2022 Canadian fruit land values: Trends and analysis

Fresh fruit production is an important part of Canadian agriculture. Cash receipts reached a record $1.4B in 2022, an increase of 13.4% over the previous year. While fresh fruit production is present in all provinces, the most notable number of acres exploited as fruit land are in British Columbia and Ontario. Our analysis complements the 2022 FCC Farmland Values Report by assessing trends in land values for the production of blueberries, apple orchards, cherry/soft fruit orchards and vineyards.

Since 2020, sustained increases in demand for locally grown produce have been experienced throughout the country. Demand for planted acres of various fruit types has increased. Although there have been noticeable increases in the demand for fresh, locally grown produce, sales of fruit land properties declined in 2022 compared to 2021.

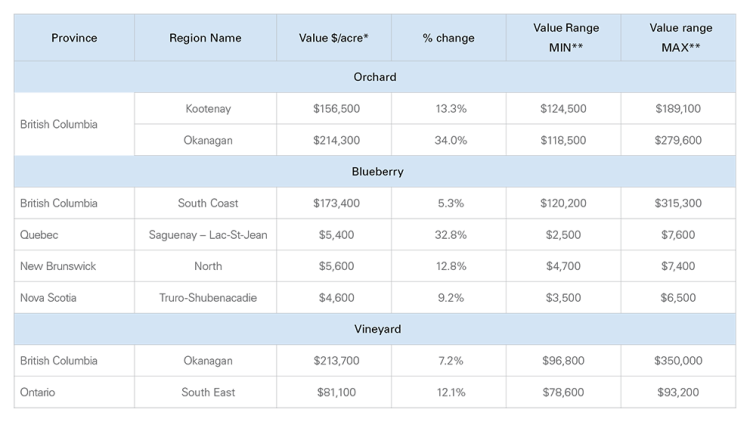

We report trends in average price per acre and minimum and maximum value ranges only in production areas with enough sales data to obtain reliable estimates (Table 1). Each province has other areas where lands are utilized in fruit production. However, limited sales activity does not support the publication of reliable land value estimates.

Provincial trends

Table 1. FCC reference Value per acre for Orchards, Blueberries and Vineyards

Source: FCC Calculations

*FCC reference value $/acre.

**The value range represents 90% of the sales in each area and excludes the top and bottom 5%

British Columbia

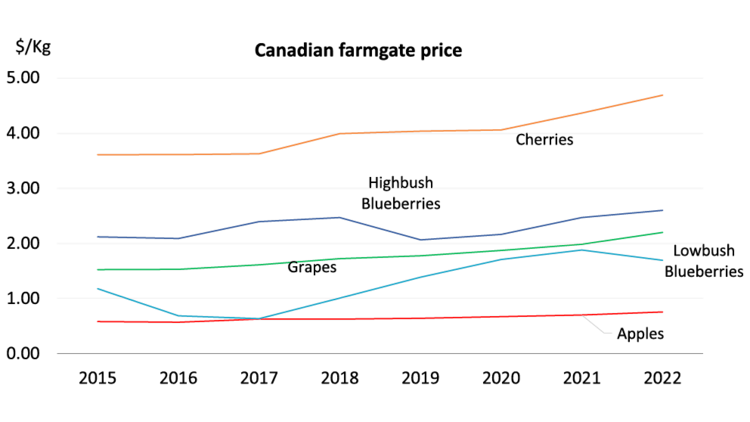

British Columbia produces approximately 20% of Canada’s fruits, including apples, cherries, blueberries, grapes and other soft fruits. Orchards are primarily found in the Okanagan, Similkameen, Creston and Fraser Valleys. Orchards experienced land value increases throughout 2022, with most sales occurring within the first half of the year. 2022 was a strong year for yields, with prices for apples and cherries being robust (Figure 1). Demand for land continues to be strong, and we are reporting an average increase in land value of 34.0% throughout the Okanagan and 13.3% in the Kootenay region.

Most of Canada’s high bush blueberry production occurs in the South Coast region of the province. Blueberry land reported an average increase of 5.3%, with demand remaining strong, despite a lower volume of sales recorded than in previous years. Most transactions involved local producers.

