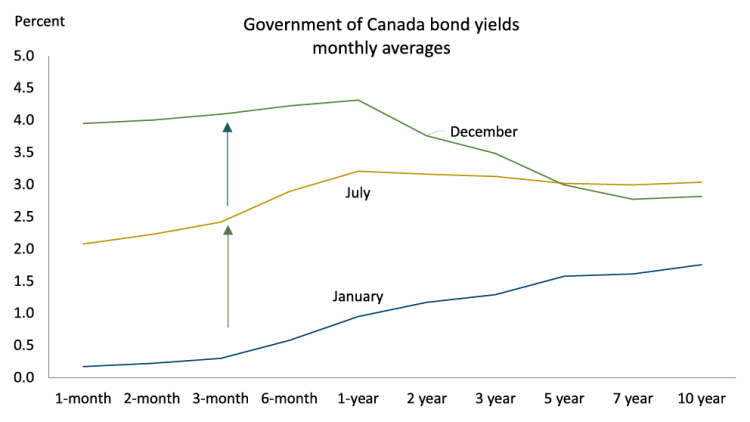

The overnight interest rate rose from 0.25 in January 2022 to 4.25 in December. Over that time, the yield has exhibited a negative slope for bonds with a maturity over 1 year (Figure 2), which means that long-term interest rates are lower than short-term interest rates. Such a pattern can serve as a signal of a looming recession as investors expect economic activity to fall over time.

Figure 2: Is there a recession looming in Canada?

Source: Statistics Canada

That may not be the case in 2023 though. Because inflation skyrocketed in 2022, the negative slope might be less a harbinger of economic fallout and more an indicator that inflation’s wild upswing is expected to moderate and, possibly, that normality will be restored.

Labour

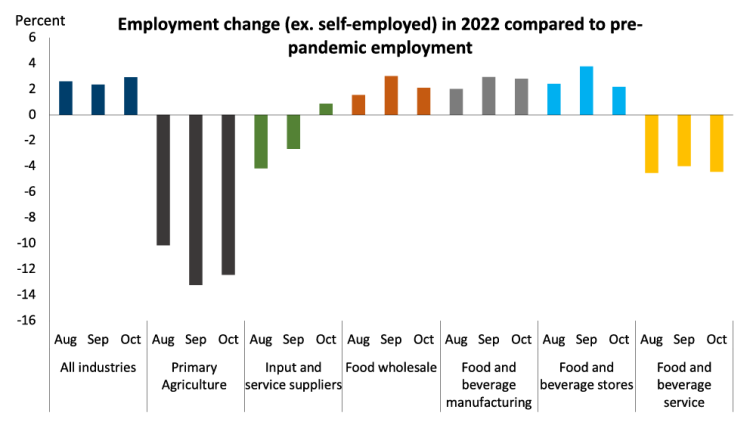

A deeply problematic outcome of the pandemic has been the seemingly endless trouble of finding labour in Canadian agri-food supply chains. That’s particularly the case for primary agriculture, among input and service suppliers and across food service establishments. Those three sectors each have lower levels of employment than in August, September and October 2019 (Figure 3).

Figure 3: A bad situation in agriculture has become worse

Source: Statistics Canada survey of employment, payrolls and hours (SEPH)

While food processors, wholesalers and stores show employment gains driven by higher sales, these industries still face significant labour shortages as evidenced by job vacancy rates that are more than double pre-pandemic levels.

The loonie

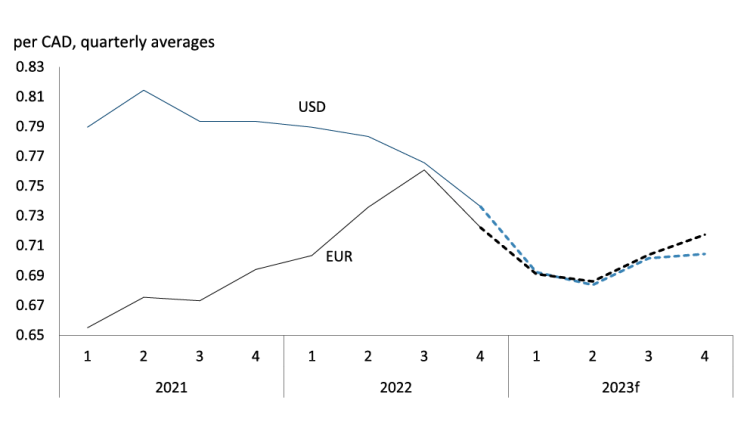

This is a chart that’s hard to miss on the watch list. The loonie started 2022 at 0.79USD before finishing the year just under 0.74USD. FCC Economics expects some further deterioration in early 2023 (Figure 4). It should decline towards 0.70USD in Q2 2023 before starting to rise again by the end of 2023.

