Let’s raise another glass: 2021 Canadian beverage outlook is improving

Beverage manufacturing companies are an important part of Canada’s food and beverage manufacturing sector and will play a critical role in Canadian economic growth in 2021. The sector employs over 42,000, 15% of all food and beverage manufacturing jobs, and contributes $7.0B in GDP to the economy.

Beverage manufacturing is a low-margin, high-volume business. Major shifts in demand or production costs like we experienced in 2020-21 have significant financial implications. The COVID pandemic shifted consumer purchases to retail away from food service, removing a core revenue stream. It forced businesses away from bulk packaging and increased costs. Overall, sales grew 4.0% in 2021, while GDP (defined as value-added output) declined 0.4% as higher production costs took hold.

Leading the sales growth in 2020 were wineries (21.3%), breweries (5.0%) and distilleries (3.1%). Conversely, non-alcoholic beverage sales declined 2.9%, based on Statistics Canada data. Beer remains the top-selling alcoholic beverage, but its market share has been declining to other drinks. Higher total sales are attributed to people drinking more when confined at home and a slight increase in selling prices (up 0.2% in 2020 YoY).

Producer prices have declined 1.3% through the first four months of 2021, although we have seen strong volume growth as food service establishments have increased inventory in anticipation of a re-opening. As a result, 2021 sales are up 14.6% YoY thru April.

Approximately 57.5% of all alcohol consumed in Canada is produced domestically, led by beer with many craft breweries and large manufacturers. For the remainder of 2021 and into 2022, we see strong demand for Canadian-made beverages.

Figure 1: Spirit coolers were the hot item in the market in 2020 and continue to be in 2021

| Province | % of Canadian product sold | Beverage with the highest retail sales growth rate* |

|---|---|---|

| BC | 60.2 | Spirit coolers |

| AB | 57.4 | Wine coolers |

| SK | 76.2 | Spirit coolers |

| MB | 64.2 | Spirit coolers |

| ON | 56.1 | Strong Beer |

| QC | 48.6 | Gin |

| NB | 80.8 | Spirit coolers |

| NS | 80.3 | Spirit coolers |

| NL | 76.9 | Cider |

| PEI | 71.0 | Spirit coolers |

| YT | 73.4 | Spirit coolers |

| NT | 73.1 | Spirit coolers |

| NU | 75.0 | Regular Beer |

| Canada | 57.5 | Spirit coolers** |

* Sales over $1M annually. Beverages listed as “Other” are excluded. Regular beer has alcohol content between 4.1% and 5.5%, strong beer is 5.6% and over, light beer is 4% and under. Sales data is from liquor authorities and other retail outlets from April 2019 to March 2020.

** weighted provincial average

Source: Statistics Canada, FCC calculations

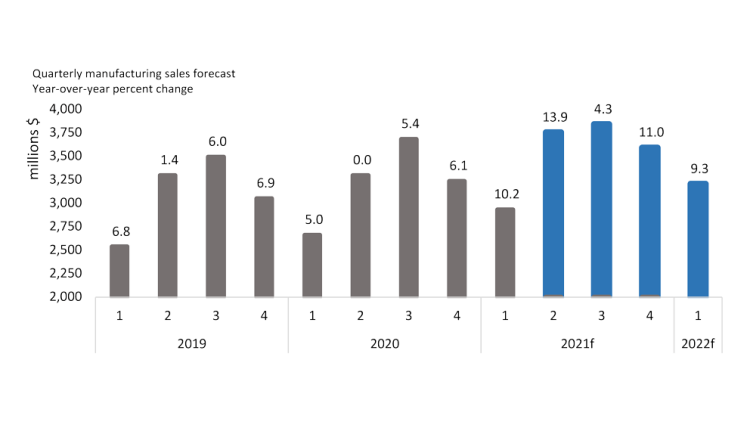

FCC projects beverage sales will increase 9.7% in 2021 (figure 2), up from our original forecast of 4.9% reported in our Food & Beverage Report as economic recovery has picked up steam. Sales are expected to return to traditional pre-COVID outlets, and demand should remain high throughout the summer assuming provincial economies reopen. As well, a backlog of large gathering events like wedding and family reunions should provide an immediate boost to sales – but tapering into 2022.

Figure 2: Beverage is expected to see strong sales thru the fall before normalizing

Sources: Statistics Canada, Quandl and FCC calculations.

The outlook for alcoholic beverages is bright despite challenges faced over the past year. Underlying consumer demand is strong, and people are itching to have a cold drink with friends and family. Business agility to changing consumer tastes will be monumental for long-term growth as consumers continue to shift preferences.

For a deeper dive into individual industry outlooks, click on the sections below.

Kyle Burak

Senior Data Scientist

Kyle joined FCC in 2020 and is a Senior Data Scientist, specializing in monitoring and analyzing FCC’s agri-food and agribusiness portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the procurement and marketing department of a Canadian food retailer. He holds a master of economics from the University of Victoria.