British Columbia is also home to over 925 vineyards, with 86% located in the Okanagan. Vineyard land value in Okanagan increased by 7.2%. Most sales involved local producers, and the highest increases were seen with high-producing, mature parcels in desirable areas along popular wine routes with water views and ideal soil conditions.

For both orchards and vineyards, overall demand has remained high, and values hold strong for productive parcels. There is concern about frost damage coming into the spring of 2023; an initial damage assessment has yet to be confirmed.

Figure 1. Canadian average prices per kilogram for apples, lowbush and highbush blueberries, grapes and cherries

Source: Statistics Canada, FCC Calculations.

Ontario

The Niagara region holds most of the fruit-growing land in Ontario. While we find a lot of apple and soft fruit orchards in the area, not many come up on the market each year. With the low sales data available, we cannot publish trends for orchards in the province, but overall, market data shows that values are trending up.

Ontario is the country’s leading grape producer, accounting for about 65% of all Canadian production. The Niagara Peninsula accounts for over 93% of Ontario’s grape-growing volume. The 2022 crop year saw unseasonably cold days, which made for a tough grape growing season, with more vine damage than is typical for the area. Grape prices have been trending up, but Ontario cash receipts in 2022 declined 9.5% due to poor weather.

Despite this downward revenue trend, demand for vineyard land in Ontario remains high. The 12.1% average YoY increase is largely attributed to the high demand from buyers looking to expand their land base.

Quebec and Atlantic provinces

Around 31% of all Canadian orchard land is in Quebec and the Atlantic provinces. Significant acreages are located in the Laurentides and Montérégie regions in Quebec, the South region in New Brunswick and Annapolis Valley region in Nova Scotia. The number of sales data is low, which makes it impossible to publish reliable estimates in these areas. But the overall prices trend of land with productive orchards is stable or trending upward. Buyers are mostly existing producers seeking to expand their operations.

Blueberry land in the Eastern part of the country is mostly wild blueberry or low-bush blueberry production. Quebec and Atlantic provinces account for roughly about 85% of total blueberry land in the country, with Quebec at nearly 42%. Most blueberry land is found in the Saguenay-Lac-St-Jean region in Quebec, in the North region of New Brunswick and the Truro-Shubenacadie region or, more specifically, the Oxford/Parrsboro area of Nova Scotia.

Unlike other fruit production, blueberry production went through a challenging period from 2015 to 2018 as prices were low (Figure 1). Additionally, production was greatly affected by several extreme weather events, such as severe frost, resulting in decreased harvested areas and yield. This appears to be behind producers, however, as the market is trending upward with substantial value increases. Yields were also very good in 2022. As a result, cash receipts for blueberries climbed almost 80% in 2022 in Quebec relative to the difficult 2021. Receipts for 2022 still represent an increase of more than 18% over 2020 revenues.

We are reporting an average increase of 32.8% for the Saguenay-Lac-St-Jean region in Quebec, putting the region’s blueberry land values at an all-time high. As for New Brunswick and Nova Scotia, we are reporting more modest increases of 12.8% and 9.2%, respectively, which are more in line with increases in gross revenues of 14.7% and 3.3% in 2022.

Less than 10% of Canadian vineyard land is in Quebec and the Atlantic provinces. The most predominant acreages are in the Montérégie region of Quebec and the Annapolis Valley region in Nova Scotia. There is strong demand for well-planted vineyards with vines appropriate for the weather and area. It is noted, however, that there is insufficient sales data to publish any rates for vineyards in these provinces.

*All data and figures are taken from the Fruits, Census of Agriculture 2021.

Bottom line

The fruit sector is a significant economic engine of the Canadian agriculture industry. The overall 2022 trend in fruit land values was positive, mostly supported by strong demand from existing producers. Market conditions can change rapidly, and fruit land is no different. Access to water, rising costs of planting due to elevated interested rates and input prices, labour shortages, securing contracts and climate change are all important factors to consider when establishing a business strategy and looking at possible expansion.

Article by: Lyne Michaud, É.A. Senior Analyst, Valuation, Constance Dagnon, Appraiser, Valuation and Alana Hinton, AACI, P. App, Senior Appraiser, Valuation