2023 Cattle and hog sector outlook

FCC Economics helps you make sense of the top economic trends and issues likely to affect your operation in 2023.

2023 FCC Economic Outlook

Watch a recording of the 2023 FCC Economic Outlook that reviews the major drivers and trends to look for in the year ahead.

The three major trends to monitor for cattle and hog operations include:

Contracting North American cattle herd

Feed costs

Global red meat demand amidst an economic slowdown

Prices continue the last two years’ growth trend for cattle and hogs. In Alberta and Ontario, steer prices will climb above the average 2022 price and above their five-year averages, which they’ve lagged recently (Table 1). Ontario and Manitoba hogs are expected to hover close to the YoY and five-year average prices.

Table 1: Livestock price forecast

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations.

The robust prices will be a big reason margins in the cow-calf sector are forecast to be strong in 2023 as they continue to climb above the good margins of 2022. Feed costs will again challenge profitability in the feedlot sector, especially for operations that purchase their own feed. Feed costs are declining from last year’s highs, but they still easily exceed the five-year average (Table 2). Overall, the sector is expected to see a YoY improvement.

Isowean profitability projections show Ontario and Manitoba will be close to breaking even and their five-year averages. Farrow-to-finish operations, on the other hand, will see margins gain significantly over their five-year averages in both regions, but especially in Manitoba, where lower feed costs provide some relief.

Trends to monitor in 2023

1.� Contraction in cattle herds boosts short-term production but will deplete the supply

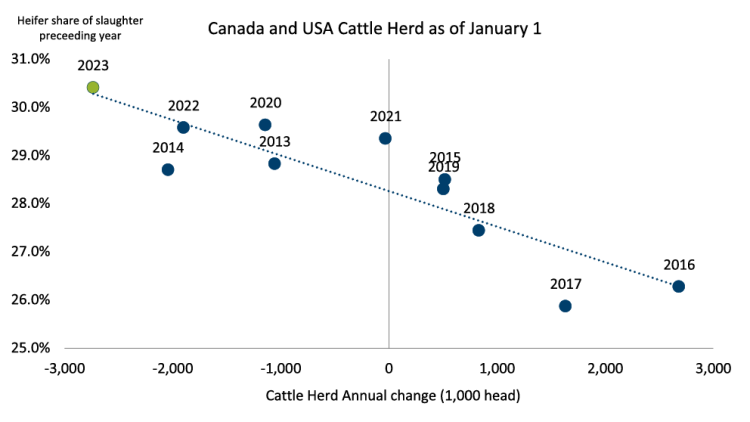

Over the last year, producers have sent more heifers to slaughter in both Canada and the U.S. as a response to drought conditions in the U.S. and extremely high feed costs. Heifer slaughter as a percent of total slaughter has been above 29% since 2020, a level at which herd size contracts the following year. During 2022, the heifer share was a decade high at 30.4% and is near the record rate of 32% set in 2004.

As reported in the USDA Livestock, Dairy and Poultry Outlook (December 2022), roughly 69% of the U.S. cattle herd is in drought-stricken areas, a 33% YoY increase. The increased heifer slaughter has led to the largest contraction of the North American herd in a decade (Figure 1), with U.S. cattle inventory down 4% YoY as of January 1, 2023. The full contraction will be official when the count of Canadian cattle as of January 1, 2023, becomes available.

Figure 1: North American cattle herd set for contraction

Sources: Canfax, Statistics Canada, USDA, FCC Calculations.

While sending heifers to slaughter improves short-term beef supplies, it will have far-reaching consequences for beef production in North America. In the U.S., in 2022, beef production was marginally down YoY while it’s forecasted to decline another 4% this year. Canadian beef production to date is up YoY (10%). The liquidation has meant higher beef production in the short term, which will slow as fewer cattle are available. The USDA forecasts a 1.4% overall contraction for Canadian beef production for 2023. That has implications for North American exports (detailed below in the third trend to monitor).

