2020 dairy outlook update: cautious optimism toward recovery

At the start of the year, we identified four economic trends and issues that were likely to affect profitability in the dairy sector in 2020:

Slow production growth

Expanded market access to foreign dairy products

Robust domestic demand for dairy products

Higher milk price and input costs

In this outlook, we update our forecasts, examine what has influenced profitability in dairy so far in 2020 and identify trends to monitor for the remainder of the year.

Milk revenues on the rise

Our mid-year update outlined how COVID-19 shifted consumption patterns and upended profitability. The outlook has since improved with prices trending up as yields for butterfat and proteins are improving after their seasonal low in the summer. Demand for dairy products is also closing on its pre-pandemic level.

Our projections for the Western Milk Pool (WMP) are similar to the mid-year update. For the P5 (all Eastern provinces except for Newfoundland and Labrador), the outlook improved because of higher butterfat price than anticipated and increases in the U.S. price for non-fat dry milk.

We expect lower average revenues and costs for 2020 than in January (Table 1). The average returns of dairy farms in 2020 will be lower than forecasted in January as costs declined less than revenues.

Table 1. Estimates of average dairy farm revenues and costs

| January 2020 forecast | Actual January - September* | Forecast October - December | October 2020 forecast | ||

|---|---|---|---|---|---|

| P5 | Gross revenues ($/hl) | 80.80 | 79.11 | 81.39 | 79.68 |

| Total costs ($/hl) | 81.38 | 80.52 | 79.68 | 80.31 | |

| WMP | Gross revenues ($/hl) | 82.93 | 81.04 | 81.76 | 81.22 |

| Total costs ($/hl) | 76.52 | 76.34 | 76.01 | 76.26 | |

* Data for September were not yet available and are forecasted.

Sources: Calculations by FCC based on cost of production estimates from the Canadian Dairy Commission and Government of Alberta and data from the Dairy Farmers of Ontario, Statistics Canada, and the USDA.

Trends to watch for the remainder of 2020

Our forecasts assume that: 1) the impact of COVID-19 on dairy consumption continues to subside; 2) the immediate impacts of the Canada-U.S.-Mexico Trade Agreement (CUSMA) are gradual and not overly significant on prices for butterfat and proteins.

1. Consumer demand for dairy products

There is a risk that dairy consumption declines in the last quarter of 2020 as foodservices are constrained to reduce activities under a second wave of COVID-19 cases. Foodservices are large buyers of cream and cheese. Their closure means a drop in the demand for dairy products and, consequently, farm revenues.

2. Production returning toward its pre-pandemic level, but no quota increases in the East yet

Our forecasts are on per hectoliter basis, and they don’t capture the impact on profitability from production cuts. A crucial element of profitability is that dairy farms operate at their most efficient scale.

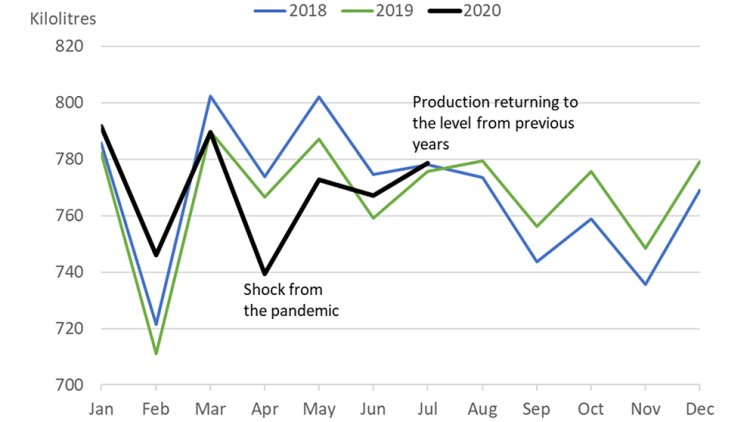

The P5 has not re-issued production quotas since the cuts in the spring and will likely wait for more certainty about the demand before returning quotas to their pre-pandemic levels. In the meantime, the P5 is using incentive days to control production. The P5 issued incentive days for the months between August and November but no news yet for the months beyond November. Starting October 1st, the WMP removed all restrictions on credit days and increased production quota by three percent. The WMP also added incentive days for October and November. Producers have been able to use credit days in the summers such that total milk production in Canada in July exceeded the levels observed in the previous two years (figure 1).

Figure 1: Milk production in Canada return to pre-pandemic level

Source: Statistics Canada table 32-10-0113.

3. Exports of skim milk powder

CUSMA includes provisions for increased access to the Canadian dairy market, modifications to the Canadian dairy pricing system and limits to exports of skim milk powder (SMP) and infant formula. All three can impact profitability, but let’s focus on export limits.

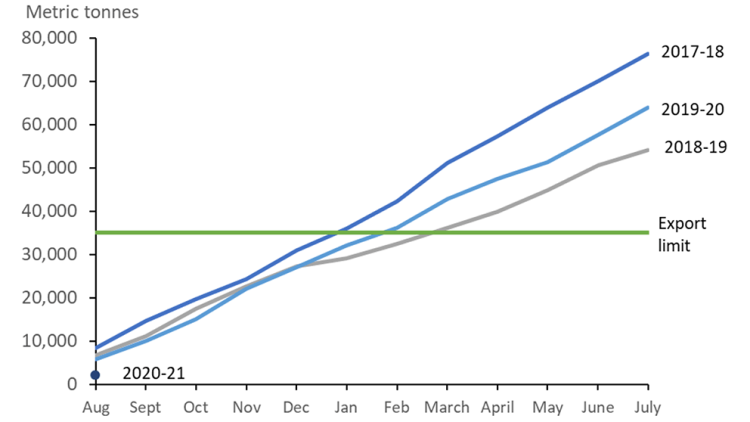

Canada agreed to 35,000 MT of SMP and 40,000 MT of infant formula export limits, each implemented on a dairy-year basis (August to July). Exports of infant formula have been historically low but will rise after the Feihe International plant in Kingston, Ontario begins production. SMP exports will likely hit the ceiling.

Figure 2 shows that in the previous three years, the export limits would have been hit between December and March. We only have data for August of the current year, which indicates that exports have been below those in the previous years.

Figure 2: Exports of SMP were lower for the first month of the 2020-21 dairy year

Source: Canadian International Merchandise Trade Database.

Exports of SMP beyond the limit will be subject to an export charge of $0.54 per kg. This means either that exports of SMP will be taxed or exports will stop, and SMP will be processed domestically, possibly under a lower-value milk class. In any case, the outcome should pressure downward the price paid to dairy producers.

4. Global and Canadian economic recoveries

Recent forecasts show a steep decline in GDP in 2020 but less pronounced than initially feared. Most GDP forecasts point toward a mix of V- and U-shape recovery. An increasing number of studies find a K-shape recovery: a situation where some parts of the economy are improving while others worsen. A strong and uniform economic recovery across all income levels will be crucial for strong demand and growth in the dairy industry.

Article by: Sébastien Pouliot, Principal Economist