2022 Grains, oilseeds, and pulses outlook update: Canada’s low stocks and dollar to strengthen crop prices

This is the last quarterly update to our 2022 Outlook for major crops published in January. Over the next three weeks, we’ll update our Outlooks for dairy and cattle and hogs.

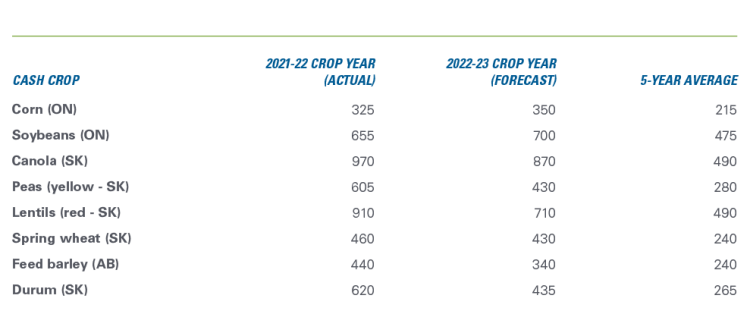

With the 2022-23 marketing year (MY) crop now mostly in the bins, we expect another year of excellent crop prices. While several crop prices fell slightly below our last forecast for the 2021-22 year (soybeans, canola, lentils and durum), each crop price ended well above their respective 5-year average (Table 1). Our forecasts show that will also be the case in the 2022-23 MY, but with most prices falling from the highs of the 2021-22 crop year.

Table 1: Expect record-high prices ($/tonne) of 2021-22 crop to fall in the upcoming MY

Source: FCC calculations

Those excellent prices will continue to support profitability across the country. Western crop margins are expected to remain strong throughout the fall marketing season. In the East, corn and soybeans will be positive, and while winter wheat will face more pressure, they’re also expected to remain positive.

Demand remains the key driver in global crop production markets

The 2021-22 crop year faced considerable uncertainty with the Russian invasion of Ukraine throwing commodity markets into chaos. Throughout the year, we’ve monitored the impacts of both the geopolitical instability and what has turned out to be persistent global inflationary pressures on crop profitability. But a third factor has been the combination of low beginning stocks and high global demand for most crops, a supply-demand imbalance that could best be offset by a good northern hemisphere harvest of the 2022-23 crop. That has happened, but only to a certain extent across major field crop production this year.

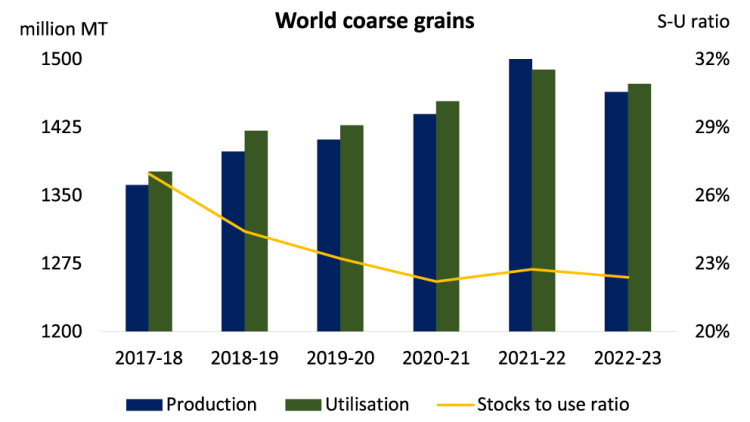

Coarse Grains

The USDA estimates global ending stocks of total grains for the 2021-22 MY will have fallen marginally year-over-year (YoY), as increases in both production and total supply negate a large increase in demand (Figure 1). The stocks-to-use ratio shows a corresponding uptick for the year that’s expected to dissipate in the coming crop year. As a result, grain carry-out stocks are also expected to shrink 3.4% YoY in 2022-23.

Figure 1: Global coarse grains stocks-to-use ratio improved in 2021-22 MY

Source: WASDE

According to AAFC, such declines were exacerbated in Canada, where increased usage and drought-impacted production of coarse grains in the 2021-22 MY combined to produce a 13.7% decline in overall carry-out stocks. However, this should be rectified in the 2022-23 MY, as total utilization falls slightly and production rebounds to near 2020 levels.

