Sugar and confectionery products: 2025 FCC Food and Beverage Report

The following information is from the 2025 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. To get the big picture, read the full report.

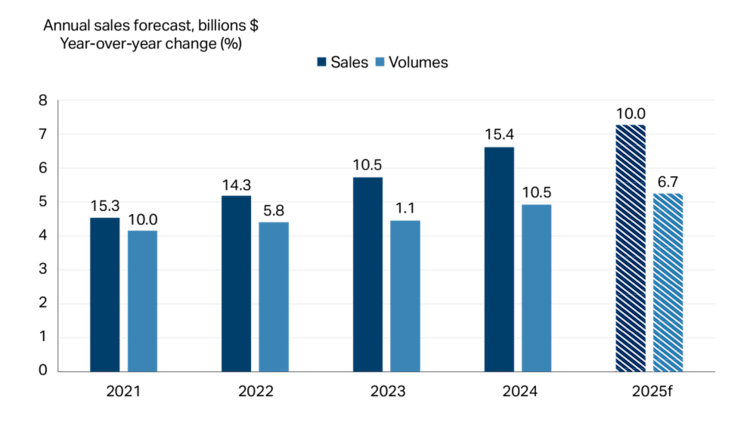

Strong prices helped drive the sector to double-digit sales growth between 2021 and 2024. Prices will drive sales again in 2025, forecasted up 10.0%, while volumes (that is, sales adjusted for inflation) are predicted to increase 6.7% (Figure 1).

Figure 1: Sales trending upwards for sugar and confectionery product manufacturing

Total sales and volumes (in $, billions) are on the vertical axis and shown by the height of each bar. The number above each bar is the year-over-year growth as a percent. Volumes are sales deflated by a price index (202001 = 100).

Source: FCC Economics, Statistics Canada

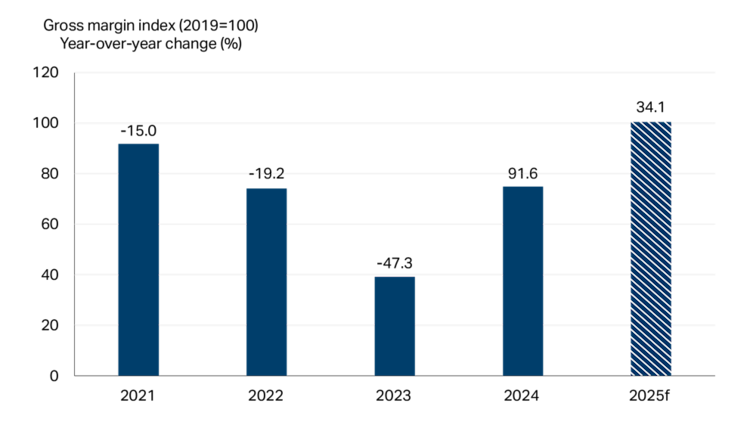

While manufacturers’ expenses increased in 2024, revenues increased faster, boosting margins. In 2025, we expect strong revenue growth again, boosting margins further. (Figure 2).

Figure 2: Higher margins for sugar and confectionery products reflective of strong sales projections

Sources: FCC Economics, Statistics Canada

The 2024 Food and Beverage Report highlighted the rise in sugar and cocoa prices due to poor weather, which damaged crops and reduced global supply. While some relief in sugar prices helped manufacturers in 2024, cocoa prices remained very high throughout the year. At this point, the market is showing little signs of relief for 2025. If cocoa prices stay high and trade disruptions persist, margins will be squeezed further in the sector.

Market insights: Eyes on the American market

Approximately 80% of sugar and confectionery product manufacturing sales are destined for the U.S. As the primary market for the sector, businesses carefully watch trends in the American market, and no doubt U.S. trade policies are top of mind for 2025.

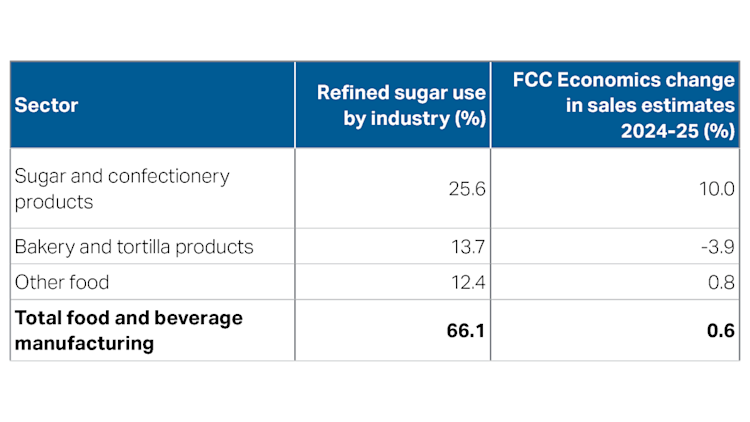

However, there are key differences for sugar and confectionery product manufacturing. In Canada, most refined sugar is used as an intermediate good in further manufacturing, and export markets account for less than 10% of sales. According to Statistics Canada, about two-thirds of the total value of refined sugar ends up in food and beverage manufacturing, primarily sugar and confectionery, bakery and tortilla, and other food1 (Table C.1). There is evidence that sugar manufacturers are feeling optimistic about the growth in these markets.

Canada’s top three sugar manufacturers are expanding their capacity to refine more sugar in the coming years to meet the increasing demand. This positive outlook aligns with FCC Economics forecasts for the food and beverage manufacturing sector in 2025 (Table 1).

Table 1: Refined sugar is an important ingredient for food and beverage manufacturing

1Other food manufacturing includes businesses that manufacturing snack food, coffee and tea, flavouring syrup and concentrate, and seasoning and dressings.

Sources: Statistics Canada, FCC Economics

With most sugar manufacturing sales in Canada destined for further processing, the impacts from trade disruptions will likely be felt indirectly. According to the Canadian Sugar Institute, about 45% of Canadian refined sugar is exported as an ingredient in food products. If the demand for Canadian food and beverage manufacturing slows down in the U.S., it could reduce the need for sugar from Canadian manufacturers.

On the other hand, confectionery manufacturing relies heavily on export markets, with over 90% of sales coming from exports. This means the confectionery sector will face more direct impacts from trade disruptions. These direct impacts could include declining sales and exports, increased expenses, and reduced margins.

Average annual export growth to non-U.S. destinations increased faster than growth in exports to the U.S. over the last five years (that is, 13.3% to other countries versus 12.5% to the U.S.), which shows there might be opportunities to diversify markets. That said, challenges related to logistics and production will have to be overcome if exporters are to exploit those opportunities fully.

Other trends to watch

The sugar and confectionery product manufacturing sector topped other food manufacturing sectors in innovation practices. According to Statistics Canada, nearly 80% of businesses introduced at least one innovation (that is, product, process, marketing, or organizational) between 2021 and 2023. For example, with soaring cocoa prices, companies are looking to innovate, such as with cocoa-free chocolate and lab-grown cocoa, to blend into confectionery recipes in the coming years.

Health-conscious consumers seek reduced/no sugar food and drink options. The challenge for the sector is managing the cost and taste of products with lower sugar while navigating the rising use of alternative sugars.

Strained budgets and a focus on health drive consumers to be more selective in their confectionery purchases, favouring quality over quantity.