Grain and oilseed milling: 2024 FCC Food and Beverage Report

The following information is from the 2024 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. For the most recent FCC Food and Beverage report, click here.

Lower raw material costs and higher demand to increase profitability

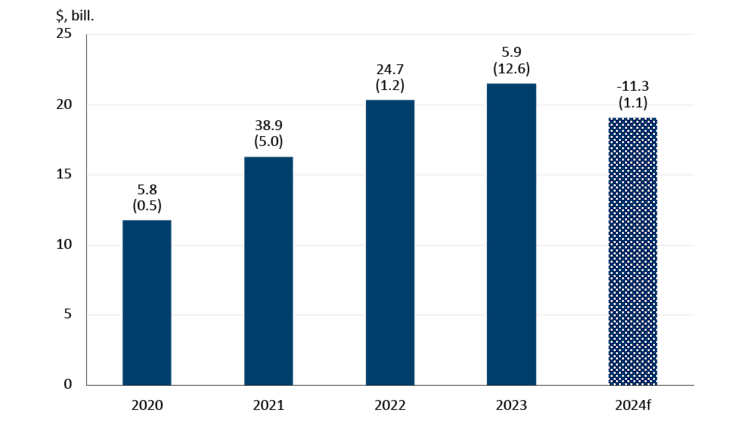

The impact of the inflation-fueled sales boom in 2021 and 2022 was most evident in the grain and oilseed milling sector. In 2021, sales grew 38.9%, but sales measured in volumes only increased 5.0% (Figure 1). A similar phenomenon occurred in 2022. Last year, this trend reversed, with volumes increasing faster (12.6%) than sales (5.9%).

Looking to 2024, FCC Economics forecasts a decline in sales (-11.3%) due to lower commodity prices working their way through the supply chain, which will result in a much lower selling price for manufacturers. We forecast volumes to increase marginally (1.1%).

Figure 1: Grain and oilseed milling sales are expected to decrease in 2024, but volumes will increase slightly

Total sales (in $, billions) are on the y-axis. The top number above each bar is the year-over-year growth in sales measured in dollars. The bottom number above each bar (in parentheses) is the year-over-year growth in volume sold. Volumes are reported sales deflated by a price index (January 2020 = 100)

Sources: FCC Economics, Statistics Canada

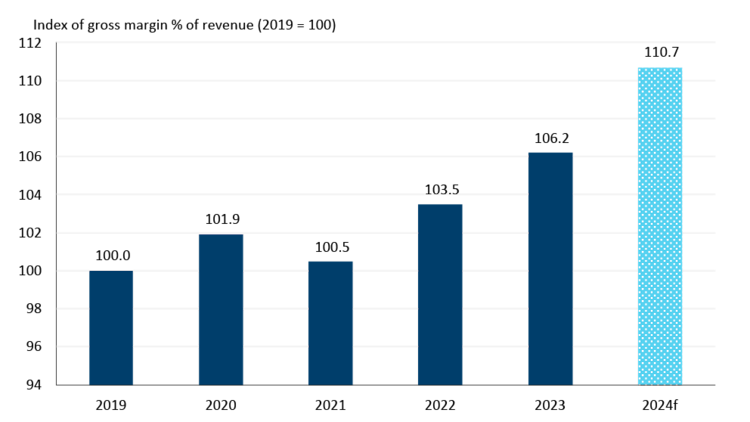

Grain and oilseed milling has been quite profitable in the last few years, and 2024 looks promising given lower commodity prices and increased demand for biofuel and renewable diesel in North America (Figure 2). Despite high retail prices, demand for end-use products (primarily flour and vegetable oil) has been remarkably strong in the last two years. With raw material costs easing into 2024, profitability will receive an additional boost.

