2023 Dairy sector outlook

FCC Economics helps you make sense of the top economic trends and issues likely to affect your operation. We believe the following will be influential drivers of dairy farm profitability in 2023:

Elevated input costs

Butter stock levels

Imports of dairy products

Retail price inflation

Total revenues are the product of price and production. In November 2022, the Canadian Dairy Commission (CDC) announced an increase in the butter support price effective February 1, 2023. The higher support price will provide the foundation for higher farmgate prices, which we expect to increase by 2.9%. Production is expected to increase 2.7% in 2023 at a national level, driven in part by the need to replenish low butter stocks. When taken together, we forecast dairy cash receipts to increase 5.7% in 2023.

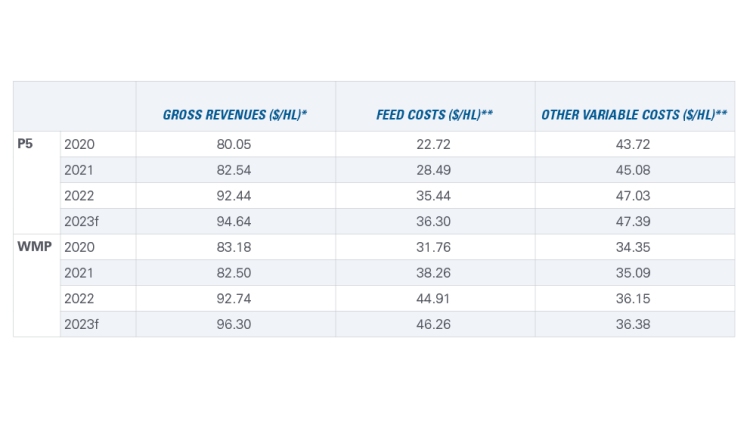

Increased dairy revenues will help offset production costs that are expected to moderate in terms of growth but remain elevated in 2023 (Table 1). After increasing substantially from 2020 to 2022 (56% and 41% for the P5 and WMP, respectively), we expect feed costs to increase only 2.4% in the P5 and 3.0% in the WMP this upcoming year.

Table 1: Estimates of dairy farm revenues and costs

Sources: Calculations by FCC based on cost of production estimates from the Canadian Dairy Commission and Government of Alberta and data from the Dairy Farmers of Ontario, Les Producteurs de Lait du Quebec, Alberta Milk, Statistics Canada and USDA.

*Gross revenues are based on data reported by producer groups, which differ from Statistics Canada data used in calculating dairy receipts.

**The calculations use different definitions of cost categories for the P5, and WMP and therefore values are not directly comparable.

Our forecasts do not consider compensation payments related to trade agreements, such as the fourth and final round of compensation from the federal government for the Comprehensive European Trade Agreement (CETA) and Comprehensive and Progressive Trans-Pacific Partnership (CPTPP). The recently announced Canada-United States-Mexico Agreement (CUSMA) payments aren’t scheduled to be administered until 2024.

Trends to watch in 2023

1. Elevated input costs

Our grains, oilseeds and pulses outlook forecasts corn prices to trend slightly higher than last year, while barley prices will decline. Hay and barley production in the Prairies rebounded in 2022 but yields varied considerably by location. Heading into 2023, moisture levels are still low but good snowpack in drought-stricken areas provides optimism that the spring thaw will help replenish them.

Increased revenues in 2022 didn’t fully offset the overall increase in input prices, so producers had to find operational efficiencies to protect profit margins.

2. Butter stock levels

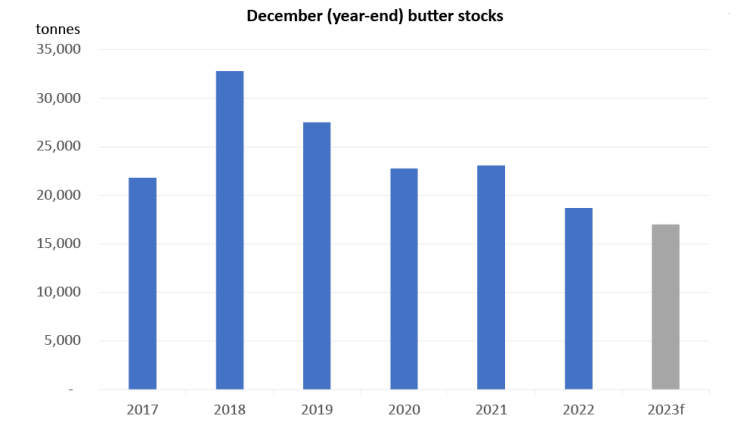

In October 2022, the CDC forecasted that butter stocks would fall to near-historic lows by December 2023. That forecast did not reflect the P5 quota increase in October 2022 – if anything, it likely spurred the quota increase. The CDC will revise these numbers higher given recent production increases, but the trend will remain: butter stocks have been declining the last few years and will remain below their average of the last five years in 2023 (Figure 1).