Although the CAD had appreciated relative to the Euro and several other key ag producing countries’ currencies throughout 2022, its recent fall against the Euro has eroded almost all gains. It’s a dual-edged sword, as the relative depreciation of the loonie makes imports from these countries more expensive in Canada but makes Canadian exports relatively more competitive in global markets.

Figure 4: Loonie expected to rise in 2023

Sources: FCC Economics, Statistics Canada

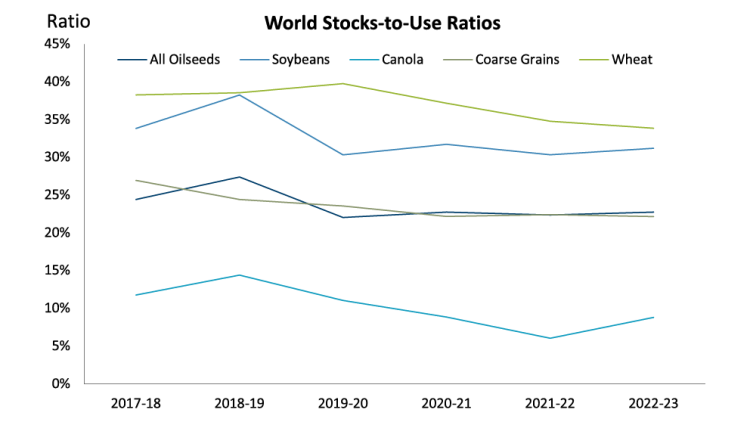

Stocks-to-use ratios

World stocks-to-use ratios are expected to be low at the end of marketing year 2022-23 for crops that are Canada’s largest exports (Figure 5). Coarse grains and wheat are lower than their respective previous 5-year averages, as are soybeans and total oilseeds. Global stocks of canola are scraping the bottom of the barrel after the poor 2021 Canadian harvest. The world canola stocks-to-use ratio in 2021-22 was the lowest since 2003-04, while Canada’s ratio was close to the record low set in 2012-13.

Figure 5: Global supplies expected to be drawn down in 2022-23 below 5-year averages

Source: USDA WASDE

South American corn and early soybean production over the winter months will be key to watch as any unanticipated declines will pressure the ratios further.

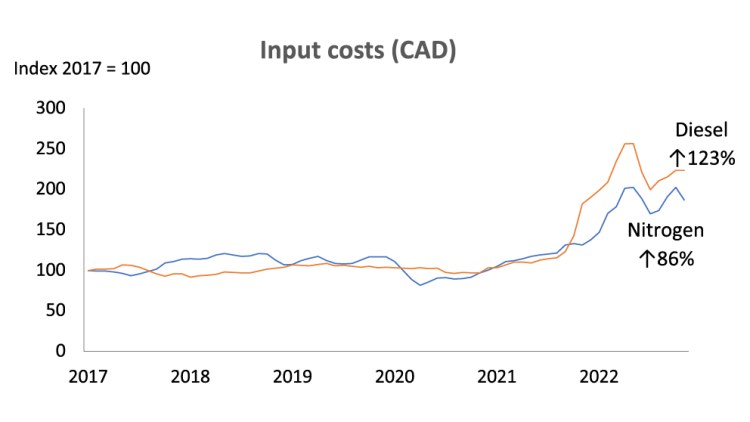

Input costs

Fertilizer production has faced numerous, severe supply shocks since the pandemic that have culminated in skyrocketing prices (Figure 6). From weather-related damage in U.S. and Pakistani fertilizer plants and an extended Chinese phosphate export ban to the impact from the war in Ukraine on Russian natural gas exports, global fertilizer producers have been largely unable to keep up with demand.

While Dutch natural gas prices declined significantly in Q4 2022, these prices in other European centres will continue to be volatile, limiting further EU fertilizer production. EU natural gas prices will set the floor price for global ammonia and other fertilizer products in 2023.

