Bakery and tortilla products: 2025 FCC Food and Beverage Report

The following information is from the 2025 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. To get the big picture, read the full report.

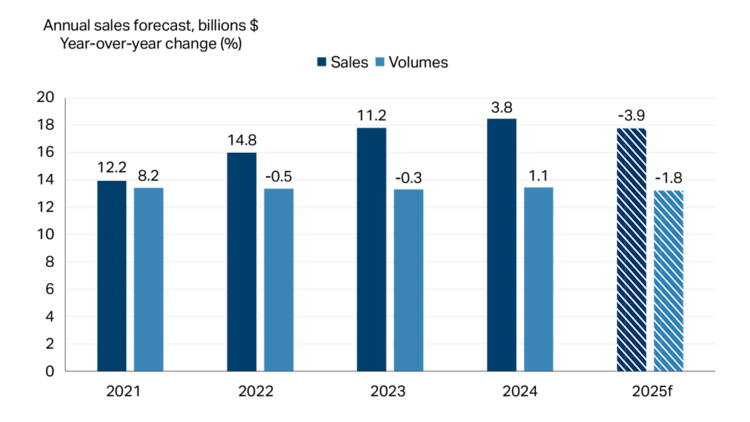

Over the last three years, sales of bakery and tortilla products were influenced by significant price increases, with volumes remaining relatively stable year-over-year. In 2025, FCC Economics forecasts sales to decline -3.9% and volumes (that is, sales adjusted for inflation) -1.8% (Figure 1).

Figure 1: Bakery and tortilla product sales and volumes expected to decline in 2025

Total sales and volumes (in $, billions) are on the vertical axis and shown by the height of each bar. The number above each bar is the year-over-year growth as a percent. Volumes are sales deflated by a price index (202001=100).

Sources: FCC Economics, Statistics Canada

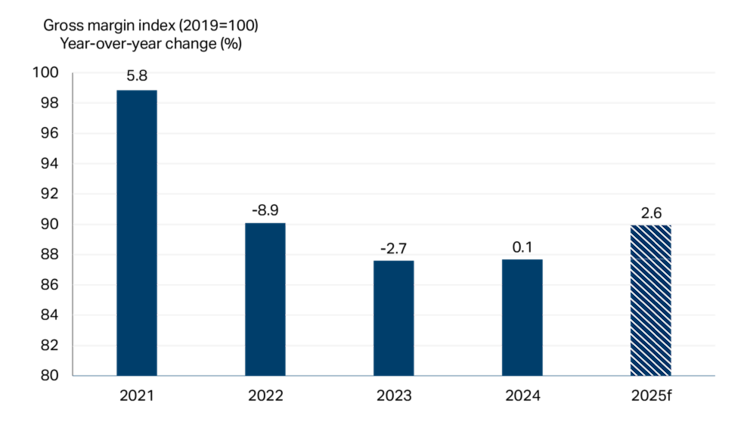

High grain prices in 2022 and 2023 impacted flour prices, the primary ingredient for the bakery and tortilla product manufacturing sector, pressuring margins down. As grain prices decline from historical highs and progress through the supply chain, margins demonstrate resilience. They improved in 2024 and are forecasted to increase again in 2025 (Figure 2). However, depending on their recipes, manufacturers will likely still have to contend with higher sugar, egg, oil and cocoa prices this year.

Figure 2: Margins to improve again in 2025

Sources: FCC Economics, Statistics Canada

According to Statistics Canada, flour products and margarine/cooking oils are the two largest input categories by value (excluding wages), while sugar is sixth. The cost of many of these top inputs soared over the last five years. Flour and cooking oil prices reached highs in 2022 and sugar in 2024. Cocoa prices also rose to record highs in 2024.

Prices are expected to stay below these highs in 2025; however, this may change depending on the harvest outcomes over the next year. While flour and cocoa prices are likely to be more reliant on short-term weather-related impacts, vegetable oil, margarine and sugar prices are also impacted by the global demand for biofuels. (For more information on biofuels, refer to Grain and oilseed milling).

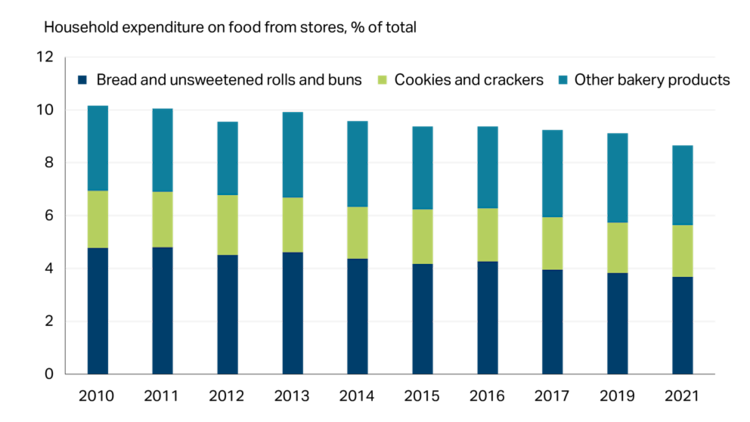

Market insights: The opportunity in novel ingredients

Consumers are not spending as much of their budget on bakery products as they have in the past (Figure 3). According to the biennial Survey of Household Spending (SHS), in 2021, bakery products made up 8.7% of a household’s average expenditure on food from a store, down from 10.2% in 2010. The decline is partly due to lower inflation in bakery products compared to overall food purchased from stores over this period. However, it’s also impacted by health trends towards low-carbohydrate and gluten-free diets that threaten this category’s ongoing importance for consumers. While the 2023 SHS results won’t be released until later this spring, we anticipate the bakery category will show a small price-induced uptick in household expenditures. Between 2021 and 2023, bakery prices increased faster than food purchased from stores. This reversed in 2024 as lower commodity prices for key grain and oilseed inputs worked through to final bakery products.

Figure 3: Declining share of household budget spent on bakery products

Source: Statistics Canada

Whether their motivation is health, budget or tastes, consumers are interested in reading the ingredient list and knowing what’s in their food. For the bakery industry the opportunity lies in the ability to use various ingredients to create innovative recipes to meet the needs of consumers.

Incorporating different grains, functional ingredients, and flavours to reinvigorate the traditional bread or bun can create excitement for staple products while meeting consumers’ demand for different nutritional properties such as gluten-free, high-protein, or high-fiber. Indulgent experiences like cookies or pastries will likely benefit from innovative flavour pairings and aesthetically pleasing displays. Keeping quality over quantity in mind will also be important as consumers try to manage their health and budget while still enjoying indulgences. The good thing for manufacturers is that products using innovative ingredients that stand out from other products typically command a premium price.

Other trends to watch

The Canadian market represented over 50% of sales in 2024. However, this share has declined over time, with exports growing by about 13% yearly over the last decade.

The U.S. is the largest market for Canadian exports of bakery products, accounting for 97%. The increased share of sales destined for international markets and the reliance on the U.S. market increases the sector’s vulnerability to trade disruptions.

A key market for the bakery and tortilla product manufacturing sector is foodservice. According to Statistics Canada, the foodservice sector accounts for approximately 10% of bread, rolls and flatbread use by value. The most recent quarterly report by Restaurants Canada forecasts foodservice sales to grow 3.9% in 2025, led by caterers (+4.3%) and quick-service restaurants (+4.0%).