Figure 1: Butter stocks projected to decline by the end of 2023

Sources: Statistics Canada table 32-10-0001, CDC’s October 2022 Market Outlook, FCC calculations.

Low stocks are driven by changing consumer preferences for products with higher butterfat content (for example, whole milk). A desire to replenish these stocks is a key reason why we expect production to increase in 2023, albeit at various rates across provinces based on the share of the industrial milk market. Tracking stocks during the year will be key to understanding quota and incentive day changes in 2023.

3. Imports of dairy products

Prior to Christmas, the U.S. identified “additional bases for concern” that Canada is not playing fair when it comes to allocating its import licenses, also known as tariff rate quotas, or TRQs, under CUSMA. New Zealand also requested a dispute resolution panel be established to address its concerns with the allocation of TRQs under the CPTPP trade deal. Settling international trade disputes is often a lengthy process so it’s difficult to say whether the allocation of TRQs will change in 2023.

Last year, the U.S. did not export its maximum allowable volume of dairy products under CUSMA. In some product categories, the fill rates were quite low. But market forces and consumer choices are a big reason why: there is high demand and low stocks of butter so the fill rate for butter was 93%. The reverse is true for skim milk powder, where the fill rate was only 8%.

More imports would weaken domestic milk production assuming consumer demand is relatively stable. A low Canadian dollar will make U.S. imports relatively more expensive, potentially limiting import volumes.

4. Retail price inflation

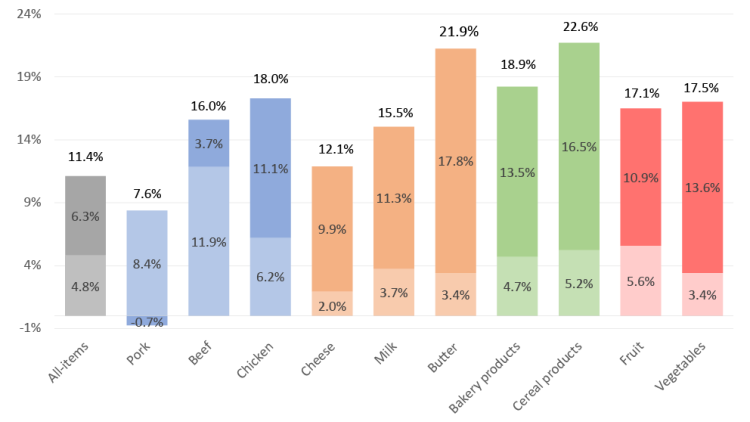

In 2021, dairy product inflation grew at a slower rate compared to other major food categories as well as the overall inflation rate (Figure 2). In 2022, dairy product inflation grew at a rate similar to other major food categories.

Figure 2: Dairy retail price inflation low in 2021, high in 2022, and overall in line with other foods

Source: Statistics Canada table 18-10-0004.

Lighter shades indicate inflation rates in 2021, darker shades 2022. Two-year price inflation rates are at the top of each bar.

Did higher dairy prices reduce demand? The limited data from Nielsen shows grocery store sales of butter did indeed decrease in 2022. However, the volume of all food purchased decreased in 2022 as consumer purchasing power was eroded and consumers ate at restaurants more often compared to 2021 when pandemic health restrictions were still partially in place. Product substitution isn’t apparent in the data: consumers purchased less butter and margarine in 2022 as high canola prices last year limited any substitution. Prices of plant-based alternatives are less sticky than those in dairy, and how those prices move in 2023 will dictate the degree to which consumers change the composition of their food baskets.

Bottom line

Production and price increases will lift dairy revenues in 2023, but the sector faces headwinds that will challenge profitability. Input costs remain elevated and the spectre of more imports looms. We expect the rate hike from the Bank of Canada on January 25 will be the last one of this tightening cycle; however, there won’t be much relief in terms of debt servicing costs in 2023 as interest rates will remain elevated during the year.

Check back for a regular update of this 2023 dairy outlook and outlooks on grain, pulse and oilseed, hog/cattle, and food processing sectors.

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.