ASF outbreak slow to lift profitability of North American producers

Trade tensions, Brexit and other geopolitical risks weigh on the world economy. Weather and animal diseases create an additional layer of uncertainty in agricultural markets. A perfect example is the global pork market. Our July profitability outlook for the Canadian hog/pork sector continues to hold, but recent economic data offer some upside. A rising hog-feed ratio indicates stronger profitability going into 2020 as the gap between China’s pork demand and supply is expected to grow.

ASF impacts on production, consumption and trade

The African Swine Fever (ASF) virus has spread across Asia and Eastern Europe. It has hit China’s hog sector particularly hard, with credible assessments suggesting a 25% drop in the 2019 pork supply and a herd size cut in half. This is significant considering China accounts for half of global hog production.

Such a shortfall in production creates a gap between supply and demand. The USDA projected in August that China would need to increase pork imports by 60% relative to the 2018 level. Yet, the pace of Chinese imports generally lagged these projections, climbing 26% year-over-year (YoY) in the first six months of 2019. Recent statistics suggest an acceleration; pork imports exceeded 100% YoY growth in July and were up 76% YoY in August.

Trade is not the only adjustment triggered by ASF:

Retail pork inflation is running rampant in China with near 50% YoY growth, leading consumers to switch to other sources of proteins like chicken, beef and mutton.

The USDA projects that the 2019 U.S. supply of pork will increase by 4.8%. Hog production in Europe will be slightly down in 2019, but production capacity there is expanding. Despite the hog supply tightening in China, reports suggest businesses are expanding production capacity given higher hog prices.

The higher pace of imports is a positive signal, yet markets remain cautiously optimistic. China has not fully removed tariffs on U.S. pork exports which suppress the U.S. price of live hogs. It also continues to enforce a ban on Canadian exports of red meat.

Muted profitability outlook for Canadian hog production

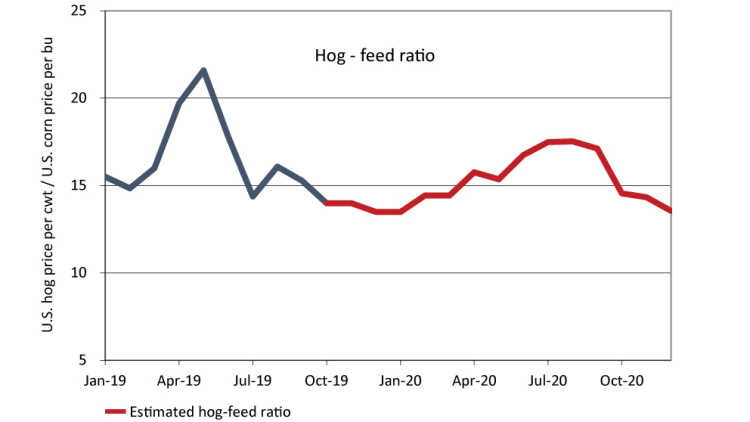

Hog margins, as measured by the hog-feed ratio, climbed in March and April as markets anticipated a significant increase in the demand for North American hogs (Figure 1). But hog prices then retreated following lower than anticipated strength in demand and a rising U.S. supply. Rising corn prices also hit profitability.

Figure 1: Low market anticipation of price gains pressures hog-feed ratio

Source: AAFC, CME, USDA and FCC computations

The hog-feed ratio is projected to slowly climb in late 2019 and throughout most of 2020, suggesting higher profits for producers. The increase is moderate, however, until the summer of 2020 when demand is expected to strengthen seasonally.

Looking after costs is essential amid geopolitical risks

There’s still much potential for volatile hog and pork prices throughout 2019 and into 2020. They’re not within our control – but managing costs is. The median operating expense ratio (OER) of a hog operation with annual sales between $1 million and $2 million was 0.77 in 2018*. This means that $0.77 were spent on variable inputs for each dollar of revenues generated on the farm. The top 25% most efficient operations managed to achieve a 5-cent lower ratio.

Farm operations should focus on what they can control:

A sound risk management strategy that accounts for the continued uncertainty in commodity prices and trade policy.

A review of production decisions to determine if changing the mix of inputs can lower expenses while avoiding or minimizing declines in output and revenues.

* according to a benchmarking analysis conducted using FCC portfolio data.

Jean-Philippe (J.P.) Gervais

Executive Vice President, Strategy and Impact and Chief Economist

J.P. Gervais is Executive Vice President, Strategy and Impact and Chief Economist at FCC. His insights help guide FCC strategy, monitor risks and identify opportunities in the economic environment. In addition to acting as an FCC spokesperson on economic matters, J.P. provides commentary on the agriculture and food industry through videos and the FCC Economics blog.

Prior to joining FCC in 2010, J.P. was a professor of agricultural economics at North Carolina State University and Laval University. J.P. is a Fellow of the Canadian Agricultural Economics Society. He obtained his PhD in economics from Iowa State University in 1999.