2021 Broiler outlook update: Production rebound and elevated prices

This is the second of three quarterly updates to our 2021 outlook for Canada’s broiler sector published in January. Over the last few weeks, we’ve updated our outlooks for grains, oilseeds and pulses, dairy and cattle and hog sectors.

As life gains normalcy and the economic recovery deepens, Canada’s broiler sector continues to shake off the effects of COVID-19. The big story in 2021 has been the recovery of pre-pandemic levels of broiler production and consumption. The next quarter shows an improved outlook with consumption buoyed throughout the summer and expected to grow further. Supply continues to lag 2019 levels due to the pandemic and other factors, but monthly slaughters in July recorded double-digit growth over the 2020 level, which was heavily constrained due to COVID.

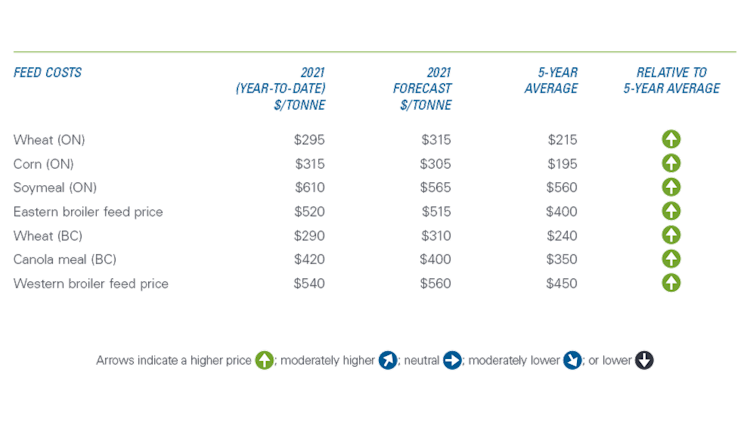

That’s some good news for a sector still grappling with high feed costs due to weather concerns and strong demand for grains and oilseeds. While soymeal and canola meal prices have stagnated compared to prices of soybeans, meal prices are expected to remain above their 5-year average (Table 1).

Table 1: Feed prices expected to remain elevated

Sources: Calculations by FCC based upon Chicken Farmers of Ontario farm-gate minimum live price estimates, and British Columbia Chicken Marketing Board cost of production formulae comparison, CME futures, Statistics Canada and USDA.

The grain and oilseed harvests are currently underway in North America, with plenty of uncertainty on the size of the 2021-22 crop. In Canada, crop production is one of two stories: drought conditions in the west and above-average crop production in Eastern and Central Canada due to timely rains. Global production estimates in the coming months will be important to monitor for corn, soybeans, and wheat to gain insights on the direction into the feed prices trend.

Rebound in production

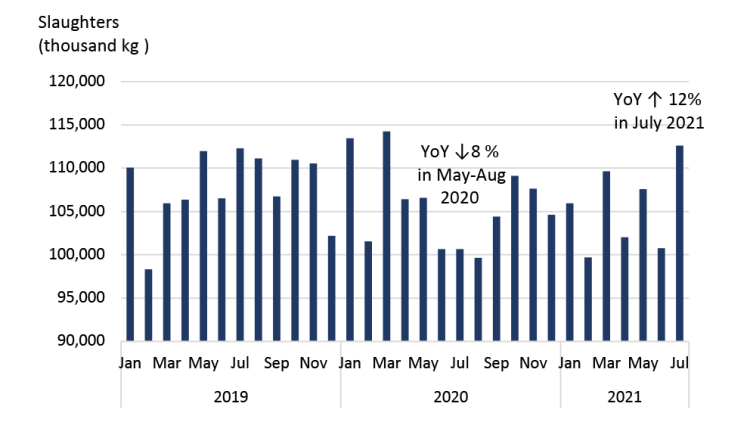

Canadian chicken slaughters increased year-over-year (YoY) in May through July off the lower volumes during the same period in 2020, but they remain below pre-pandemic levels (Figure 1). Canadian broiler production increased 12% YoY in July.

Figure 1: Canada’s chicken slaughters look to rebound in the 2nd half of 2021

Source: AAFC.

While the recovery may be taking longer than we initially expected in January, stocks of chicken in frozen storage did decline in July – they’re now 3.5% lower than a year ago. Production allocations for the rest of the year have been set higher than a year ago, reflecting the reopening of the economy. As well, the issues with Canadian imports of chicken as outlined in our May outlook update haven’t gone away. This is supportive of the demand for Canadian products.

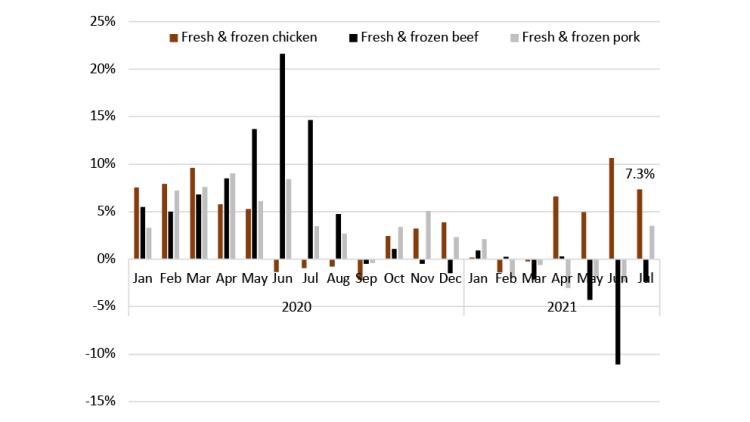

Chicken’s relative retail price advantage at retail to pork has been eroded in the last 3 months (Figure 2). During Q2 2021, chicken inflation has increased 7.4% compared to Q2 2020. The YoY retail price inflation for fresh and frozen chicken was 7.3% in July (Figure 2). This was the fourth consecutive month of strong increases. Beef cut-out values have continued to be surprisingly strong this year. But beef retail prices have traced back some of the large price increases observed in the summer of 2020. Pork cut-out values remain above their 5-year average, and retail prices have also trended down relative to last year. As a result, chicken is losing some of the price competitiveness it had gained at the height of the pandemic in 2020.

Figure 2: YoY monthly decline in retail price of competing meats is eroding chicken’s price advantage

Source: Statistics Canada.

Feed costs continuing to rise will keep prices of live chicken elevated. This should push up the entire pricing structure in the supply chain. Renewed strength in chicken demand should alleviate some of these inflationary trends if production volumes match up the rebounding consumer demand.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.