Beverage manufacturing: 2025 FCC Food and Beverage Report

The following information is from the 2025 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. To get the big picture, read the full report.

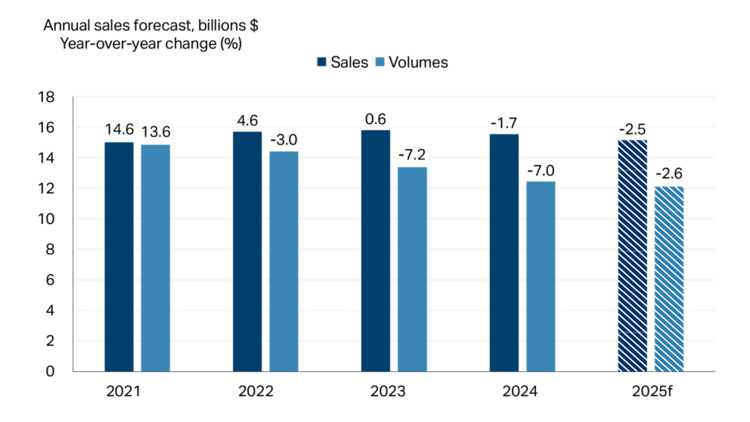

Beverage manufacturers faced a challenging year in 2024 as many consumers pulled back on discretionary spending, while substituting away from alcohol in favour of low or non-alcoholic beverages. Growth in soft drink sales in 2024 couldn’t overcome the downward pressure from alcoholic beverage sales. Overall sales fell -1.7% while volumes (that is, sales adjusted for inflation) fell -7.0% (Figure 1). In fact, volumes sank last year to 2018 levels, wiping away gains during the pandemic.

For 2025, FCC Economics forecasts a further decline in sales of -2.5% and -2.6% in volumes. The anticipated decline is driven by a continued shift away from alcoholic beverages, particularly beer, and a slight slowdown in non-alcoholic beverage sales after four years of strong growth.

Figure 1: Beverage manufacturing sales set for declines again in 2025

Total sales and volumes (in $, billions) are on the vertical axis and shown by the height of each bar. The number above each bar is the year-over-year growth as a percent. Volumes are sales deflated by a price index (202001=100).

Sources: FCC Economics, Statistics Canada

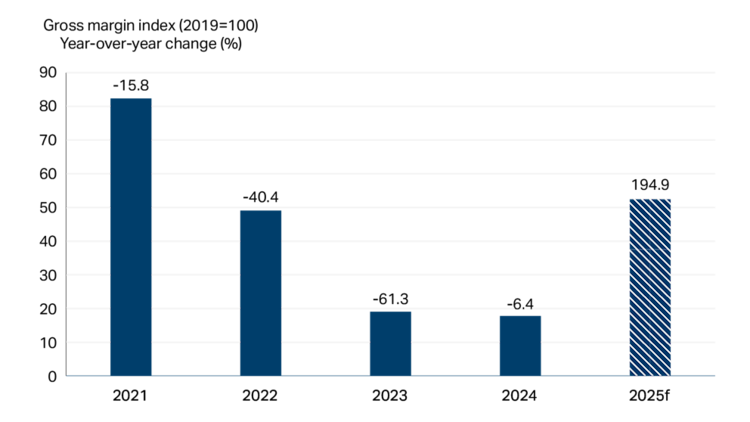

Amid lower revenues, declining raw material costs should help boost margins in 2025 (Figure 2).

Figure 2: Margins improve on falling raw material costs

Sources: FCC Economics, Statistics Canada

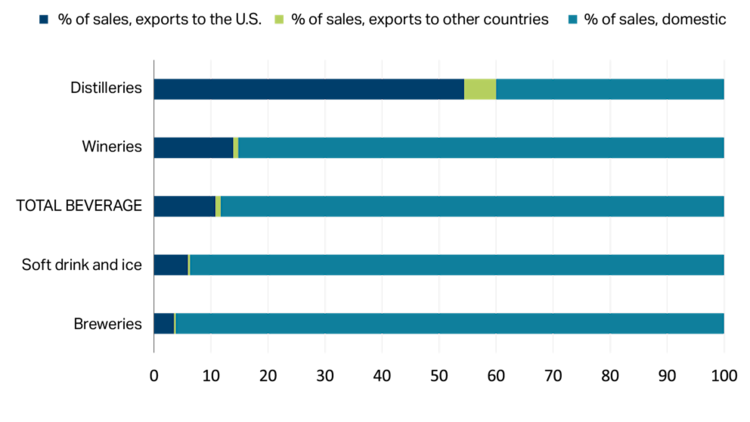

A major downside risk to our forecast, however, is the impact of trade disruptions on beverage exports and packaging imports. Exports to the U.S. market account for about 10% of total beverage sales, a relatively low exposure compared to other food and beverage manufacturing sub-sectors. However, not all beverage producers have similar exposures. Distilleries, for example, are at the highest risk of trade disruptions given that the U.S. accounts for more than half of their sales (Figure 3).

