2020 Outlook: Canada’s grains, oilseeds and pulses sectors

FCC Economics helps you make sense of these top economic trends and issues likely to affect your operation in 2020:

Trade tensions’ influence on the global economy and agri-food markets

African Swine Fever’s disruption of livestock and meat markets

Large global supplies amid challenging growing conditions for crops

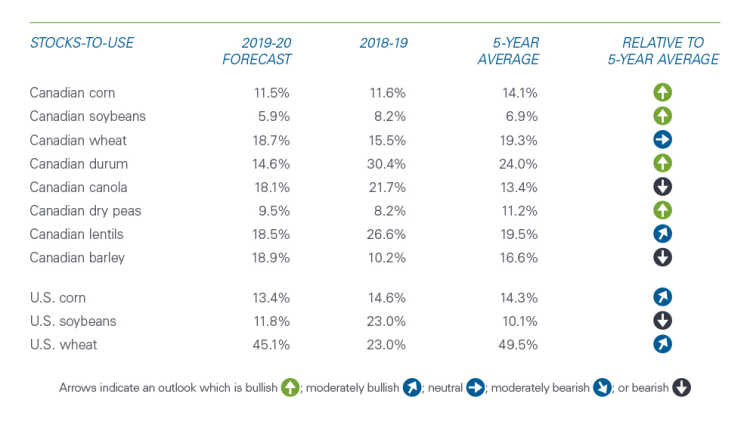

Profitability is expected to be uneven for grain, oilseed, and pulse producers in 2020. Prices will continue to be pressured by abundant global supplies. Demand will be the story to watch in 2020. A reduction in the global hog herd from African Swine Fever (ASF), trade tensions and flat U.S. ethanol demand may result in weaker demand. Futures markets suggest prices for most grain, oilseed and pulse commodities will remain under their five-year average (Table 1).

Table 1. The upside for crop prices remains limited in 2020

Sources: Statistics Canada, AAFC, USDA, CME, MGEX and ICE Futures contracts, and FCC calculations.

While low prices likely result in tight margins for 2020, several factors can shift this outlook. A faster-than-expected rebuild of the Chinese hog herd could grow the demand for oilseeds. The U.S. and China agreed to a phase one deal which, upon implementation, could yield a significant jump in grain and oilseed purchases, raising North American prices. And the U.S. administration may choose to boost ethanol demand looking to offset the declines of recent years. In short, the uncertain environment of 2019 will carry into 2020.

Crop input prices are expected to trend slightly higher in 2020. While fertilizer prices are currently weaker due to harvest challenges that delayed fall fertilizer placement across North America, they could climb before the Spring, with an annual jump between 5% to 7% in 2020. Inflation for fuel and pesticides is expected to stay in the 0% to 3% range. There shouldn’t be any increase in interest rates in 2020, making interest expenses manageable.

Grains

U.S. wheat prices for the 2019-20 crop year are projected 10% lower than the year prior, resulting in a projection of C$241 per tonne for the 2020 average Canadian spring wheat price. This puts margins slightly above break-even levels, assuming average yield. Global wheat ending stocks in 2020 are projected to be at a record high, pressuring global prices. A 3.5% year-over-year (YoY) increase in 2019 Canadian production yields a projected increase in the Canadian stocks-to-use ratio (Table 2). However, premiums for high-quality protein wheat are expected to remain strong due to supply challenges for hard red spring wheat and quality issues in Canada and the northern U.S.

Weaker global and domestic supplies of durum are expected to result in higher durum prices in 2020; our projection is for an average price of C$253 a tonne, resulting in positive margins for growers. While Italy’s country-of-origin legislation remains in place, exports of durum to Italy have nearly doubled in the 2019-20 crop year compared to the 2018-19 crop year. Profitability is expected to trigger an increase in 2020 durum seeded acreage.

We expect corn profitability to be positive for 2020 based on a much tighter Canadian supply due to 2019 weather challenges. Prices should also improve if estimates of the U.S. 2019 crop production are revised downward as expected.

Table 2. Stocks-to-use ratios point to a tighter available supply in Canada

Sources: Statistics Canada, AAFC, USDA, and FCC calculations.

Oilseeds

Both soy and canola should record break-even to slightly positive margins in 2020. Canola prices are projected to average C$465 a tonne as the year-end Canadian canola stocks-to-use ratio is estimated at 18.1% for 2019-20, well above the five-year average of 13.4%. An 8.8% YoY reduction in 2019 seeded acres cut Canadian canola production by 8.3% to 18.6 million tonnes.