Wheat

Global ending stocks of wheat faced a similar crunch in the 2021-22 MY and are expected to have fallen 5.1% YoY as growth in demand outpaced production. For the upcoming year, output is expected to increase marginally, and demand is expected to fall marginally. But taken together and despite actual and estimated growth in production after the 2019-20 MY, global demand for wheat has risen faster, pushing the stocks-to-use ratio lower each year since then (Figure 2).

Figure 2: Global wheat stocks-to-use ratios for 2021-22 MY under increasing pressure

Source: WASDE

It’s a different situation for Canada’s wheat ending stocks. According to AAFC, the 2021-22 drought-impacted carry-out is expected to have declined by a whopping 38% YoY, led by a 37% fall in production and a 9% increase in total use. The 2022-23 crop will wipe out that deficit, with 55.6% YoY growth in production and a 6.4% YoY decline in total use. Carryout stocks are expected to grow 71.6% YoY.

Oilseeds

The USDA forecasts that, after taking a hit in the 2021-22 MY, the global oilseed carry-out will grow 9.7% YoY by the end of the 2022-23 MY. In Canada, AAFC doesn’t expect canola production to reach the pre-drought 2020-21 level, but it will grow 38.9% in the 2022-23 MY. But with domestic demand likely to grow 8.2% in the coming year and with staggeringly low carry-in stocks to start the year, the 2022-23 carry-out stocks are expected to fall to 500,000 tonnes.

Disrupted supply lines, geopolitics, hurricanes and unchecked demand amid a global pandemic: how to spell I-N-F-L-A-T-I-O-N

The growing influence of climate change on global weather patterns has disrupted crop production, aiding and abetting seemingly permanent pressure on global supplies. If that’s now the status quo, the more transitory influences of geopolitical turmoil and inflation during a global pandemic can produce overwhelming uncertainty in commodity markets.

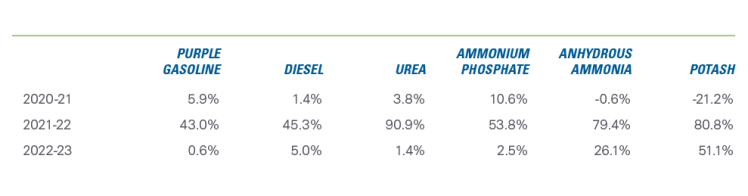

Nowhere is that clearer than in the world’s fertilizer markets. The war has severely disrupted Russia and Ukraine’s trade in global ag, with exports tied up in logistical stalemates, albeit with some recent loosening. However, it’s unclear how long those trade routes, opened with help from the UN, will remain. Russian aggression, coupled with sanctions from European nations against Russia, has eroded trade between the bloc and the energy-exporting giant, resulting in energy shortages and exploding prices.

It’s hard to count the ways global events have impacted fertilizer prices since the pandemic’s start. But, it’s fair to say that the Russian war, poor weather wreaking havoc on manufacturing centres, a growing energy crunch, tight shipping and, most recently, Hurricane Ian have created a tsunami of upheaval in fertilizer markets.

Given the number of confounding factors, it’s no surprise to see fertilizer prices aren’t expected to loosen soon (Table 2). They’ll fall YoY but will remain high well past the outlook period.

Table 2: Growth in input costs expected to taper YoY, but the pain will continue

Sources: Alberta Ag and FCC calculations

Bottom line

The enormous demand that has helped spike inflation rates globally in commodity markets and elsewhere may finally be waning. As central banks clamp down on inflation, sluggish global economic growth is widely expected. China’s zero-COVID policies will likely dampen its manufacturing output and consumer demand. Asia will feel most of that impact, but Brazil will too. If China isn’t buying, global supplies of grains and oilseeds may see a reprieve, which may continue the slide in commodity prices we’ve seen from the highs reached in the first half of the year.

Reports of strong crops in Russia and China, the continued possibility of open borders in the Black Sea region, and excellent soy trade out of South America, may prove to weaken prices in the coming months. But forecasts of large declines in European crops, threatened border closures, and still-strong demand for canola, pulses, barley and wheat means continued price strength. And as the U.S. dollar strengthens and the Canadian loonie weakens, that will only add to the prices received by Canadian producers. For more on the outlook for the dollar, see our Macroeconomic snapshot.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.