Mid-year 2022 farmland values puts focus on income, interest rates and supply

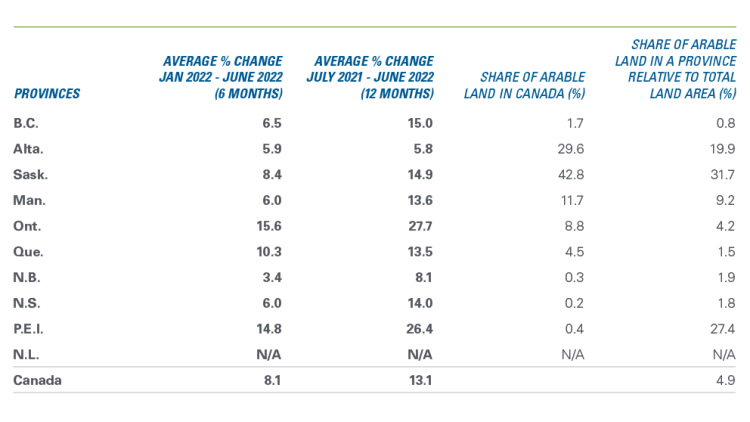

The main drivers of farmland values remained strong in the first half of 2022. We report an average increase of 8.1% nationwide in farmland values over the period (Table 1). Commodity prices were robust, strengthening farm cash receipts. Higher interest rates and elevated farm input prices seemed to have had minimal influence on the demand for farmland.

Our analysis covers the period of January 1 to June 30, 2022. The highest increases were observed in Ontario, Prince Edward Island and Quebec, with 15.6%, 14.8% and 10.3% increases, respectively. Saskatchewan follows with an 8.4% average increase. British Columbia, Alberta, Manitoba, and Nova Scotia recorded below-average increases, varying from 5.9% to 6.5%. New Brunswick has the smallest increase, with a reported 3.4%.

Table 1. Average farmland values changes in the first half of 2022 by province vs. supply of arable land

Sources: FCC computations and Statistics Canada

Timing of sales, tight supply and farm income all matter in the context of higher borrowing costs

The Bank of Canada started lifting its policy interest rate in early March. But this was a muted response to emerging inflationary pressures. It wasn’t until July that the Bank of Canada frontloaded the required hikes in the overnight rate to bring down inflation. It’s important to note that many sales were negotiated or closed before the significant borrowing costs increases. It’s not rare for transactions to close multiple months after being negotiated.

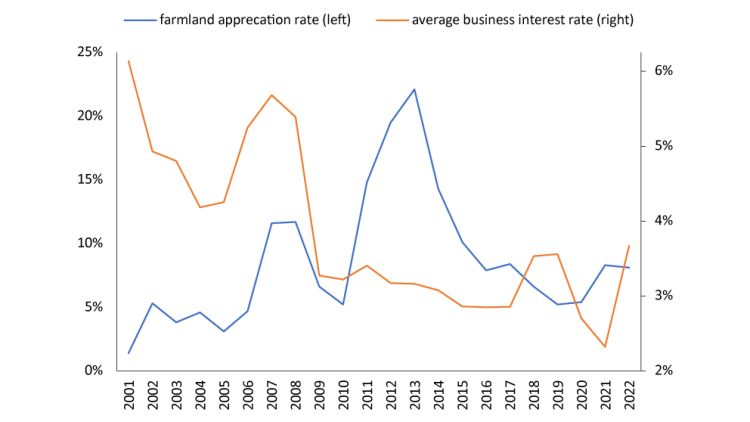

FCC has been reporting on farmland values since 1985. Historically, we’ve seen other periods of rising interest rates – the previous significant increase occurred in 2006-07 (Figure 1). Yet, this period coincided with increases in the appreciation rate of farmland values, highlighting the importance of considering factors beyond borrowing costs.

Figure 1. Average farmland values appreciation rate with average business interest rates

Sources: FCC computations and Bank of Canada; 2022 represents an average of the first 6 months.

The acreage available for farmland that can be cultivated and productive is limited and does not increase as opposed to real estate markets. This puts upward pressure on prices, given a stable and robust demand. The percentage of land used as arable land is limited in most provinces (Table 1). Recently, provinces with more arable land seemed to experience a slower pace of increase in land values.

Farm cash receipts have climbed 14.6% year-over-year for the first half of 2022. Grain, oilseed, and pulse receipts were slightly lower in the first six months, but this was expected given the poor 2021 crop in the Prairies. The outlook remains positive. Despite inflationary pressures and geopolitical tensions, new crop prices continue to exceed early expectations, and margins should be profitable, given encouraging 2022 production estimates.

Provincial trends

In British Columbia, land values increased by an average of 6.5% for the first half of 2022. Increases varied a lot across the province, with the highest changes mostly located in areas with easy access and close to urban centers. We observed strong competition between farm operations and non-traditional buyers.

Alberta farmland increased at a more moderate pace of 5.9% for the first six months of 2022. It’s important to note that this increase applies to dryland only, and irrigated land values are only provided in the annual report. Farmland availability remains low in this province.

For Saskatchewan, favourable land market conditions observed in 2021 seem to have carried over into the first half of 2022. We are reporting an average increase of 8.4% for the latter period. Demand remains strong in most areas. We observed in some regions (North West, North East) no or little change in values as opposed to other regions with important increases.

In Manitoba, farmland values increased by 6.0% in the first half of 2022. Spring weather conditions were difficult in certain areas; for example, flooding delayed seeding. Increases in areas that coped best with moisture were higher than those affected by excess moisture.

Ontario has the most significant increase in value with 15.6% for the first six months of 2022, a 12-month pace of 27.7%. Land purchases that drive larger percentage increases in values are generally in less expensive areas of the province. There’s lots of variability across regions. The most important increases are observed in the South East and Central East regions, with average 6-month changes ranging from 20.0% to 24.0%. Conversely, average increases in the Western part of the province range from 10.0% to 17.0%.

In Quebec, the average increase in farmland value for the first half of 2022 was 10.3%. Supply is very limited in some regions, driving prices higher. Variability is also a characteristic of the market, and the most predominant increases were observed in the lower dollar-per-acre areas of the province.

Atlantic provinces recorded average increases of 3.4%, 6.0% and 14.8% for New Brunswick, Nova Scotia, and Prince Edward Island, respectively. A strong demand for forage and cultivated land from out-of-province buyers contributed to the overall increase. A limited number of sales in Newfoundland and Labrador prevented us from reporting an estimate.

Both demand and supply factors drive farmland values

The Bank of Canada has lifted its overnight rate by 3% since early March, and another hike of at least 50-basis points is anticipated at the end of October. In some cases, farm operations have seen their interest expenses more than double. In other instances, prudent financial risk management mitigated the negative influence of higher rates on profit margins.

There’s little doubt that higher borrowing costs will moderate the demand for farmland. However, farmland supply is limited, which combined with farm income trending in the right direction, could offset the impact of interest rate increases. We can’t wait to revisit these factors in early 2023.

Article by: Lyne Michaud, É.A., Senior Analyst, Valuations and Leigh Anderson, Senior Economist