Figure 2: Grain and oilseed milling margins forecast to be very promising in 2024

Sources: FCC Economics, Statistics Canada

FCC Economics spotlight: Building upon a record-breaking 2023

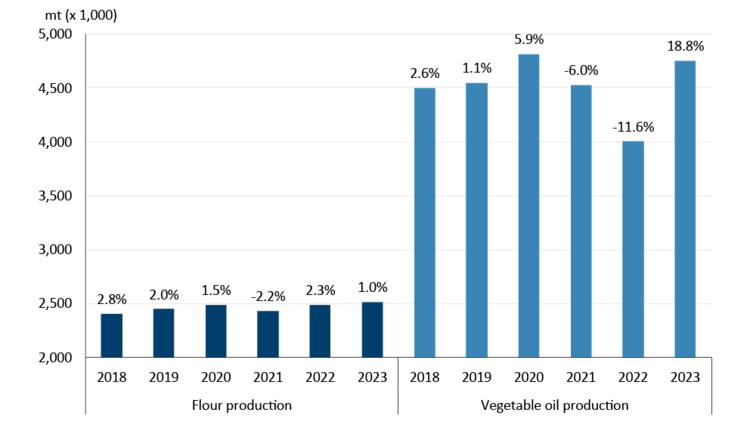

In 2023, flour milling and oilseed crushing volumes were at record and near-record levels, respectively (Figure 3).

Figure 3: Flour production reached a record high in 2023, vegetable oil production near record high

Total sales production is on the y-axis. The year-over-year growth is above each bar.

Source: Statistics Canada

More vegetable oil is diverted to industrial use each year, primarily as a biofuel feedstock. U.S. vegetable oil exports have been and will continue to be strong as processors look to take advantage of the biofuel boom and tax incentives in the U.S. In 2022, the Environmental Protection Agency approved canola oil as a feedstock for advanced renewable fuel. This is good news for Canadian companies bringing crush plants online in the next few years, some of which are close to completion.

At the grocery store, vegetable oil price inflation slowed toward the end of 2023, falling to 12.8% YoY, lower than the 21.1% increase in 2022. Margarine price inflation also slowed in 2023, falling to 6.7% on the back of a massive 36.0% increase in 2022. With manufacturers' selling prices forecast to fall in 2024 (over -12.0%), we expect this deceleration in inflation of downstream retail products to continue, with prices possibly even declining later in the year.

Despite drought concerns, 2023 was a better-than-expected year for the production of major wheat varieties used to produce flour. Issues with access to high-quality durum and spring wheat are not as serious as they were in the fall of 2021 and the first half of 2022. This will help provide an adequate supply for most of 2024 until the new crop is harvested.

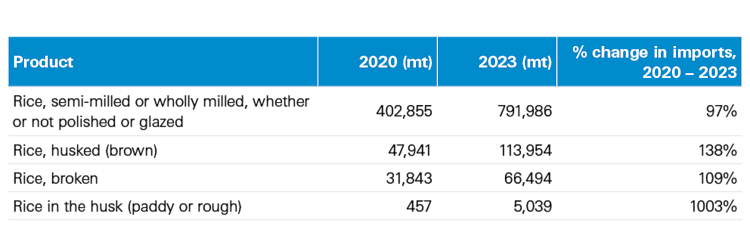

This sector also includes rice milling, where we see an opportunity. Many new immigrants to Canada are coming from cultures where rice is a staple foodstuff. These demands are currently being met by imports (Table 1). While nearly zero rice is produced in Canada, there's an opportunity to import in bulk to refine, package and sell to a rapidly growing market segment.

Table 1: Rice imports and growth, 2020 to 2023

Source: CIMT database

Even after a banner year in 2023, flour, oil from oilseeds, and rice demand will only continue to grow, leading to increased profitability for the sector.

Other trends to monitor in 2024

The outlook for canola oil demand beyond this year is also promising, with three of the five planned canola crush plants in Saskatchewan currently under construction. One plant expansion was already completed in 2023.

Statistics Canada reported three new medium-sized flour mills (that is, with between 50 and 99 employees) in operation as of December 2023, compared to December 2022. Some existing flour mills have announced expansion plans for this year, demonstrating the long-term growth and sustainability of flour milling.

Watch for employee wage growth in this sector. Average weekly earnings grew 18.5% last year, the highest amongst sectors covered in this report.