2022 Grains, oilseeds and pulses sector outlook

FCC Economics helps you make sense of the top economic trends and issues likely to affect your operation in 2022.

2022 FCC Ag Economic Outlook

Watch a recording of the 2022 FCC Ag Economic Outlook that reviews the major drivers and trends to look for in the year ahead.

The major trends to monitor for grain, oilseed and pulse operations include:

Inflationary pressures on crop inputs

Geopolitical tensions and global trade

It was another extraordinary year in 2021. We witnessed record-breaking drought in parts of Canada and the U.S., unrivalled shipping rate increases and increasingly costly global demand for most crops amid ever-shrinking supplies. In Canada, grains, oilseeds and pulse producers did well, with an estimated 11.9% year-over-year (YoY) growth in farm cash receipts. They took a hit on expenses, as general inflation on goods rose 4.4% YoY, and farm inputs increased, on average, by 12.0% for the first three quarters of 2021.

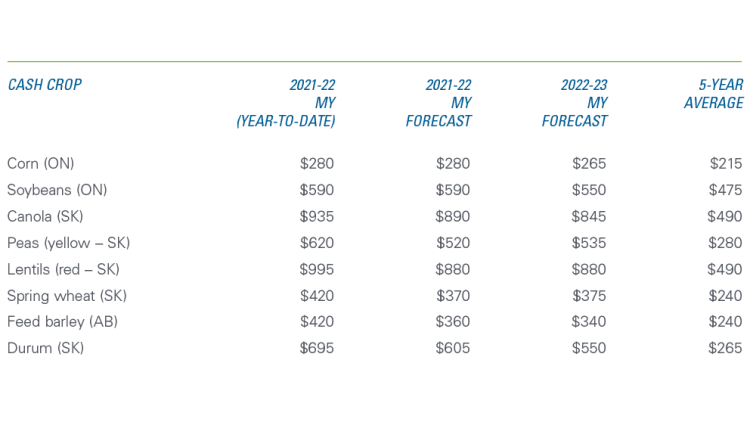

Commodity prices will continue to boost revenues throughout the 2021-22 and 2022-23 marketing years (MY) (Table 1). We forecast prices for all principal field crops to remain elevated above their five-year averages, even though for all but yellow peas, red lentils and spring wheat, they’re projected 5.1% (canola) to 9.1% (durum) lower YoY in 2022-23.

Table 1: 2021-22 and 2022-23 crop prices ($/tonne) well ahead of 5-year average (‘16-‘17 to ‘20-‘21)

Sources: Statistics Canada, AAFC, USDA, PDQ, CanFax, CME, MGEX and ICE Futures, and FCC calculations

Marketing Year for corn and soybeans: September 1 – August 31

Marketing Year for wheat, canola, barley, peas and lentils: August 1 – July 31

Global supplies of principal crops improved in 2021, but many are still tight. That, along with record-low Canadian supplies and persistent global demand, is expected to maintain strong Canadian prices throughout 2022.

Profitability to be challenged by input costs in 2022-23

While revenues should be good for the 2022-23 MY, the biggest concern will still be profitability. Input costs continue to rise from elevated levels, although the speed at which they do so is expected to taper off. We expect producers of all major field crops to be profitable throughout the MY, although margins will be tight on barley and spring wheat.

Wheat

The USDA projects 2021-22 Argentinian wheat production at a record 20.5 MMt, a 16.2% YoY increase and the European Union at 138.9 MMt, a 9.4% YoY increase. Russia and Ukraine are projected to have produced a combined 108.5 MMt. Global wheat supply, expected to be stable YoY in the 2021-22 MY, will still be tight, with global ending stocks forecast to be the smallest since 2016/17. Canadian total supply is even tighter at 32.1% lower YoY. The good news is that, aside from the lowered yields, the quality of the Canadian crop was good. That will help with revenues as higher quality wheat offers a premium in global export markets, a boon in a year when Canadian exports are expected to be 38.3% lower YoY to 16.3 MMt according to AAFC.

While all seeding estimates are likely to change in the coming months when more information can be included in the analysis, FCC’s preliminary seeding forecasts for durum and non-durum wheat show slightly higher acres YoY in 2022.

Corn

With Western feed stocks in short supply for the 2021-22 MY, AAFC has projected a YoY increase of almost 50% in corn imports, primarily to the West. Along with record-high Eastern Canadian corn yields and production, they boosted total supplies for the 2021-22 MY to 19.2 MMt, also a record. Carryout stocks are expected to decline slightly YoY, with domestic feed use and exports rising. Chatham prices are currently expected to be extremely high throughout the MY.