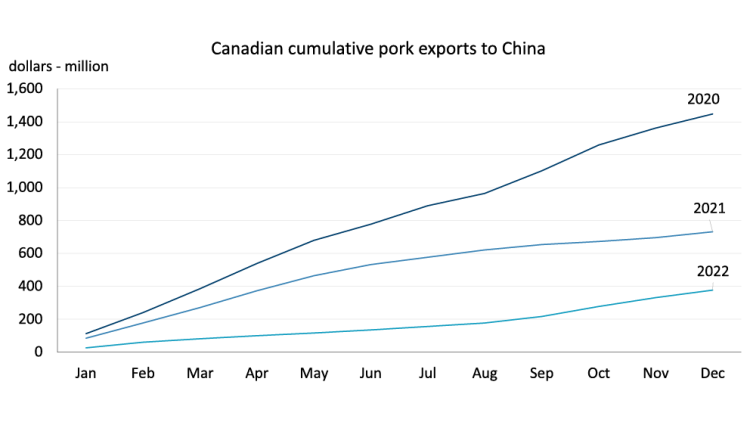

Canadian pork production is forecast to hold steady at 2022 levels. With Canadian exports to China quickly dropping YoY (Figure 2), suppliers here will have to find new buyers in other markets.

Figure 2: The boon of China’s import demand is over

Source: Canadian International Merchant Trade database.

2. Feed costs are still elevated

It is a tired topic now, but feed costs remain historically high, down from the record levels last year but still very much a downside risk for producer profitability. We expect they’ll remain above their five-year averages (Table 2) throughout 2023 despite an improved YoY feed grain crop in 2022 in North America. Canadian production of feed grains, estimated to be almost one-quarter larger YoY by Statistics Canada, led to fewer imports of U.S. corn in the second half of 2022 and has helped manage costs. That’s been good for producers who grow their own feed but leaves more risk for those forced to buy.

Table 2: Feed costs ($/tonne) remain high

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations.

The war in Ukraine continues to be another upside risk for feed costs. Supply chain issues caused by the war, expected to ramp up in the spring, will again impact crop input prices and could result in some feed grain growers limiting production.

3. Demand for red meat a mixed story

The possible demand destruction of red meat that we noted in our last outlook update of 2022 hasn’t materialized to the extent we envisioned. At least part of that is due to the easing of recessionary pressures, as reported by the International Monetary Fund (IMF). The world isn’t completely out of the woods regarding a possible significant economic slowdown, with growth expected to slow this year and centred on advanced economies where red meat consumption is greatest. But their latest outlook has brightened since October, suggesting that 2023 could be the bottom of the decline in economic growth and the year of declining inflation. They expect global growth of 2.9% in 2023, falling from 3.4% in 2022.

Overall economic growth will be led by emerging economies, including China, where the USDA pegs beef consumption to grow almost 3% YoY and pork to stabilize. Canadian beef exports aren’t expected to grow this year, and U.S. exports are forecast to shrink 12.8% YoY – to be expected with the production slowdowns. The USDA projects Canadian pork exports to decline by 2% while the U.S. remains at 2022 levels.

Pork import demand from China is a wildcard. The USDA projected Chinese 2023 pork production at 55 million metric tons (MMt) in January. China’s National Bureau of Statistics pegged 2022 production at 55.4 MMt, the highest in eight years and a much larger number than anticipated. The USDA production projections for 2023 are bound to be revised higher, influencing exports downward.

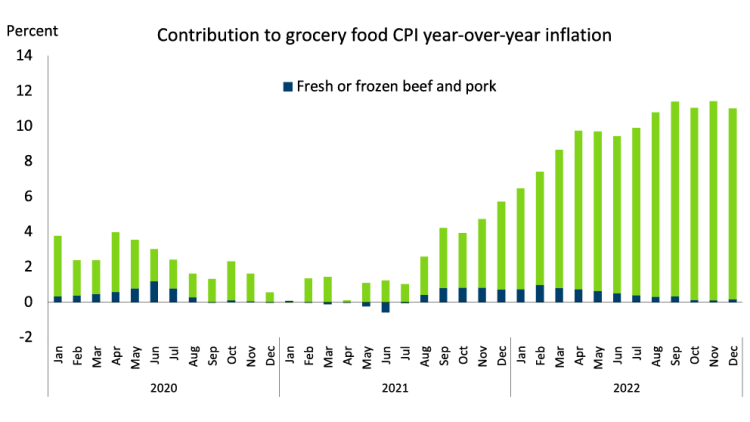

North American beef consumption will fall marginally (1.2%) in Canada and 5% in the U.S. this year. Another reason demand isn’t imploding may be tied to comparative inflationary pressures, which in Canada were lower for meat (6% YoY) than other food categories (10.1% YoY). From early to late 2022, beef and pork took up relatively less of overall food inflation (Figure 3).

Figure 3: As inflation rises in many other foods, beef and pork inflation falls in comparison

Source: StatsCan

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.