2022 farm cash receipts forecast to break new records

2021 was eventful for the Canadian ag sector, with a severe drought in the West, floods in British Columbia, COVID lasting impacts and input costs rising. Even so, it was overall a good year for Canadian farms with a significant increase in farm revenues. Looking forward, we expect Farm Cash Receipts (FCR) to continue growing in 2022, although at a more moderate pace.

FCR are only half of the equation for measuring profitability. We must keep in mind that observing FCR growth does not necessarily mean that farm profits are increasing - especially this year with the rapid rise of farm input costs.

A look back at 2021 and forward to 2022

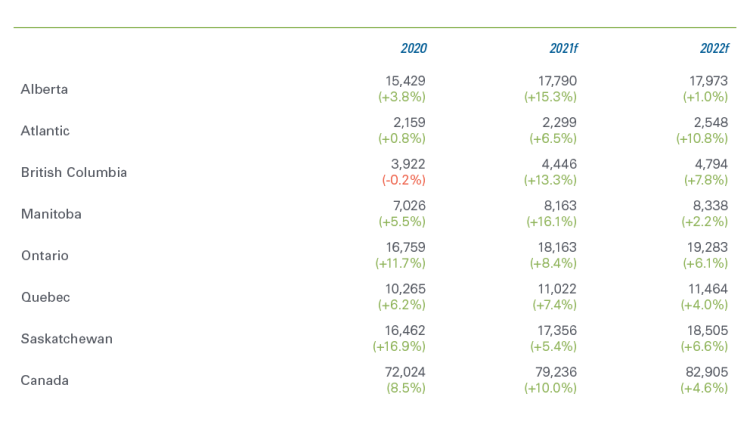

Statistics Canada is set to release complete FCR data for 2021 later this year. Our forecasts for 2021 incorporate StatCan FCR estimates for the first three-quarters of 2021 and data from various other sources. Table 1 compares FCR data for 2020 to FCC forecasts for 2021 and 2022. FCR were resilient to the numerous disruptions, grew in all provinces in 2021, and we forecast that they grew by 10.0% overall in Canada. We expect growth to continue in 2022, but at a lower rate (4.6%). We expand on the largest agricultural sectors below.

Table 1: Estimates of FCR by province (Million $)

Notes: FCR for 2020 are from Statistics Canada table 32-10-0046. FCR for 2021 and 2022 are FCC forecasts based on data including Statistics Canada table 32-10-0077 for prices, table 32-10-0046 for FCR and table 32-10-0351 for deliveries, futures data from CME.

Despite 2021 drought – grains, oilseeds and pulses receipts strong

Table 2 presents estimates of deliveries, prices and FCR (all on a calendar year basis) for Canada’s main crops. It might a surprise that we expect FCR for all crops, but especially for soybeans and lentils to increase in 2021, despite the severe drought that affected Western provinces.

Three factors explain this forecast:

2020 harvest was plentiful and most crops were marketed in the 2021 calendar year.

Crop prices soared through 2021.

Farmers priced their crop before harvest and committed to delivering volumes off the field, inflating fall 2021 deliveries relative to harvest size.

Our model assumes that yields return toward their trends in 2022 following the 2021 drought. Nonetheless, we expect deliveries to decline for several crops because a good share of the 2021 harvest was sold in the fall. With the modest harvest, the quantity of grain available for sale in the first three quarters of 2022 is small compared to previous years. Strong prices should continue in 2022 and result in higher receipts for most crops.

Table 2: 2022 FCR forecasts for selected crops

Notes: The forecasts are from FCC based on data including Statistics Canada table 32-10-0077 for prices, table 32-10-0046 for FCR and table 32-10-0351 for deliveries, futures data from CME.

Can the cattle industry continue its growth?