Beverage manufacturers could also have to contend with higher costs of raw materials imported from the U.S. if trade is disrupted and, accordingly, lower margins. Note that packaging costs (that is, metal containers, paperboard containers, plastic bottles and glass) make up approximately 30% of raw material costs for beverage manufacturers and therefore play a big role in determining margins.

Figure 3: Canadian beverage manufacturing trade exposure to the U.S.

Source: Statistics Canada

Market insights: Low and non-alcoholic beverages

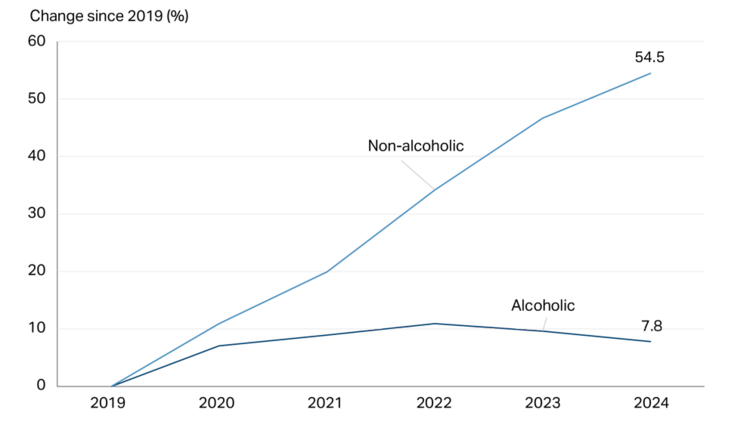

With recent inflationary pressures impacting household budgets and a growing focus on health and well-being, sales of alcoholic beverages are taking a hit. In contrast, sales of non-alcoholic beverages, which appeal to a wider audience and can be sold in more locations than alcohol, are doing better (Figure 4).

Figure 4: Non-alcoholic beverage retail sales outpacing alcohol

Source: Statistics Canada

One market to watch closely is energy drinks. The caffeinated beverage industry is evolving beyond coffee and tea, embracing innovative ingredients and flavours. The Survey of Household Spending conducted by Statistics Canada every two years shows that spending on sports and energy drinks increased 50% between 2019 and 2021, outpacing the 19% growth in the broader non-alcoholic beverage category.

The beverage market is experiencing significant shifts as consumers explore options beyond traditional alcoholic beverages. Product offerings are ramping up with innovative cannabis products, energy drinks, sparkling water, sports drinks, and dealcoholized beer, wine, and spirits coming to shelves. By expanding their product lines and tapping into existing production capabilities, manufacturers can stay ahead of the curve and meet the evolving demands of consumers.

Other trends to watch

Beer still holds the largest share of alcohol sales, followed by wine, spirits, ciders and coolers. However, ciders, coolers and other alcoholic drinks are gaining ground, thanks to the high demand for canned, small-batch and low-calorie beverages with exciting flavours and ingredients.

Declining labour productivity is restraining the sector’s potential as growth outpaces production. The sector is characterized by many small businesses, which may find it challenging to scale up or innovate to improve productivity. It will be important for these businesses to focus on finding solutions to manage efficiency, expand opportunities to scale up and increase innovative practices that complement their business size.

Selling alcohol in Canada comes with many challenges such as taxation, storage, shipping, labelling and distribution rules that vary from province to province. A focus on barriers to trade between Canadian provinces and territories, especially for alcohol, will come into focus with uncertainty around U.S.-Canada trade disruptions.

The impacts of the severe frost in 2024 that wiped out vines in British Columbia won’t be fully realized until the spring. Early estimates show that about 50% of vines on the ground were fatally impacted.

There are opportunities to service the Canadian wine market with domestic production if regulatory burdens impacting internal trade can be addressed.

Alcohol sales will be further pressured given the expectations for slower population growth in the short term. Per capita alcohol consumption has steadily declined since 2009, reaching a low of 88.2 litres per person in 2024, down from 107.3 in 2009.

Ontario’s decision to decentralize alcohol sales in the province will make alcohol more accessible to consumers. Yet, it’s unclear how much of an impact that will have on sales as alcohol consumption continues to trend downwards. This will also shift the point of purchase for alcoholic beverages.