2022 farm cash receipts forecast update: Inflation spreading across ag markets

In our January forecasts, we expected Farm Cash Receipts (FCR) to continue growing in 2022, although at a more moderate pace than in 2021. Much has changed since the war in Ukraine and inflation ramping up. We forecast FCR to grow by nearly 16% because of elevated commodity prices and expectations that crop yields will match their projected trend.

FCR do not paint the full picture of farm profitability, as FCR growth does not necessarily mean that farm profits are increasing. The rapid rise of farm input prices and interest rates are significant factors to monitor for profitability in 2022.

2022 projections surpass record-high 2021 estimates

FCR data for the 2021 Q4 came out stronger than we expected in January, mostly from larger than forecasted direct payments (which include crop insurance payments) because of the drought in the Prairies.

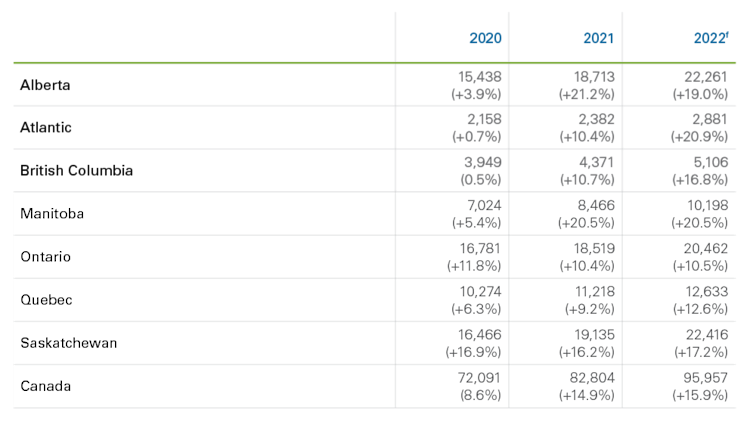

Table 1 compares FCR data for 2020 and 2021 to FCC forecasts for 2022. Total FCR in Canada grew 14.9% in 2021, and we project receipts to grow even faster in 2022 (15.9%). We expand on the largest agricultural sectors below.

Table 1: Estimates of FCR by province (Million $)

Notes: FCR for 2020 and 2021 are from Statistics Canada table 32-10-0046. 2022 FCR are FCC forecasts based on data including Statistics Canada table 32-10-0077 for prices, table 32-10-0046 for FCR and table 32-10-0351 for deliveries and futures data from CME.

Grains, oilseeds and pulses receipts continue to grow

Table 2 presents estimates of deliveries, prices and FCR (all on a calendar year basis) for selected crops. 2021 can be qualified as a great year for FRC because crop prices increased abruptly. However, deliveries were significantly down for most crops because of the drought, and some farm operations suffered more dire consequences than others.

Smaller stocks carried into 2022 mean lower delivery volumes in the first three quarters of the year. However, deliveries will return to normal if yields are on trend in 2022. With the war in Ukraine, prices continued rising, and farmers should be able to secure high prices for their 2022 crops. We forecast FCR for all crops to appreciate substantially except for barley, for which we expect seeded acres to decline.

Table 2: 2022 FCR forecasts for selected crops

Notes: The forecasts are from FCC based on data including Statistics Canada table 32-10-0077 for prices, table 32-10-0046 for FCR and table 32-10-0351 for deliveries, futures data from CME.

Cattle and hog receipts will also climb, but that’s only part of the story

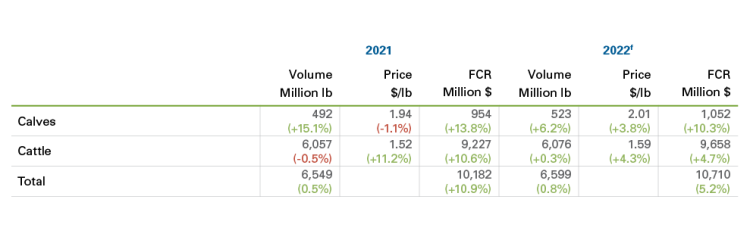

Total cattle receipts grew almost 11% in 2021 (Table 3). In a normal year, this would be great news. However, considering the drought in the Prairies parched pastures, affordable feeds became rare, leading some producers to downsize their herd.

We see cattle prices growing moderately in 2022 compared to 2021. We expect the volume of fed cattle marketed in 2022 to stay relatively constant. The volume of feeder cattle will continue to grow, but strong export volumes to the U.S. will continue until feeds are more readily available in the Prairies. Overall, cash receipts for cattle will grow by 5%.

Table 3: 2022 FCR forecasts for calves and cattle

Notes: The forecasts are from FCC based on data including Statistics Canada table 32-10-0077 for prices, table 32-10-0046 for FCR and futures data from CME.

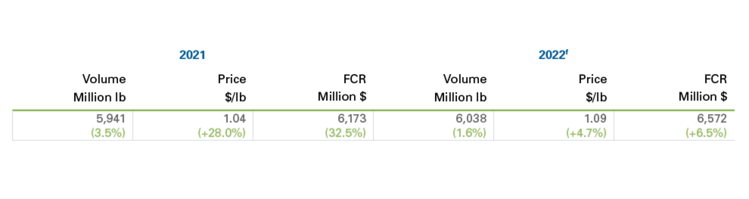

Hog receipts grew 32.5% in 2021 because of sustained price growth from strong demand, even though Canadian pork exports to China and Japan declined in 2021. Canadian pork exports to Mexico, the Philippines and the United States grew.

Pork demand is still strong in 2022, and we expect prices to grow by almost 5%. However, with high feed costs, profitability is down and for that reason, we expect production to grow only by 1.6%. In total, we forecast hog cash receipts to grow by 6.5%.

Table 4: 2022 FCR forecasts for hogs

Notes: The forecasts are from FCC based on data including Statistics Canada table 32-10-0077 for prices, table 32-10-0046 for FCR and futures data from CME.

Dairy receipts to grow from higher prices

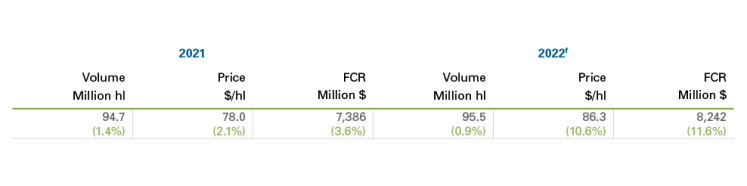

Dairy receipts grew 3.6% in 2021 (Table 5). This is a good performance given all the headwinds from the pandemic, the reopening of food services and the growing dairy imports.

The farmgate price grew 2.1% in 2021, while production costs increased significantly more. In response, the Canadian Dairy Commission increased the support price for butter, resulting in an estimated $6.31/hl increase in the farm gate milk price, effective February 1. As production costs continue to rise, the Canadian Dairy Commission is reviewing the producers’ request to increase the farm gate milk price, effective September 1. With milk prices rising and import volumes growing, we project marketed volumes to grow 0.9%, resulting in 11.6% growth of dairy cash receipts.

Table 5: 2022 FCR forecasts for dairy

Notes: The forecasts are from FCC based on data including Statistics Canada table 32-10-0077 for prices, table 32-10-0046 for FCR and futures data from CME.

On our watch for the rest of 2022

Major disruptors like the war in Ukraine made our January FCR forecasts obsolete. This update captures the available information and makes us appreciate how much can change in the ag economy in a few months. This lesson applies to the rest of 2022. We expect strong FCR growth in 2022, and hopefully, the weather will cooperate to make these forecasts a reality and bring relief to livestock producers.

Article by: Sébastien Pouliot, Principal Economist