Farm equipment outlook strong amid production challenges

Overall demand for farm equipment is projected to remain strong due to a combination of elevated grain and oilseed prices and low interest rates. However, drought in western Canada and supply chain disruptions create uncertainty for 2022.

New farm equipment sales from manufactures are robust

After COVID-driven market uncertainty, 2021 has brought optimism for the farm equipment market as demand from both producers and retailers increased. On the farm, strengthening commodity prices and increased delivery opportunities resulted in crop receipts increasing 10.9% in 2020 and 18.1% in the first half of 2021. Livestock receipts are also recovering in 2021 (YTD increase of 12.7%), resulting in strong pre-orders of farm equipment. At the dealer level, strong demand for farm equipment in 2020 significantly reduced new and used inventories, creating further opportunities for manufacturing sales.

New farm equipment manufacturing sales increased 33.6% through the first 7 months of 2021. Multiple equipment segments are strong: Canadian dealer purchases of new 4WD tractors, 100+ HP tractors and combines are up 62.8%, 46.8%, and 33.2%, respectively, in the first 7 months of 2021.

Sales for the remainder of 2021 expected to remain strong

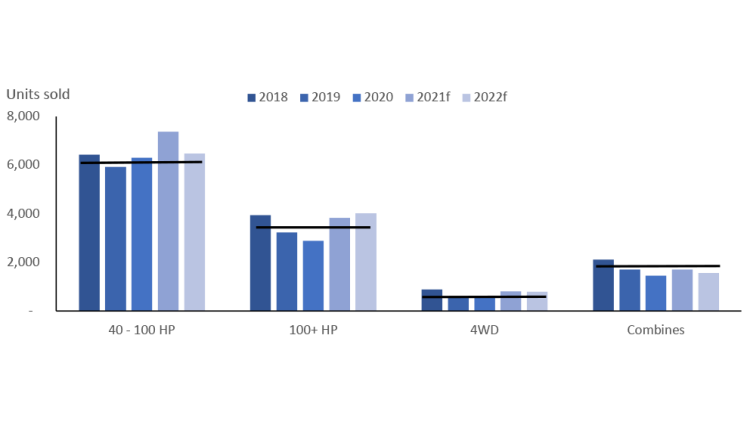

Farm equipment sales will remain strong through the remainder of 2021, and the beginning part of 2022 (Figure 1) as many purchasing decisions for new equipment have already been made.

Farm equipment sales from manufacturers are expected to weaken later in 2022 due to an estimated 25.6% decline in principal field crop production in western Canada and high feed costs, challenging profitability and leading producers to reconsider future investments.

Additionally, shortages of semiconductors could result in higher farm equipment prices and delays in delivery of pre-orders, further impacting sales. Despite softer farm equipment sales, all equipment categories in 2022 (except for combines) are projected to trend above their 5-year average (2016-2020).

Figure 1: Manufacturing sales projected to soften in 2022

Sources: Association of Equipment Manufacturers and FCC calculations.

Dealer sales strong

We anticipate inventory levels will remain tight in 2022 as producer demand remains strong for farm equipment and supply chain disruptions limited manufacturers output. New farm equipment inventory levels have trended below the five-year average (tractors are down 42% and combines down 47%) as dealers focused on right-sizing both new and used inventory lots. Strong demand for farm equipment for the remainder of 2021 is expected to reduce inventory levels further and continue to support higher prices. The good news is equipment manufacturers are expected to adjust their production upward due to the changing economic environment as North American equipment dealers begin to rebuild their inventories.

Key trends to monitor in 2022

Supply chain disruptions

The biggest wild card impacting our outlook for the farm equipment market will be supply chain disruptions. We do know the global supply chain disruptions have impacted the farm equipment market, but what remains unclear is how long they will last.

Canadian dollar

The Canadian dollar appreciated in the first half of 2021, easing price pressure on farm machinery. The loonie has recently softened relative to the USD, and we expect it will stay under $US0.80 for the remainder of the year. In its current range, the CAD remains supportive of both farm revenue and farm equipment prices.

Interest rates

Interest rates remain historically low and attractive for producers looking for equipment financing. The Bank of Canada overnight rate is expected to increase in the second half of 2022 as the Canadian and U.S. economies recover. It is also likely to see a small shift upward in long-term interest rates before the Bank of Canada rate hike.

Farm revenues

The grain and oilseed harvests are currently underway in North America. There remains uncertainty with regards to revenues from the 2021-22 crop. In Canada, crop production is one of two stories: drought conditions in the west and above-average crop production in Eastern and Central Canada due to timely rains. Global production estimates in the coming months will be important to monitor for corn, soybeans, and wheat to gain insights into price direction and, ultimately, farm revenues.

Strong commodity prices have increased demand for farm equipment. The farm equipment market in 2022 will be one of continued tight inventory as manufactures and dealers rebalance inventory and adjust to the evolving agriculture economic environment. As equipment inventory remains tight, producers may have to examine their equipment replacement plans.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.