2021 Farmland Values – Canada’s farmland market shows strength amid production challenges

Last year brought its fair share of challenges with extreme weather conditions and supply-chain upheavals. Yet the farmland market showed strength as FCC reports an 8.3% increase in 2021 average farmland values in Canada.

Provincial trends

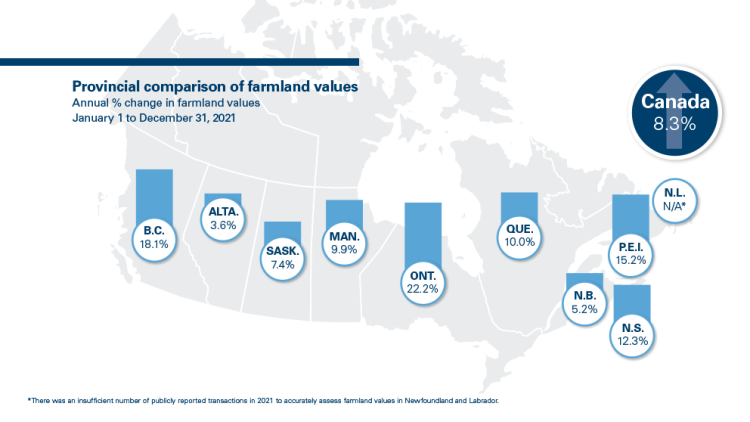

The FCC Farmland Values Report highlights some significant increases in average land values in several areas, with the highest recorded in Ontario (22.2%) and British Columbia (18.1%). Two of the Atlantic provinces follow with increases of 15.2% in Prince Edward Island and 12.3% in Nova Scotia.

Quebec and Manitoba showed similar average increases of 10% and 9.9% respectively, with growth in each region of those provinces being widely dispersed. Saskatchewan followed with an average increase of 7.4%. New Brunswick and Alberta brought up the rear with 5.2% and 3.6% increases, respectively.

Table 1. Average farmland value increases for 2021

Source: FCC computations

Farmland market drivers

Sustained demand for farmland buoyed by elevated commodity prices and historically low interest rates combined with tight supply of farmland available for sale have led to growth in farmland values.

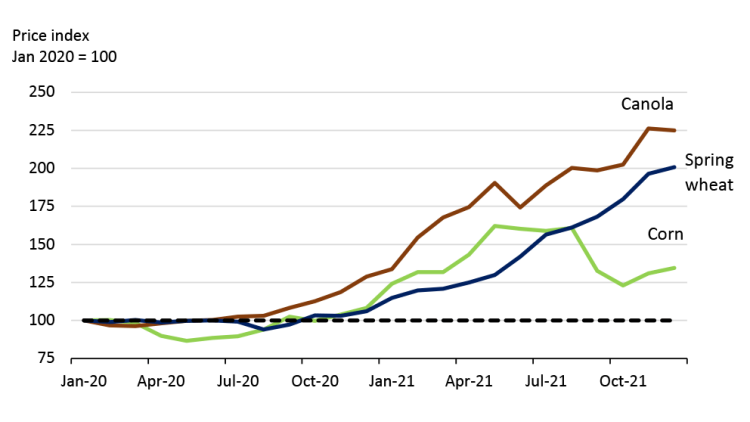

Commodity prices have been rising since the second half of 2020 (Figure 1), driving farm receipts of grains, oilseeds and pulses in 2021 at an all time high despite drought conditions in the Canadian Prairies. The outlook for 2022 is favourable given tight global supplies of crops and strength in demand for grains and vegetable oil.

