Beverage manufacturing: 2024 FCC Food and Beverage Report

The following information is from the 2024 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. For the most recent FCC Food and Beverage report, click here.

Consumers cutting back on alcohol amid economic stress

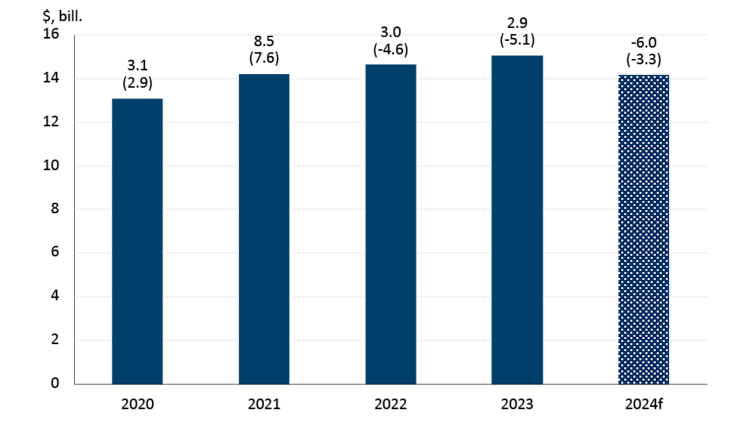

In 2023, total beverage sales increased 2.9%, but performances across beverage types were mixed. Distilleries had a better year, while breweries and wineries – especially wineries – had a tough year.

For 2024, FCC Economics forecasts decline in sales (-6.0%) and volumes (-3.3%). This would be the third consecutive year of declining volume for the sector. Alcoholic beverage sales and volumes (all types) are forecast to decrease in 2024, while soft drink and ice manufacturing sales should increase.

Figure 1: Beverage manufacturing volumes are expected to decline for a third consecutive year

Total sales (in $, billions) are on the y-axis. The top number above each bar is the year-over-year growth in sales measured in dollars. The bottom number above each bar (in parentheses) is the year-over-year growth in volume sold. Volumes are reported sales deflated by a price index (January 2020 = 100).

Sources: FCC Economics, Statistics Canada

Table 1 below shows that most beverage manufacturers had a challenging 2023, except for distilleries. It should be noted that distilleries rebounded in 2023 after three consecutive years of declining sales and volumes from 2020 to 2022, and distillery volumes in 2023 are estimated to be 15.0% lower than in 2019.

Table 1: 2023 sales, price and volume growth rates amongst different beverage manufacturers

Source: Statistics Canada

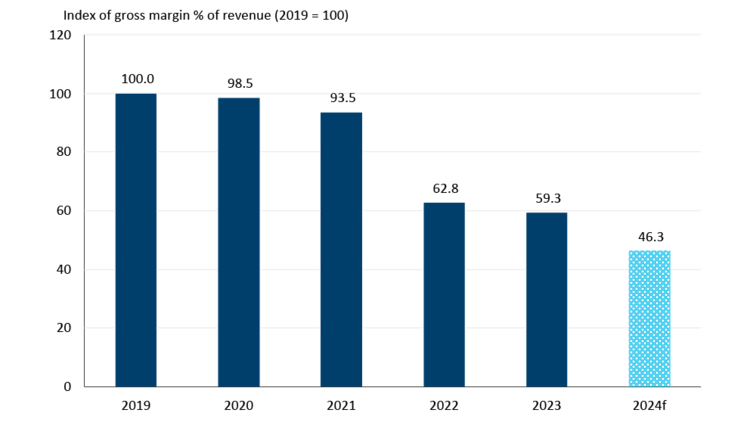

Margins for beverage manufacturers have been under pressure in the last three years and 2024 will be no exception. Again, the results differ amongst the sectors depending on the beverage produced. Wages in the beverage manufacturing sector grew rapidly in 2023 (17.9%), the second-highest rate of wage growth of the sectors covered in this report (see Appendix).

Figure 2: Beverage manufacturing margins will be further compressed in 2024

Source: FCC Economics

FCC Economics spotlight: Canadian wineries under extreme pressure

A series of unfortunate events has hammered the wine industry in the last 18 months. This is particularly true for B.C. wineries. Despite loosening pandemic restrictions, 2023 tourism numbers did not return to pre-pandemic levels as forest fire risk and smoke kept some tourists away. And there have been back-to-back winters where extreme cold has damaged grape vines.

A study conducted by Wines of British Columbia estimated this winter's extreme cold will result in a 97-99% decrease in grape production this year. Some wineries can rely on imported grapes to drive production and sales. Industry groups are calling for temporary changes to import rules around grapes so that wineries reliant on B.C.-grown grapes have an opportunity to bottle something this year. The federal government recently announced an extension of the Wine Sector Support Program with an additional $177 million in support.

Production issues, combined with Canadians purchasing less wine than during the pandemic, are why wine volumes sold in 2024 are forecast to be equal to 2019 volumes. During the pandemic, Canadian wineries moved a lot of product, despite restrictions and other logistic challenges. Volumes increased 64.0% between 2019 and 2021; all of this gain will be effectively wiped out by 2024.

Canadian wineries are not alone in their struggles. A significant reduction in European wine consumption led the European Commission to pass measures in the summer of 2023 to address 'imbalances' in their wine market, allowing member states to buy and distil wine inventories to remove unwanted wine from the market. The 2023 European wine production year is estimated to have fallen to a 60-year low, which will help alleviate the increase in wine inventories but not enough to offset declining demand in a time of tight consumer budgets.

Other trends to monitor

Wineries are in for a challenging 2024 and beyond. Wineries that can access imported grapes and produce non-Vinters Quality Alliance (VOA) wines will benefit from the lack of Canadian production in years ahead.

The non-alcoholic beverage market will diversify and grow as the 'sober curious' movement continues to grow. Producing and marketing non-alcoholic drinks requires significantly less red tape and taxes.

Alternative alcoholic beverages (seltzers, coolers, ciders) will continue to provide another avenue of diversification and growth. This is true for distilleries providing hard liquor (for example, for seltzers) and breweries with the production lines to assemble. Over the last five years, sales of ciders and coolers (by volume) have increased by 15.5% annually on average.

Given the market saturation of craft breweries and declining beer sales, we're likely to see continued mergers and acquisitions in the brewery space. In 2022-23, per capita beer consumption fell to an all-time low since record-keeping began in 1949, according to Statistics Canada.

Longer-term regulatory changes to the sale and distribution of wine and beer in Ontario will provide wineries and brewers in that province the opportunity to reach more consumers. The first changes are scheduled for implementation in 2026.