2021 Outlook for Canada’s dairy sector

FCC Economics helps you make sense of the top economic trends and issues likely to affect your operation in 2021. We consider the following will be influential profitability drivers in 2021:

Expanded market access and export of skim milk powder (SMP) and milk protein concentrate (MPC)

Demand for dairy products from hotels, restaurants and institutions (HRIs)

High input costs

Global and Canadian economic recoveries

The pandemic made 2020 a year to remember for Canada’s dairy sector, but there was a lot more to it. Changes to the Canadian dairy system following the launch of the Canada-U.S.-Mexico Trade Agreement (CUSMA) were also significant: increased market access, elimination of class 7 and limits to exports of skim milk powder and infant formula. Another major shift was the launch of the transition toward full milk revenue pooling between the P5 and the Western Milk Pool (WMP) provinces. 2021 will be a year of adjustments, but hopefully less eventful than 2020.

Although the pandemic forced temporary production cut measures, 2020 milk production exceeded 2019. Growth was not uniform across Canada. Current available 2020 data shows production likely grew slightly more than 1% in the P5 but stayed flat in the WMP. Production should keep growing in 2021, with the P5 and the WMP increasing production quotas in the fall of 2020.

Farm milk prices went through wild swings in 2020, especially in the P5 with strong milk prices at the start and end of the year. Early in the pandemic, the drop in the U.S. nonfat dry milk price contributed to a lower milk price in the P5. In the middle of the summer, butterfat revenues dropped from increased production of butter (in french only) for further processing. In the WMP, the pandemic impacted farm gate prices but to a lesser extent. Overall, farm milk prices increased by less than 1% on average in the P5 and the WMP.

On the cost side, grain prices were relatively low in the first half of the year. This contrasts with the second half as grain prices rallied following increased U.S. exports of corn and soybeans to China. Overall, estimated costs declined less than 1% in the East but increased slightly in the West.

For 2021, we forecast milk revenues to increase for the following reasons:

The Canadian Dairy Commission announced an increase in the butter support price effective on February 1

Expected full reopening of food services in the second half of the year

Higher and more stable US non-fat dry milk prices

Accounting for these three factors, we expect revenues to increase by $1.80/hl in the P5 and by $0.86/hl in the WMP (Table 1).

Regarding costs, we’ll follow whether the long-lasting grain prices rally will continue. The 2021 FCC grain and oilseed outlook will provide detailed forecasts. We expect interest rates to stay low for 2021 as the Bank of Canada does not expect to increase its policy rate until 2023. We forecast costs to increase by $0.47/hl in the P5 and $1.69/hl in the WMP.

Table 1: Estimates of dairy farm revenues and costs

Gross revenues ($/hl) |

Total costs ($/hl) |

||

|---|---|---|---|

| P5 | 2019 | 79.30 | 81.61 |

| 2020 | 79.98 | 81.16 | |

| 2021f | 81.78 | 81.63 | |

| WMP | 2019 | 81.27 | 76.38 |

| 2020 | 81.83 | 76.58 | |

| 2021f | 82.69 | 78.27 | |

Sources: Calculations by FCC based on cost of production estimates from the Canadian Dairy Commission and Government of Alberta and data from the Dairy Farmers of Ontario, Statistics Canada and USDA. The calculations for gross revenues do not include the butterfat premium and penalties for over-quota production.

Revenue and cost forecasts indicate improved profitability in the P5 but tighter margins for WMP farms in 2021. Note that our forecasts do not consider compensation from the federal government for CETA and CPTPP. Compensation details for CUSMA have not been announced yet.

Trends to watch in 2021

1. Exports of skim milk powder and milk protein concentrate

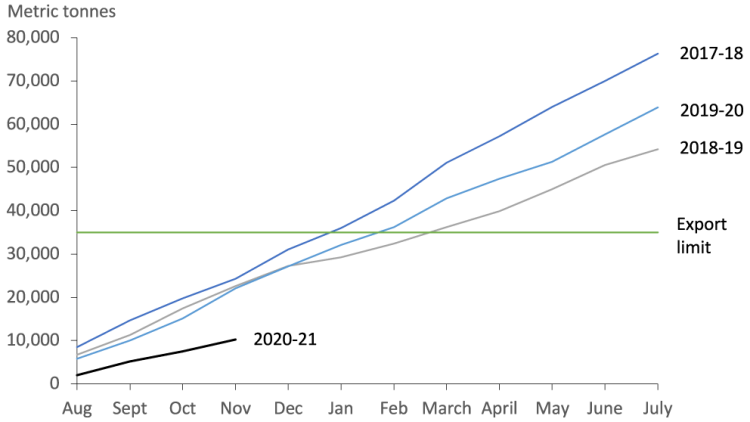

We started following exports of SMP and MPC in our October 2020 dairy outlook update. Canada agreed under CUSMA to a 35,000 MT SMP and MPC export quota on a dairy-year basis (August to July), increasing by 1.2% annually. Exports over the quota are subject to a $0.54/kg tariff. Figure 1 shows that in the previous three years, the export quota would have been filled between December and March.

The government of Canada issues permits for exports of SMP and MPC free of tariff. Complete use of the export permits early in the year means that more nonfat solids would need to go into low value milk classes or be exported with a $0.54/kg tariff, ultimately lowering farm price. Anecdotal evidence suggests that the industry has been finding ways to add value to non-fat solids in Canada, diminishing the impact of the export quota. Figure 1 shows that SMP and MPC exports are on pace to be below the export quota for 2020-21.

Figure 1: Exports of SMP and MPC were lower for the first four months of the 2020-21 dairy year

Source: Canadian International Merchandise Trade Database.

2. Reopening of food services

With the ongoing distribution of vaccines for COVID-19, we expect food services to fully reopen in the second half of the year. Restaurants are important buyers of cream and cheese, and their reopening will boost demand for dairy products. The pent-up demand for food away from home could help trigger a significant rebound. After months of closures, consumers are longing to return to restaurants. Canadian households’ saving rate jumped with the pandemic limiting spending opportunities. The accumulation of disposable income will boost the demand for foodservices once sanitary measures are removed. However, the uncertain financial health of the food service establishments tempers these expectations. Indeed, the lasting impacts of sanitary measures may result in many not reopening their doors.

3. U.S. dairy prices

U.S. non-fat dry milk has grown in importance as it sets a minimum value for milk going in class 4a under CUSMA. The USDA forecasts U.S. non-fat dry milk price to average US$ 1.100/lb in 2021 compared to US$ 1.042/lb in 2020. The U.S. non-fat dry milk price was volatile in 2020, averaging US$ 1.202/lb in the first quarter and then dropping to US$ 0.905/lb in the second quarter. We expect a more stable and predictable price in 2021.

4. Uncertain macroeconomic environment

The economy has a lot of ground to make to get back to pre-pandemic levels. The Bank of Canada calculates that GDP dropped by about 5.5% in 2020. GDP growth will depend on vaccine distribution and lasting damages to the economy caused by the downturn. The Bank of Canada forecasts Canada’s GDP to grow by 4% in 2021.

Check back on our blog for a regular update of this 2021 dairy outlook and for outlooks on grain and oilseed, hog/cattle, broiler, and food processing sectors.

Article by: Sébastien Pouliot, Principal Economist