Figure 6: The pain of high input costs isn’t over yet

Source: Alberta Farm Input Prices and Natural Resources Canada

U.S. distillate stocks (for example, diesel and heating oil) declined in September, October and November of 2022 to levels not seen since the 1950s. The low stocks have pushed diesel prices significantly higher, with the spread between gas and diesel over $0.50/litre in December. We’re watching this as diesel is the primary fuel of the economy and low distillate stocks will continue to keep inflated energy prices elevated. Going forward, the supply of diesel in the U.S. and globally is set to tighten even further with the EU embargoes on imports of Russian diesel starting in February 2023.

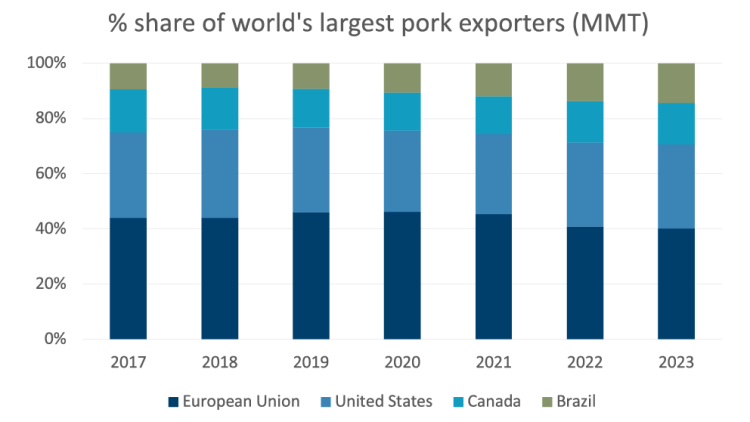

Hogs/Pork

The story of pork exports has been one of record demand and high prices since African Swine Fever (ASF) decimated China’s hog herd in 2018-19. With the Chinese hog herd now rebuilt, Brazil has emerged as an increasingly larger supplier while exports from the EU, U.S. and Canada are expected to continue their declining trends (Figure 7). Among the four largest global exporters, Brazil has grown their share of total exports between 2017 and what’s expected in 2023 by 51.1%. The U.S. and Canada have each lost less than 5% total market share, while the EU’s share has dropped 8.7% in the same timeframe. Brazil is South America’s and China’s biggest pork supplier and is expected to increase their exports to the Philippines where ASF remains a threat.

Figure 7: Brazil gains in global pork export markets at other top three exporters’ expense

Source: USDA WASDE

While the U.S. and the EU are considerably larger exporters than Brazil, the country is poised to overtake Canada as the world’s third-largest global supplier soon. We’ll watch the growth trends in exports and imports this year.

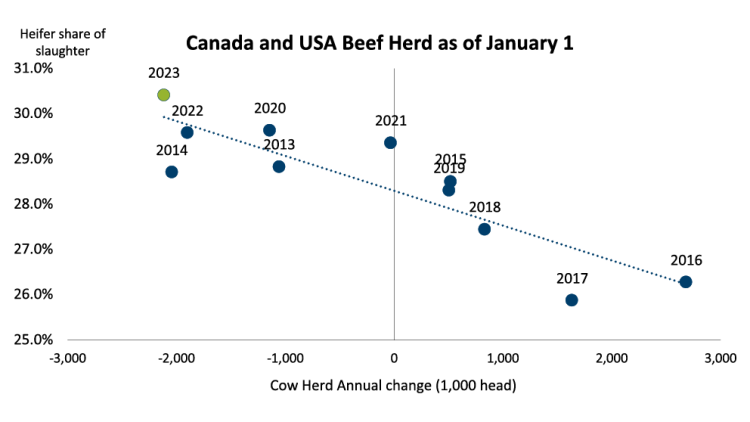

Cattle/Beef

With the highest rate of heifer slaughters as a percentage of total slaughters since at least 2013, the North American cattle herd is set to show its largest contraction in the count on January 1, 2023 (Figure 8). In a move to offset extremely high feed costs, producers have opted to cull cattle rather than retain heifers and grow the herd. While it improves the short-term situation, it will have far-reaching consequences for beef production in North America.