Opening market access into China could go a long way in reducing the year-end stocks-to-use ratio. Being able to increase exports by half of what we historically shipped to China would bring the stocks-to-use ratio to a more supportive level around 13.0% and could increase farm-gate prices in the C$500 - $550 per tonne range (Figure 1).

Figure 1. Canola prices have some upside if market access issues are resolved

Sources: Statistics Canada, Agriculture and Agri-Food Canada, and FCC calculations.

Canadian soybean production fell 19% in 2019, from a combination of reduced acres and lower yields. This will lower Canadian soybean ending stocks; however, abundant U.S. supplies should continue to make soybean prices trend sideways in 2020. We are projecting soybean prices to average C$440 a tonne in 2020.

Pulses

Canada’s 2019 pea production increased significantly with more acres and yields in line with the five-year average. Profitability for yellow peas continues to be challenged due to export restrictions into India. Projections for green peas suggest positive margins for 2020. The spread of ASF in China lowered imports of Canadian peas in 2019, and this trend is expected to continue in 2020.

While profitability for lentils remains pressured, margins are expected to improve in 2020 due to a decline in ending stocks. Canadian lentil exports to India in 2019 increased 300%, as the production of pigeon peas in India and neighbouring countries declined. Indian trade restrictions reduced the global production of pigeon peas and this yields a favourable outlook for the Canadian lentil sector.

Other trends and issues to monitor in 2020

1. The resiliency of the global and Canadian economies will continue to be tested

Trade tensions weighed on the global economy in 2019, which is estimated to have grown at 2.9% in 2019, its weakest performance since the 2008-09 period. Many central banks (led by the U.S. Federal Reserve) proceeded to lower interest rates as insurance against a possible global slowdown. The International Monetary Fund (IMF) projects that economic growth will rebound to 3.3% in 2020, but only if trade tensions continue to ease.

The Bank of Canada chose to remain idle in 2019, likely concerned that any easing in financial conditions could disrupt the delicate balance between household spending and debt. Unemployment stayed low: a positive for workers that benefited from significant wage gains, but a continued struggle for businesses looking to hire.

Financial markets place a higher probability on a cut to the overnight rate than a hike in 2020. And that’s where our assessment lands: we expect one rate cut in 2020 to support the resiliency of the Canadian economy.

The loonie gained value against the U.S. dollar in 2019, starting the year under US$0.74 to finish just under US$0.77. The momentum carried into 2020. Uncertainty should be a major theme of global financial markets in 2020, and thus we project the loonie to return towards the US$0.75 level in 2020.

2. Global production is trending up, but weather injects uncertainty

Weather patterns may once again play a significant role in global grain, oilseed and pulse markets. India’s monsoon rains may lower pulse production and generate opportunities for Canadian exporters. Dry weather conditions in South America could reduce corn and soybean production below expectations. While the wildfires in Australia had little impact on Australia's grain production as harvest was essentially complete, the destruction to its ecosystem and the livestock sector could shock the grain supply complex, especially the demand for feed grain. Despite dry conditions, wheat production in Russia, Ukraine and Kazakhstan for 2019-20 is projected to total 115 million tonnes (MT), up 3.9% from 2018-19 but below the record 126.9 MT of 2017-18. European rapeseed production declined 15% this past year to 17 MT due to weather challenges and fewer seeded acres.

3. China’s oversized influence on global oilseed markets and ASF

China’s overall impact on global agricultural markets cannot be understated. Consider these statistics: China consumes 27% of all global meat, with 62% of China’s meat consumption being pork. Historically, China only imported 3% of its pork requirements, given its large production capacity. As a result, it accounted for more than 60% of the global soybean trade.

The FAO estimated that China’s pork production declined at least 20% in 2019. Various forecasts call for at least an additional 15% decline in 2020, creating a potentially large gap between demand and supply. Pork retail inflation reached over 100% YoY in 2019 and pork imports are expected to increase considerably in 2020. China’s demand for soybeans will soften. Despite the industry consolidation, Chinese hog operations are rebuilding. The pace of the rebuild is key when anticipating the impact of ASF in the demand for grains and oilseeds.

Check our blog for a regular update of this 2020 outlook for grains and oilseeds. You’ll also find an outlook for the dairy, red meat, and food processing sectors.

Download PDF versionLeigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.