Dairy product manufacturing: 2025 FCC Food and Beverage Report

The following information is from the 2025 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. To get the big picture, read the full report.

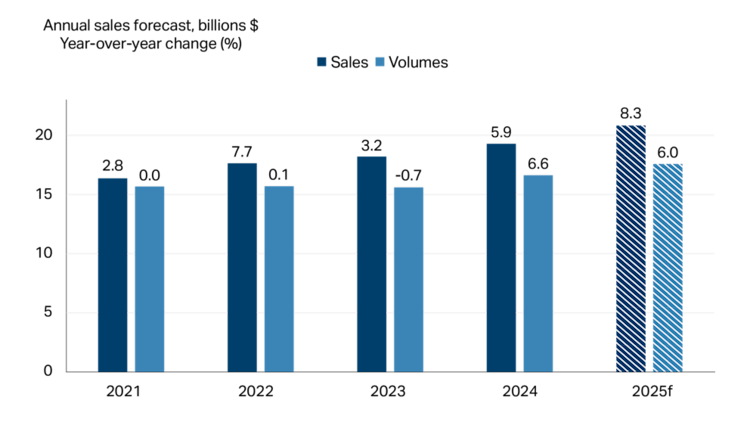

Another strong year for dairy product manufacturing sales is expected for 2025. FCC Economics forecasts an 8.3% increase in sales and a 6.0% increase in volumes (that is, sales adjusted for inflation), even with the prospect of slowing population growth (Figure 1).

Milk sales from the farm were up in 2024 and are expected to grow again in 2025, supported by already announced quota increases and two incentive days per month until the end of November for Western Canada.

Figure 1: Dairy product sales poised for another year of growth

Total sales and volumes (in $, billions) are on the vertical axis and shown by the height of each bar. The number above each bar is the year-over-year growth as a percent. Volumes are sales deflated by a price index (202001=100).

Sources: FCC Economics, Statistics Canada

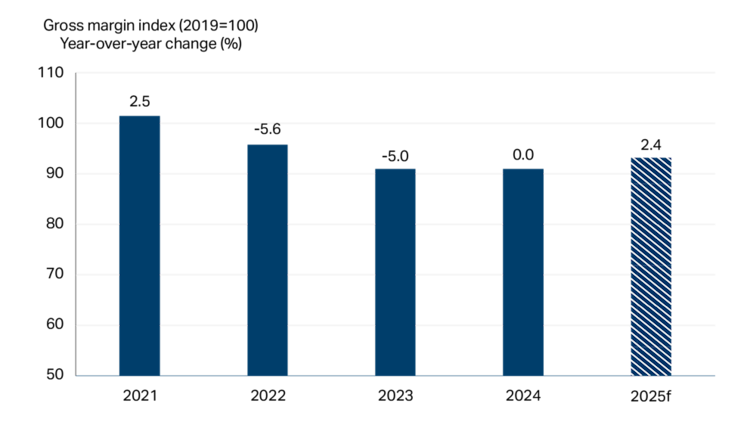

Gross margins in the dairy product manufacturing sector remained stable over the past decade and are expected to improve in 2025, to the highest level over the past two years, as raw material costs decrease (Figure 2).

Figure 2: Dairy product manufacturing margins to improve in 2025

Sources: FCC Economics, Statistics Canada

While the price farmers receive for their milk is based on production costs, the cost of milk for dairy product manufacturers varies according to the harmonized milk classification system. Dairy processors of milk, cream, yogurt, sour cream, ice cream and cheese will face little change in the price of dairy components in 2025 as the Canadian Dairy Commission decided to leave the farmgate prices of milk essentially unchanged (actual decrease of -0.0237%) this year. On the other hand, processors using dairy products as ingredients for further processing face prices set on the world market, resulting in less stable costs for these processors.

Market insights: Protein-packed products

The demand for high-protein food and beverages continues to rise, and dairy products, naturally rich in protein, are well-positioned to benefit from this trend. According to the International Food Information Council’s Food and Health Survey, high-protein diets were the most popular diet in 2024. In the survey, 71% of respondents aimed to include more protein in their diets, up 12% from 2022.

The versatility of dairy products and ingredients allows the industry to focus on marketing the protein content of traditional dairy products like fluid milk, yogurt and cottage cheese, but also provide protein ingredients to other food processing, such as bakery, snack bars and beverages. One example is the uptick in protein-added fluid milk in recent years. After years of declining per capita fluid milk consumption, tapping into consumers’ desire for high-protein products is one way to try and reverse this trend. In addition, high-protein products often command a premium price, providing opportunities to manage margins.

Other trends to watch

Trade is not a significant contributor to sales, so the sector is less vulnerable to trade disruption impacts than other sectors. However, the cost of non-dairy raw materials from outside Canada, including packaging, could rise under U.S/Canada trade disruptions, negatively impacting margins.

Although the review of the Canada-U.S.-Mexico (CUSMA) agreement is not until 2026, discussions around provisions related to the dairy sector could emerge in 2025.

The dairy industry is already innovating with new product lines focused on protein tailored for those using appetite suppression medications (for example, Ozempic), but watch for more opportunities in the high-protein, low-sugar space in 2025.

An increasingly diversified population and changing dietary patterns have shifted dairy consumption over the past decade. Per capita consumption of fluid milk has declined, while demand for other processed dairy products is on the rise. According to the Canadian Dairy Commission, consumption across major dairy product categories was up in 2024, with butter (+2.7%) and ice cream (+2.1%) being the highest.

Stocks of butter trended near their five-year low to start 2024 but were slowly rebuilt in the latter half of the year. December 2024 stocks were the highest levels recorded for that month since 2019. When adjusted for population growth, however, stocks are still relatively tight. If butter inventory continues to build in the first half of 2025, production growth could slow towards the end of the year.