2021 Food and Beverage Report: Creating opportunity from resilience

The FCC Food and Beverage Report highlights opportunities and risks for Canadian food manufacturers to help navigate the economic recovery. Industries featured in the report are:

Grain and oilseed milling

Sugar and confectionery products

Fruit, vegetable and specialty food

Dairy products

Meat products

Seafood preparation

Bakery and tortilla products

Beverages

Resilience will pay off

The onset of COVID-19 provoked shockwaves throughout the agri-food supply chain. Shutting down foodservices caused significant disruptions as manufacturers were forced to re-evaluate their current business strategies and sometimes move production away from foodservice to the grocery store. New concerns over employee health forced companies to make significant investments in personal protective equipment (PPE) and adjust production processes. Vaccines bring hope as economies gradually re-open, but the pandemic still looms large on the economy.

1. Food and beverage sector should continue to outperform the overall economy

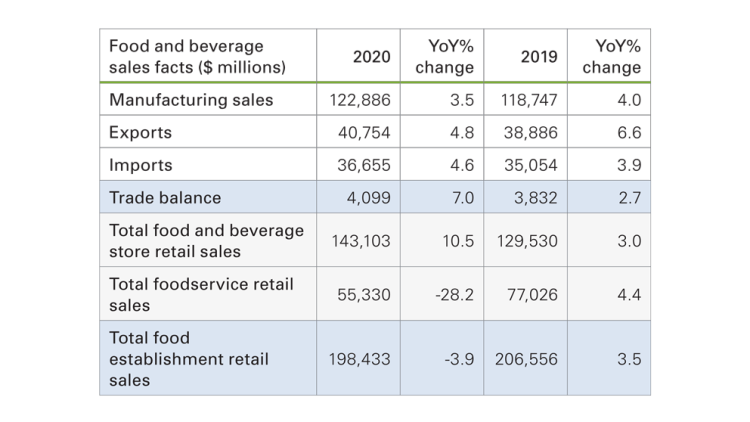

Food and beverage manufacturing sales increased 3.5% year-over-year (YoY) to $122.9 billion in 2020 (table 1). Declines in sales to the foodservice industry were offset by increases in domestic grocery store sales and growing exports. GDP for food and beverage manufacturing fell 1.0% from lower investment and higher costs.

Food manufacturing sales are projected to increase 4.8% in 2021, driven by:

Increases in disposable income and savings in 2020 will be supportive of domestic food purchases

Robust export markets as food and beverage exports represent an estimated 32.0% of overall sales

Table 1: Manufacturing sales and exports grew in 2020 YoY

Source: Statistics Canada.

2. Low interest rates create investment opportunities

Capital expenditures and employment in food and beverage fell less in percentage terms versus all industries combined. Yet, the low interest rate environment can be a catalyst for the sector to address productivity challenges arising because of labour availability. Investment in capital, along with mergers and acquisitions, can help address the challenge by creating production efficiencies.

3. Re-opening of the economy will influence profitability

Profitability for the food and beverage manufacturers in 2021 will be closely tied to the pandemic’s evolution and its social distance measures. The re-opening of foodservice and pent-up consumer demand could provide an immediate boost to the sector and make up for, at least in part, declines in profitability in 2020. On the production line, fewer social distance measures will lower PPE costs and increase production capacity. Despite significant competitive pressures, the sector outlook remains favourable.

Senior Data Scientist

Kyle joined FCC in 2020 and is a Senior Data Scientist, specializing in monitoring and analyzing FCC’s agri-food and agribusiness portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the procurement and marketing department of a Canadian food retailer. He holds a master of economics from the University of Victoria.