While corn prices are expected to be above average for 22-23, acreage in 2022 is expected to fall, due to high fertilizer prices and competitive pressures from higher-priced crops.

Soybeans

The Canadian soybean supply for the 2021-22 MY is the lowest in three years, as 2021 carry-in stocks, production and imports all declined YoY. And although carryout stocks will be 53.1% higher YoY, they’re still expected to be 27.5% lower than the 2019-20 carryout. Globally, YoY stronger production won’t be enough to keep ending stocks from dropping again, as continued strength in global demand will support prices that remain above the five-year average.

Planting estimates show Canadian soybean acreage is likely to gain in 2022. Several factors are behind the increase. First, fertilizer costs are expected to lower corn acres (where relatively more nitrogen fertilizer is required). Second, newly minted U.S. renewable fuel mandates are calling for a large increase in the use of soy oil while human oil consumption continues to rise.

Canola

Very tight Canadian supplies are the cornerstone of this marketing year’s story for canola and, at 14.5 MMt, are expected to reach a 13-year low. Stocks were low to begin the year, and a 40% dint in overall Canadian yields (46% in Saskatchewan) reduced total production to 12.6 MMt., a 35.4% YoY decline. But, as with wheat, the quality of the smaller crop is high.

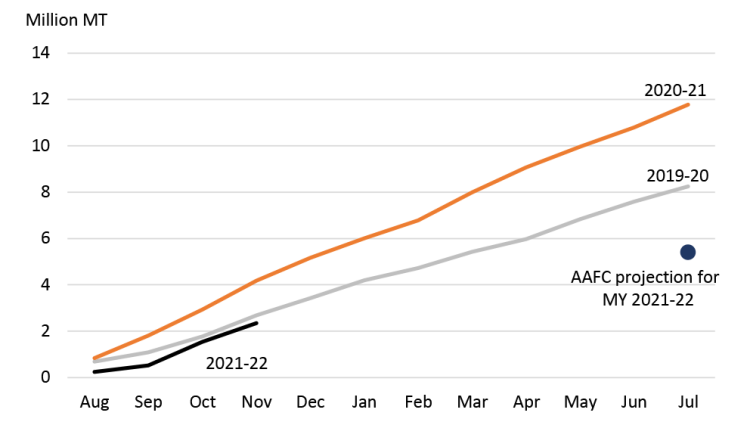

Given the low stocks, domestic crush and exports are forecast lower YoY, exports by 48.7%. That’s despite strong global demand for oilseeds expected throughout the MY. The pace of exports is strong at the beginning of this MY (Figure 1), which may dampen demand from domestic crushers throughout the rest of the year.

Figure 1: Canadian canola exports (HS 1205) on pace to exceed projections for MY 2021-22

Sources: Statistics Canada, AAFC

With low supplies hampering world trade, canola pricing could be subject to considerable volatility in 2022. Nonetheless, they should remain well above their five-year average. Prices for the 2022-23 MY are forecast lower YoY, but still 72.5% more than the five-year average.

FCC projects canola acres to gain the most in 2022, with global and Canadian stocks so low, prices so high and a crop that will be highly profitable. Any further strength in the oilseeds markets will only bolster canola prices before planting.

Lentils and peas

Tight stocks provide most of the story for Canadian pulse crops too. Dry pea supplies have fallen to 2.8 Mt for the 2021-22 MY, a 43% YoY drop. Domestic use is expected to fall, exports will likely tumble more than 40%, and carryout stocks are expected to plummet 90% to 50 Mt for the year. With a large decline in 2021 production due to low yields, Canadian lentil supplies have also fallen to 2.1 thousand kt, representing a drop of slightly more than one-third.

FCC forecasts the total seeded area in 2022 to rise for dry peas and decline for lentils.

