2023 alcoholic beverages outlook: Slow sales a symptom of weaker economy

Alcohol beverage manufacturing is a low-margin, high-volume business. Major shifts in demand or production costs have had significant financial implications over the last few years.

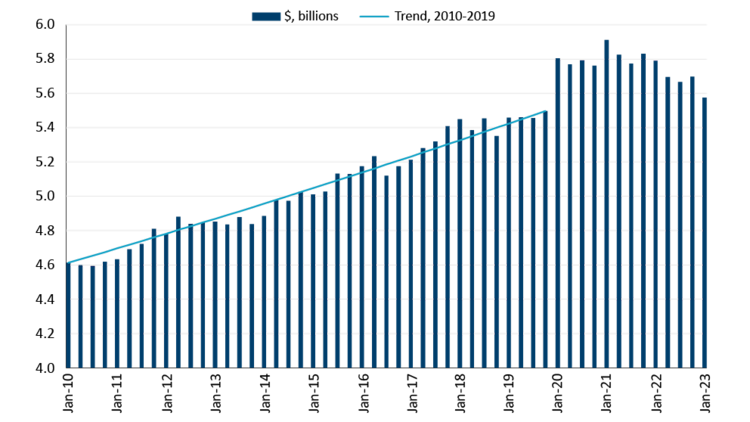

Canadian alcoholic beverage manufacturers derive 88% of their revenue domestically, and consumer spending on alcohol has been volatile in the last three years. Canadians spent more on alcohol during the pandemic than the historical trend, despite the intermittent opportunities to purchase higher-priced alcohol in dining establishments during that period. That reversed in 2022 as inflation took off and budget-conscious consumers needed to decide what or how much they drank. Household spending on alcoholic beverages is now below the pre-pandemic trend. On a per capita basis, sales numbers would look worse considering the large population growth of the last two years.

Figure 1. Purchases of alcoholic beverages have trended downward since the pandemic boom

Sources: Statistics Canada and FCC Economics

All numbers are in constant (2012) dollars.

Total sales are split among more competitors. As of July 2022, there were 2,766 beverage manufacturers in Canada, 15% more than in July 2019.

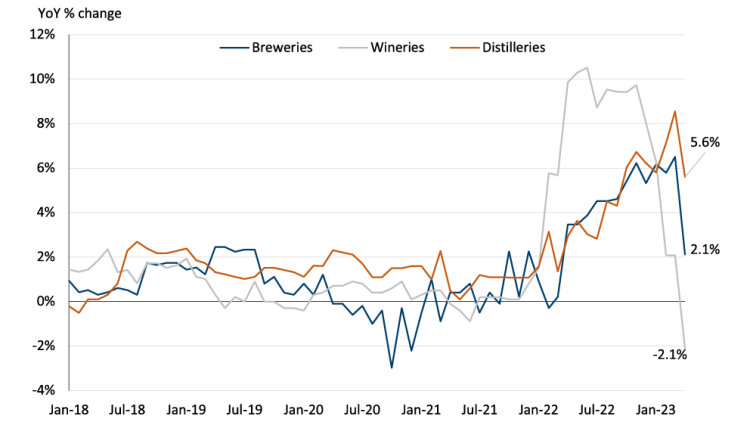

Input costs began increasing in late 2021 and into 2022. The Industrial Product Price Index (IPPI) (measuring prices received by alcoholic beverage manufacturers) began increasing in mid-2022 (Figure 2) but did not fully offset higher input costs, squeezing manufacturers’ margins last year. The manufacturers’ selling price started to decline in early 2023 (and even led to lower prices for wineries), reflecting a stabilization in input costs, weaker demand and competitive pressures in each market.

Figure 2. Prices received by alcoholic beverage manufacturers are declining

Source: Statistics Canada

The markets for hard seltzers and non-alcoholic beer are growing revenue streams. The market share of ‘other’ alcoholic beverages is now 8.0%, up from 4.2% just four years ago. The increased demand for non-alcoholic beverages could provide opportunities for manufacturers of alcoholic beverages to increase sales by utilizing supply chains and production processes already in place.

For a deeper dive into industry outlooks, click the sections below.

Consumer belts are tightening, and an economic slowdown is on the horizon. Business agility to changing consumer tastes will be important for long-term growth as consumers’ preferences continue to shift and the country’s demographics change. Cost management in a slowing or negative sales growth environment will be key to maintaining or growing margins. All told, 2023 will be challenging for manufacturers of alcoholic beverages.

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.