Figure 1. Grain and oilseed prices elevated through 2021

Source: Grain Farmers of Ontario, Saskatchewan Ministry of Agriculture

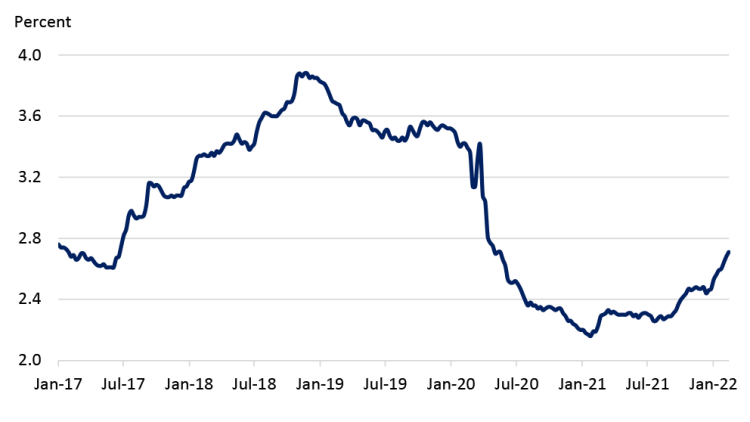

- Interest rates have declined following the aggressive monetary policy actions of the Bank of Canada (BoC) at the outset of the pandemic, resulting in average business borrowing costs reaching an all-time low in early 2021 (Figure 2). FCC Economics projects the BoC to lift its key policy rate by 125 basis points in 2022, but this would keep borrowing costs at a low level from an historical perspective.

Figure 2. Average business borrowing costs reached record-low level in early 2021

Source: Bank of Canada

Connections between weather and land values?

Unfavourable weather conditions are one of the risks that Canadian farm operations account for in their planning. But unique and extreme weather conditions like those in the Canadian Prairies and British Columbia in 2021 are infrequent. Could these adverse conditions affect land prices over time? We look at historical data to learn of markets’ reactions to extreme weather conditions.

Manitoba

In 1997, the southern part of the province experienced one of its worst floods, the Red River flood. The same area was also affected by flooding along with the Assiniboine River area in 2009 and 2011. Average farmland values in these affected areas all went up in the following years. FCC reported increases in values in Manitoba for 1997 and 1998 (11.7% and 3.4%, respectively). For 2009 and the next couple of years, FCC reported increases of 11.7%, 4.7%, 4.4% and 25.6%, respectively in the average farmland values in Manitoba.

Saskatchewan

Saskatchewan experienced in certain areas significant dry weather conditions from 2001 to 2003, and then again in 2009. FCC reported a small decrease of the average farmland values for the province in 2001 of -1.5% followed by years of growth of 3.9% growth in 2002, 3.1% increase in 2003 and a 1.9% increase in 2004. In 2009, FCC estimated a gain of 6.9%, followed by a 5.7% increase in 2010 and a 22.9% increase in 2011.

Alberta

Dry weather conditions experienced in areas of Saskatchewan in 2001-2003 and 2009, were also present in areas of Alberta. Despite these adverse weather conditions, values continued to rise in the affected areas (mostly in the Central region). FCC published 4.8%, 4.4% and 8.7% average increases in 2009 to 2011, respectively for this province.

While it’s difficult to isolate the impact of a natural disaster on land values from all the other farmland supply and demand drivers, it seems large floods or extremely dry conditions have had no large detectable impacts on land values. Farm operators consider the stream revenues attached to land over a long period of time. Higher prices can also sometimes offset yield declines and mitigate the revenue impact from challenging weather. This does not imply however that revenue expectations aren’t or won’t be affected by changing weather patterns. More research is needed to understand the influence of climate change on farmland values.

Bottom line

Farmland values continued to climb in 2021 amid adverse weather conditions and economic uncertainties. The outlook remains positive for the farmland market as supply of available land remains very limited and the outlook for 2022 farm income is robust. One headwind is the likely increases in interest rates. Producers should have a risk management plan that considers possible economic changes to ensure budget flexibility if commodity prices, yields or interest rates shift. Market conditions can change rapidly, which can impact land values.

Watch for the FCC rental rate analysis of 2021 to be released on April 12, 2022.

Article by: Lyne Michaud, É.A., Senior Analyst, Valuations