3 reasons why Canadian food manufacturing is thriving

Food manufacturing is an important part of the Canadian economy. 2016 census data shows about 240,000 jobs in food manufacturing, generating about 103 billion dollars in sales in 2018. A vibrant sector is critical to the success of other industries across the entire agri-food supply chain. We explore in figures a few interesting facts about the economics of the food manufacturing in Canada.

1. Food manufacturing is resilient to economic downturns

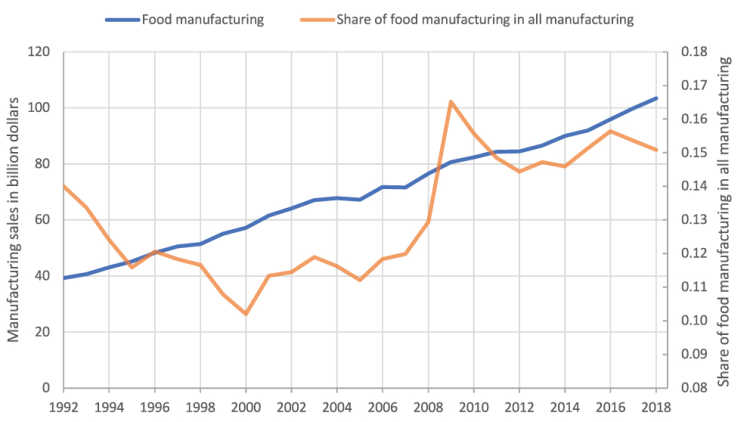

Food manufacturing sales (blue line in Figure 1) have been growing steadily at a 2.3% annual average rate since 1992 compared to 1.8% for all manufacturing sales.

It’s remarkable how resilient the food manufacturing sector has been. The share of food manufacturing in all manufacturing sales (orange line in Figure 1) shows a sudden jump between 2008 and 2009: as sales in all manufacturing sectors plummeted during the recession, those food manufacturing continued to grow.

The demand for food doesn’t decline significantly when income drops, but the demand for other manufactured products is very sensitive to the strength of the economy. The overall manufacturing industry never recovered to its pre-recession level while food manufacturing sales continue to represent about 15% of all manufacturing in Canada.

Figure 1: Food manufacturing sales and share of food manufacturing in all manufacturing sales

Source: Statistics Canada table 16-10-0047

2. Canadian food manufacturers compete on the global food market

Canadian food manufacturers compete with foreign firms on the domestic and export markets. Canada has been a net exporter of food products since the early 1990s.

Figure 2 shows Canadian exports and imports of food for products categories that closely match food manufactures output. Between 1992 and 1994, Canada was a net importer of food products. Canadian food manufacturers benefited from the weakness in the Canadian dollar between 1994 and 2007 and Canada started growing a net food exporter position. With the rebound in the economy after 2008, exports and imports of food grew rapidly. Imports began to stagnate in 2016 and in 2018 Canada exported 6.7 billion dollars more food products than it imported.

Figure 2: Canadian imports and exports of food products

Source: Statistics Canada table 12-10-0120

Food products here are defined as the following NAPCS categories: animal feed, coffee and tea, dairy products, fruit and vegetable juices, intermediate food products, meat products, other food products, and prepared and packaged seafood products.

In sectors where Canadian manufactures have a revealed comparative advantage, Canada is a net exporter: meat products, animal feed, seafood products and intermediate food products. Notably, Canadian exports of meat products exceeded imports by 3.7 billion dollars. Canadian food manufacturers face stiff competition in sectors where Canada is a net importer: dairy, coffee and tea and fruit and vegetable juices.

3. The food manufacturing sector is diverse

Food manufacturing sales in Canada are spread across many products. Figure 3 shows the distribution of food manufacturing sales in 2018. Dairy is the largest sector followed by animal slaughtering, starch and vegetable fat and oil, poultry processing, and animal food.

Figure 3: Food manufacturing sales in 2018 (total $103 billion)

Source: Statistics Canada table 16-10-0047

Takeaways

Canada’s food manufacturing sector is resilient to downturns in the economy, a significant contributor to Canada’s export position and a diverse industry.

On their own, these characteristics are not out of the ordinary, but their combination provides strength to the food manufacturing industry. Food manufacturers possess the know-how and resources to meet the growing global demand for food but must also innovate to fight off competitive pressures from foreign manufacturers looking to grow their export presence to Canada.

Article by: Sébastien Pouliot, Principal Economist