Trends to monitor in 2022

1. Inflationary pressures on inputs, energy, equipment and land

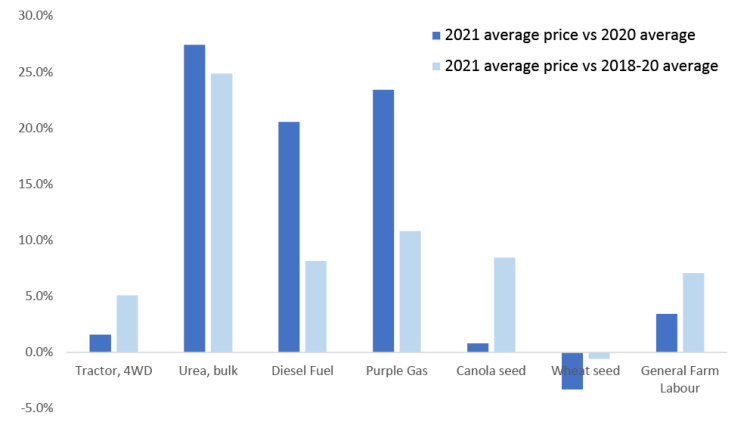

For many producers, the largest hurdles of 2021 came from the steep growth trends across many different expenses. According to a database of Alberta farm input prices, year-over-year prices spiked across categories of fertilizers, machinery, energy, labour and seeds, with costs of fertilizers and fuel rising between 20 and 27% (Figure 2). The meteoric price gains for inputs in 2021 were partly due to price contractions in 2020 that were reversed in 2021.

However, while the YoY gains for fertilizer and energy were more pronounced than their respective three-year averages, four-wheel-drive tractors, canola seed and general farm labour were more expensive in 2021 than they averaged between 2018 and 2020. Wheat seeds were slightly cheaper last year than in 2020, and the average of 2018-2020.

Figure 2: Fertilizer and energy costs pressured farm profitability the most

Sources: Statistics and Data Development Branch, Economics and Competitiveness Division, Alberta Agriculture and Forestry

What’s more worrying than the base-year effect (of comparing 2021 prices to an unusual year of pandemic-led price declines) are the supply chain issues that have exacerbated the inflationary pressures.

In the U.S., fertilizer production had fallen in 2020 in response to anticipated curtailed demand arising from COVID, and it was further limited by natural gas shortages due to both the Texan freeze and Hurricane Ida. Those constraints occurred at the same time of unexpected and large boosts in demand for fertilizer in response to higher commodity prices from both U.S. and global buyers. And global supply was hampered when China, the world’s largest producer of phosphate, introduced export taxes.

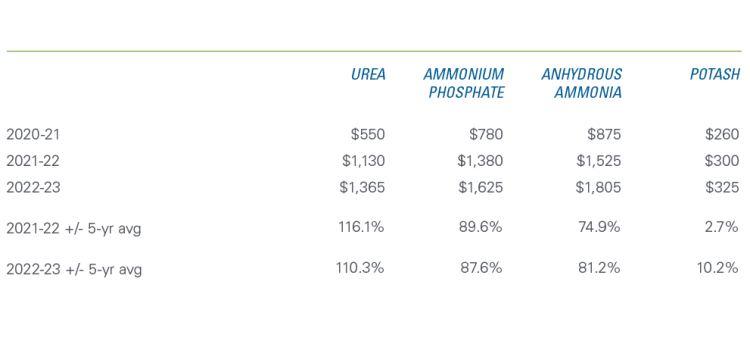

This year, fertilizer production and exports are likely again to be subject to supply chain disruptions, possibly pushing prices higher (Table 2) - although the worst increases appear to be behind us. Energy costs are expected to also rise, with farm diesel, oil and purple gasoline averaging 14.3% price hikes in 2022.

Table 2: Average fertilizer prices ($/tonne) projected to remain high in 2022

Sources: Alberta Farm Inputs, World Bank, FCC calculations

Land values are also expected to have risen as producers respond to high commodity prices and low interest rates by vying for more acres. Watch for the FCC Farmland Values Report on March 15 for more detail.

2. Geopolitical tensions and global demand

The U.S. is at the heart of two current geopolitical conflicts, each with implications for Canadian agriculture. The Biden administration must respond to China’s noncompliance in meeting its import commitments, but the 2020 Phase One trade deal has proven to be as precarious as it seemed when struck. China has purchased no more than 55% of the total volume of imports it had promised to buy by January 2022. Their imports of ag commodities are better, with close to 80% of the agreed-upon volumes. As a huge grain importer, especially with the ongoing hog herd reconstruction, China’s imports can lead to sustained periods of high grain prices.

The threat of war between Russia and Ukraine is growing. Russia’s warnings of U.S. interference in its domestic security are stoking European and U.S. talk of “massive” sanctions should Ukraine be invaded. Economic sanctions could be applied to the trade of agricultural commodities and create more supply chain issues with implications for price volatility. As the world’s largest exporter of wheat in 2020, Russia will limit exports with an 8.0-million-ton wheat export quota in 2022 spring and early summer. The conflict could also further deplete very tight global supplies of fertilizers.

Check our blog for 2022 outlook updates for field crops, cattle, hog, dairy and food processing sectors. And watch for an in-depth analysis and projections for interest rates, currencies and GDP in early March.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.