Figure 8: North American cattle herd set for contraction

Sources: Canfax, Statistics Canada, USDA, FCC Calculations

Household consumption

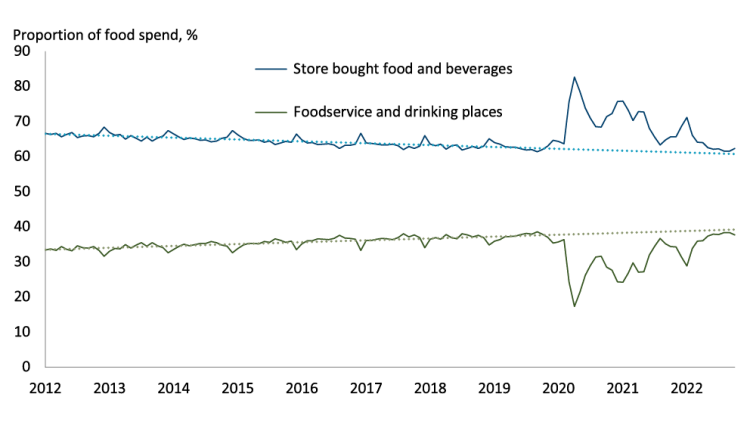

The pandemic changed everything consumer-related, and we haven’t returned to the “same old, same old.” Canadians stopped patronizing foodservice businesses and drinking places during the first two and a half years of COVID and bought more food and beverages in retail outlets. As we head into Year 3, food purchases have more closely aligned with the 10-year trend (Figure 9). Consumers have shown a strong demand for restaurants and ready-to-eat meals despite inflationary pressures on these discretionary purchases.

Between 2015 and 2019, foodservice sales accounted for 37% of food retail sales in Canada. These nosedived during the pandemic, but as of September 2022, they’ve fully recovered, sitting at 38% (and at 48% in the U.S.). Foodservice sales are expected to surpass 50% of total food consumption in the U.S. within the next few years.

Figure 9: Foodservice purchases have recovered and are about to dominate food sales

Source: Statistics Canada

In 2023, we’ll be watching how closely the long-term pre-COVID trend holds. As the possibility of a recession looms at the start of 2023 and the upward foodservice trend starts to buckle, we’ll see if the upheaval the pandemic has helped create is finished.

Farm equipment inventories

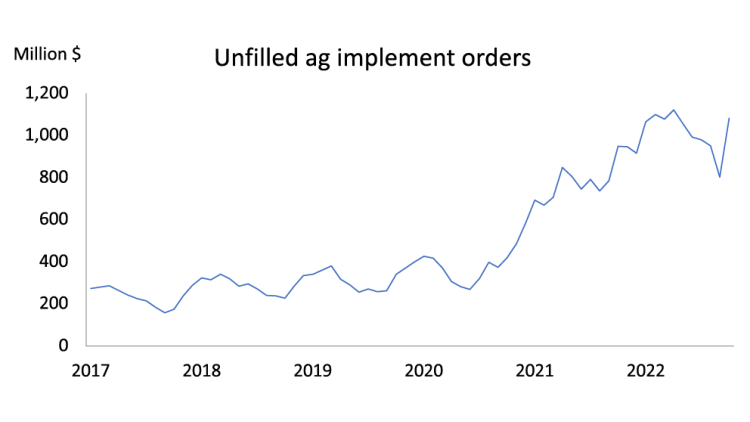

Supply chain disruptions have been a big news story each of the last two years, and in 2023, the Canadian agri-food chain may have a chance to get ahead of some of the upheaval. Our last chart to monitor this year is the trend in the value of unfilled orders of Canadian agricultural implement manufacturers (Figure 10). The trend is a proxy for farm equipment sales and inventory levels as it indicates the status of equipment manufacturers’ pre-orders.

Figure 10: Recovery from supply chain woes needed to restore ag implement supply

Source: Statistics Canada

Equipment sales have been mixed in 2022 following a strong performance in 2021. Continued strength in crop receipts in 2022 supported demand for new and used farm equipment. At the end of 2022, inventory levels of new farm equipment were nearly 50% below their 5-year average and are expected to remain tight through 2024. Farm equipment sales in 2023 will largely depend on the speed of supply chain recovery and equipment manufacturers’ deliveries on previous orders. Strong farm equipment sales in Canada and the U.S. are expected to reduce farm equipment inventories of new and used farm equipment further.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.