2022 FCC Food Industry Report: Growth amid inflationary pressures

The annual FCC Food Report reviews last year’s economic environment and highlights opportunities and risks for Canadian food manufacturers for 2022. This includes an annual sales forecast, grocery sales performance, and a new gross margin index.

Industries featured in the report are:

Grain and oilseed milling

Sugar and confectionery products

Fruit, vegetable and specialty food

Dairy products

Meat products

Seafood preparation

Bakery and tortilla products

Beverage manufacturers, we didn’t forget about you. We will be releasing a separate beverage report later this year.

Takeaways

Several external factors impacted Canadian food industries in 2021, which have resulted in higher input costs, amplified labour shortages and upended food consumption patterns. In early 2021, there was hope that the pandemic could soon be behind us; however, new variants provoked more disruptions, restrictions and uncertainty. Despite these challenges, food manufacturers’ performance proved to be strong.

Here are three key observations from this year’s report:

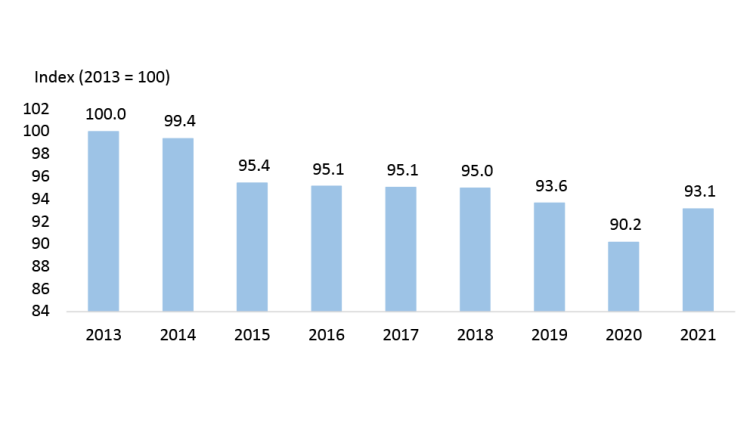

1. Industry gross margins bounced back in 2021 but remain below historical levels

Gross margins as a percent of sales in food manufacturing increased in 2021 YoY but remain below historical levels and below 2019 (Figure 1). Manufacturers have struggled to fully pass on higher labour and material costs for almost a decade. But margins improved slightly in 2021. At the individual industry level, results widely differ, which we dive into in the report.

Figure 1: Gross margins grew in 2021 but remain below historical levels

Source: Statistics Canada, FCC Economics

2. Food manufacturing sector to outperform the overall economy

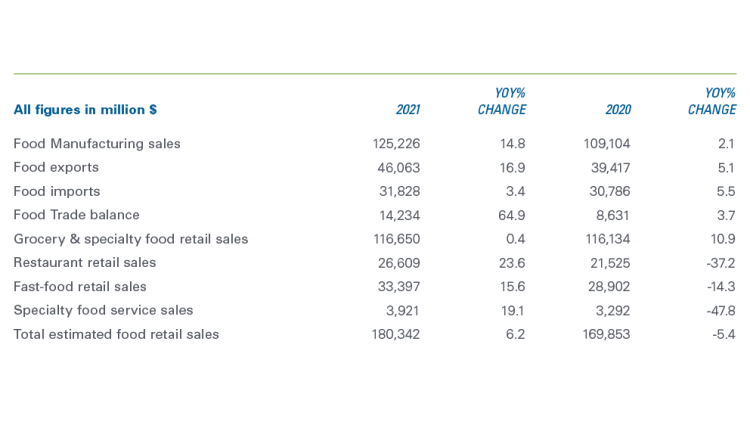

Food manufacturing sales increased 14.8% YoY to $125 billion in 2021 (Table 1). This is the strongest YoY sales growth in recorded history (starting in 1992). Increased foodservice volumes and higher selling prices offset volume declines at grocery stores.

Food manufacturing sales are projected to increase 7.4% in 2022, driven by:

Historically strong disposable income and accumulated savings in 2021

Food prices remaining elevated

Robust export markets with food exports representing an estimated 36.8% of overall sales

Table 1: Manufacturing sales and exports grew in 2021

Source: Statistics Canada

3. Consumption of Canadian manufactured food climbed in 2021

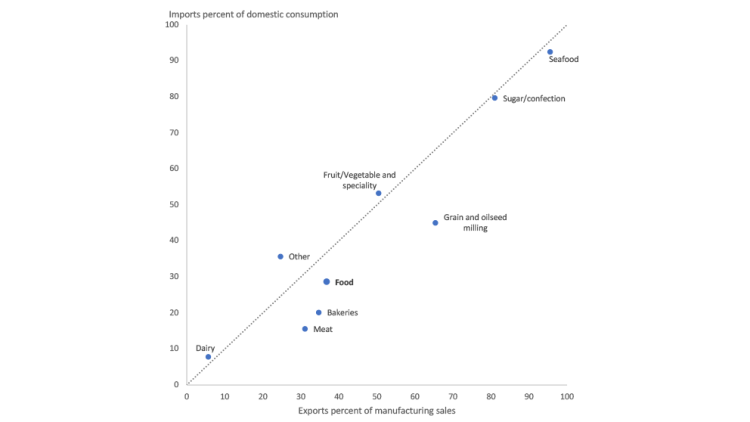

The total share of domestically manufactured food consumed in Canada increased an estimated 1.9% after declining for two straight years. The combination of ‘buy local’ approach by many and domestic investments boosted Canadian sales.

The share of imports relative to consumption as opposed to the share of exports relative to manufacturing sales within an industry provides information about the domestic vs foreign emphasis of manufacturers (Figure 2).

Sales within the dairy manufacturing industry almost entirely occur within Canada. Under 10% of the value of dairy manufacturing sales are exported, and under 10% of Canadian consumption is of imported products. On the other end of the spectrum, seafood is more of a global industry. Over 90% of the sales value were exported, and the percent of imported product consumed was also over 90%. Overall, there’s a lot of two-way trade in the Canadian food industry. For example, nearly 50% of sales in fruit, vegetable and specialty food manufacturing is exported while an equivalent share of domestic consumption is imported.

Figure 2: Most manufactured food consumed in Canada is made in Canada

Source: Statistics Canada, FCC Economics

Bottom line

Economic conditions are evolving rapidly. The labour market continues to be a challenge, and inflationary pressures continue to climb. War in Eastern Europe and economic sanctions also pose a risk to global economic growth, creating food shortages in many countries that depend on commodities from this region, potentially causing a food crisis for millions.

Stronger disposable income and higher savings in 2021 will support 2022 domestic food consumption growth, although inflation is diminishing many households’ purchasing power. Margin growth will depend on several factors, the biggest being the COVID pandemic’s evolution and how businesses adapt to interest rates increases and input costs.

Kyle Burak

Senior Data Scientist

Kyle joined FCC in 2020 and is a Senior Data Scientist, specializing in monitoring and analyzing FCC’s agri-food and agribusiness portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the procurement and marketing department of a Canadian food retailer. He holds a master of economics from the University of Victoria.