Seafood preparation: 2024 FCC Food and Beverage Report

The following information is from the 2024 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. For the most recent FCC Food and Beverage report, click here.

Optimism abounds for an export-led turnaround

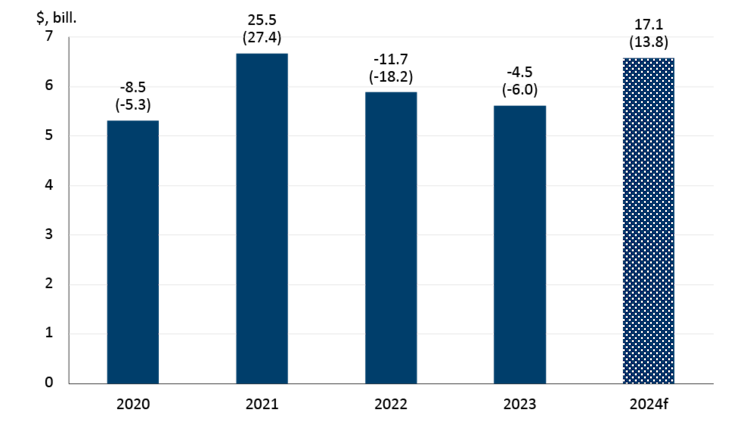

Seafood product sales have decreased in the last two years but are poised for a rebound in 2024. FCC Economics forecasts sales and volumes to increase in 2024 (17.5% and 13.8%, respectively), which would be impressive growth but still lower than in 2021 (Figure 1).

Figure 1: Seafood product sales, volumes are forecast to have the best year since 2021

Total sales (in $, billions) are on the y-axis. The top number above each bar is the year-over-year growth in sales measured in dollars. The bottom number above each bar (in parentheses) is the year-over-year growth in volume sold. Volumes are reported sales deflated by a price index (January 2020 = 100).

Sources: FCC Economics, Statistics Canada

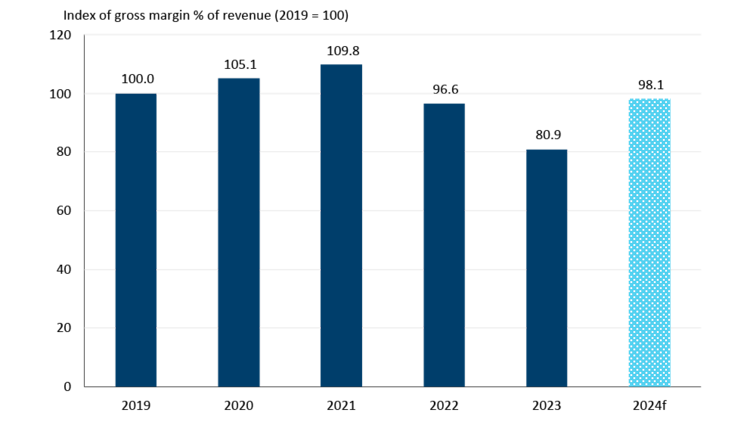

Consistent with falling sales over the last two years, margins have been under pressure but should improve in 2024 (Figure 2). Declining sales and profitability in the last two years have led to some contraction in seafood processing. Employment fell by 2,500 people (-15.4% YoY) in 2023, the only sector covered in this report where employment growth was negative. Some large plants in Atlantic Canada closed in 2023, causing the largest employment losses.

Figure 2: Seafood product margins to improve in 2024

Sources: FCC Economics, Statistics Canada

FCC Economics spotlight: How seafood exports change during economic uncertainty

Domestic seafood consumption has been waning for two decades, with per capita consumption of seafood peaking in the early 2000s. Retail prices of fish, seafood and other marine products increased 3.9% on average in 2023, much lower than comparable protein groups and products. Still, seafood products are more expensive than comparable meat proteins on a price per gram of protein basis. And many Canadian consumers don't view seafood as a diet staple: Mintel reports more than half view seafood as an occasion for special events rather than as part of an everyday meal.

Due to domestic challenges (including logistics), the seafood sector relies on exports. In 2023, 86% of sales were from exports, the highest of any sector covered in this report. As the economic health and changing tastes of importing countries change, so does the sector's health. The U.S. and China account for 70% of Canadian seafood exports by volume and 80% by value. Export volumes to the U.S. have decreased in the last two years, while export volumes to China have increased.

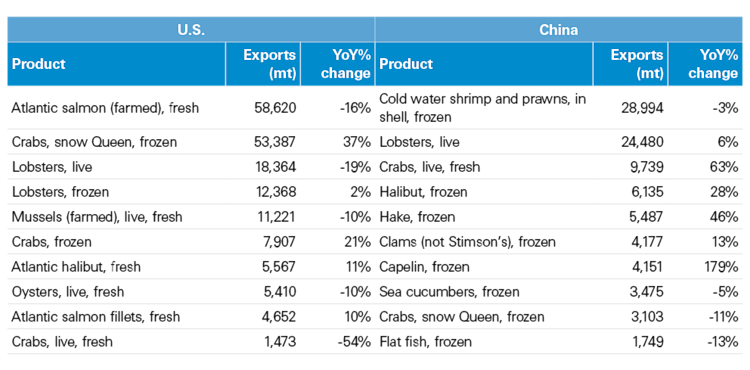

In the western world, seafood is usually one of the first casualties in consumer diets during economic uncertainty. Although the U.S. economy has performed well in the last few years, consumers are dedicating more household income to food than before the pandemic. This results in the need to re-evaluate their purchasing choices. Despite recent economic concerns in China, GDP growth is still positive and protein demand is increasing, supporting exports to that country where seafood is a diet staple. The top export to the U.S. is farmed Atlantic salmon; to China it is cold water shrimp and prawns (Table 1).

Table 1: Top 10 seafood exports to the U.S. and China, 2023

Source: CIMT database

Seafood product sales are highly cyclical and the sector is due for a rebound in 2024, with exports to the U.S. and China leading the way.

Other trends to monitor in 2024

Convenient, prepared, ready-to-eat seafood items (for example, sushi, appetizers) performed well in the latter half of 2023 and 2024.

Many Canadians are uncomfortable preparing seafood. Mintel reports that over seven in 10 Canadians would like more meal ideas in-store (for example, recipe cards, cooking demonstrations) on using seafood. Processors could increase sales by leveraging these insights.

Despite the overall export decline from 2021, there were pockets of strong export growth during that time in countries such as the Philippines, Macao, Lithuania and Myanmar.

Conservation efforts have resulted in the North American Atlantic salmon harvest remaining near the lowest on record, including in Canada. This will increase farmed salmon demand, likely raising raw material costs for processors creating value-added products and ready-to-eat meals.