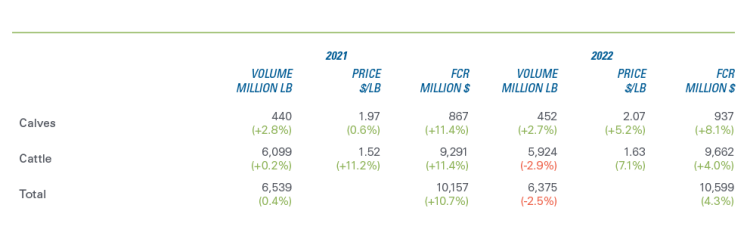

Cattle prices grew in the second half of 2021, and receipts largely beat our forecasts. However, the drought in the Prairies parched pastures, making access to low-cost feeds increasingly difficult. As a result, some cattle farmers downsized their operations.

Market signals suggest strong cattle prices in 2022. We forecast the number of fed cattle marketed in 2022 to decline, and because of the high feed costs, we expect fed cattle will be marketed at lower weights, causing volume by weight to decline. Nevertheless, given higher prices, total cattle receipts should grow (Table 3).

Table 3: 2022 FCR forecasts for calves and cattle

Notes: The forecasts are from FCC based on data including Statistics Canada table 32-10-0077 for prices, table 32-10-0046 for FCR and futures data from CME.

Hog receipts are moving sideways

Last year we forecasted a sharp growth in hog receipts in 2021 from higher prices. The data show that hog receipts were even stronger than anticipated and grew nearly 34% in 2021 from a 29% price surge, and output increasing by almost 4% (Table 4). In the previous two years, strong Chinese pork imports were the driver of higher prices on the world market. However, in 2021, domestic hog production rebounded in China, and imports dwindled. Nonetheless, hog and pork prices grew in 2021 from strong demand in other markets. In 2021, Canadian pork exports to China and Japan declined, but increased exports to Mexico, the Philippines and the United States made up for the losses.

Markets signal limited growth potential for 2022. We project hog prices to decline slightly and marginal growth in production. High feed prices will negatively impact profitability and hinder production growth.

Table 4: 2022 FCR forecasts for hogs

Notes: The forecasts are from FCC based on data including Statistics Canada table 32-10-0077 for prices, table 32-10-0046 for FCR and futures data from CME.

Dairy receipts to grow from higher prices

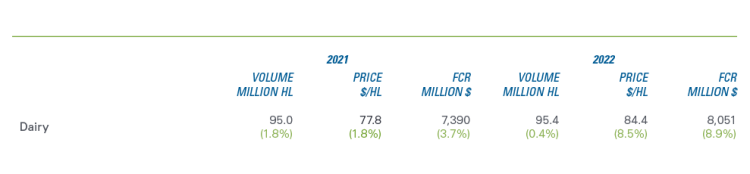

Demand for dairy products grew in 2021 but at a pace below expectations. Although 2021 was disappointing because it did not meet expectations, we estimate that dairy receipts increased by a respectable 3.7% (Table 5).

In response to increasing costs for feed and energy, the Canadian Dairy Commission will increase on February 1st the support price for butter, estimating it will result in an increase of $6.31/hl in the farm gate milk price. Accordingly, we forecast the dairy farm price to increase by 8.5%. Projections for farm output growth are limited to a 0.4% gain.

Table 5: 2022 FCR forecasts for dairy

Notes: The forecasts are from FCC based on data including Statistics Canada table 32-10-0077 for prices, table 32-10-0046 for FCR and futures data from CME.

What to watch for in 2022?

The usual words of caution apply to the forecasts above: they reflect current market conditions and expectations for the rest of the year. Potential market shocks include swings in the Canada-US exchange rate, currently supported by a strong oil price which could drop in the second part of the year as oil supply ramps up. We must also pay close attention to the evolution of the pandemic and related disruptors.

Join us January 25 for our 2022 FCC Ag Economic Outlook webinar where we’ll examine the trends, risks and opportunities for all sectors.

Article by: Sébastien Pouliot, Principal Economist