2020 farm equipment outlook – farm income key driver of sales

Investments in farm equipment, buildings and land are essential to sustain an operations’ productivity. And new farm equipment sales provide a strong indicator of the health of Canadian agriculture. Over the past few years, market uncertainty and revenue pressures have reduced profitability in the agriculture sector, resulting in lower agricultural equipment purchases. Future sales rest on the ability for the ag sector to rebound.

Trends in Canadian farm equipment

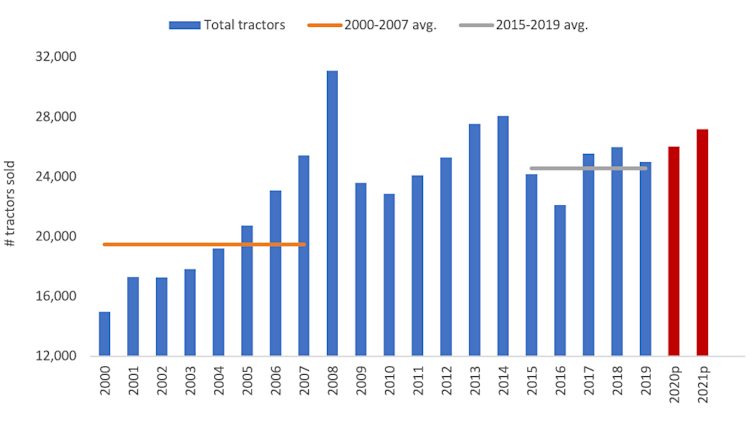

Through the first six months of 2020, COVID-19 has created significant headwinds for the Canadian economy and agri-food supply chain. Despite these challenges, year-to-date (as of July 31) total farm equipment sales have increased 4.8% in 2020 compared to 2019, according to the Association of Equipment Manufacturers (Figure 1).

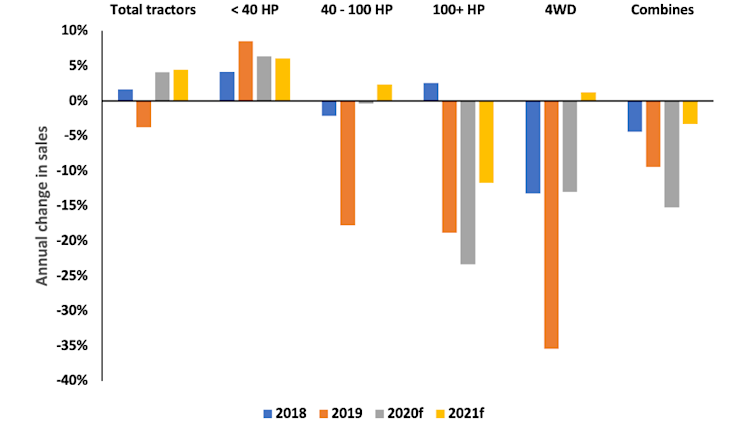

Breaking down the equipment type provides a different picture. Tractors sales less than 40 HP or utility tractors have increased, while equipment primarily used on agriculture operations have declined or remained flat. Utility tractor sales, representing nearly 70% of total tractor sales have increased by 12.3% year-to-date in 2020. The health of the Canadian economy generally drives this market segment.

Tractors 40 to 100 HP sales have remained unchanged, and 100+ HP has declined 21.1%. Large four-wheel-drive tractors and combine sales have declined 12.4% and 16.8% respectively year-to-date.

Figure 1: Annual new tractor sales projected to increase in 2020-21

Sources: AEM and FCC computations.

Farm equipment sales surged in July 2020 relative to 2019, as the economy continues to re-open after the COVID-19 lockdown, and farmers took delivery of their new equipment. With farm revenues expected to tighten, producers should change their buying behaviour, either keeping equipment longer or exploring the used equipment market.

What we expect for the remainder of 2020 and 2021

Farm revenues expected to soften in 2020

Our 2020 forecast of farm cash receipts suggests a 3.4% decline, the largest year-over-year decline since 2003. However, the impact across sectors varies with livestock sectors hit the hardest from disruptions to processing facilities and lower prices. Grain and oilseed revenues are expected to improve with higher producer deliveries and record grain movement. According to Statistics Canada, current crop conditions are also supportive of farm revenue with an expected production of 96.8 million tonnes. The outlook for farm equipment sales is mixed (Figure 2). A rebound in 2021 hinges on the outlook for farm cash receipts.

Figure 2: Large tractor and combine sales projected down in 2020 and 2021

Sources: AEM and FCC computations.

Trends to watch for in 2020 and into 2021

Canadian dollar

The Canadian dollar has gained value against the USD since it reached a low of US$0.69 in March 2020. We believe the loonie has limited upside at the current levels, yet it’s possible it could trend sideways in the CAD$0.75-$0.76 range for the remainder of 2020. The higher loonie softens inflationary pressures on equipment but can introduce pressures on farm income.

Interest rates

COVID-19 has significantly changed the outlook for interest rates. We expect interest rates to stay at historically low levels into 2021. This low-interest rate environment may increase producers' incentives to revisit their equipment replacement plans and financing needs.

Trade landscape with the U.S.

The implementation of CUSMA solidifies the trade relationship with the U.S. On August 16, 2020, a 10% tariff on Canadian aluminum exported to the U.S. took effect. We expect these tariffs to have minimal impact on farm equipment sales since most farm equipment uses little aluminum in manufacturing. Steel tariffs that were removed in May 2019 were not re-enacted.

Farm equipment sales are an important indicator of overall farm health. While overall tractor sales often mask equipment trends primarily used for agriculture, tighter profitability in Canadian agriculture and market uncertainty has decreased demand for larger HP tractors and combines. Improvements in farm cash receipts and lower interest rates are expected to support improved equipment sales in 2021.

Article by: Joy Adejumo, Agricultural Economist