2022 Foodservice and grocery update: Challenges are lurking

Last year’s story was about how pent-up post-pandemic demand and elevated household savings would benefit foodservices (i.e., restaurants and fast food). While this played out, for the most part, it was muted by inflation. High input costs, higher borrowing costs and a difficult labour market also limited opportunities. Heading into 2023, these concerns will continue to play a major role along with slower economic growth.

Shifting demand within food

Household consumption spending in Canada has been strong in 2022. Total consumption rose 15% in Q2 compared to the inflation rate of 7.5%. Consumption of food and beverage products rose 16% and accounted for 17% of total household consumption in the quarter, a slight increase YoY. Now in Q4, there are indications that real (inflation-adjusted) spending growth is declining, but while sluggishness in the overall economy is a concern, the food sector remains robust.

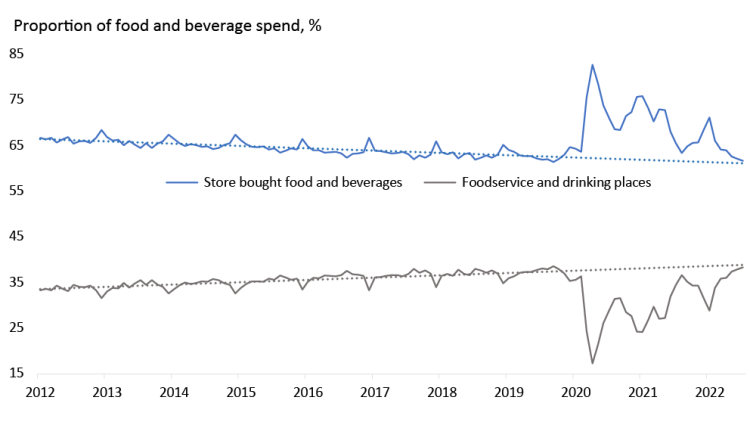

Foodservice sales accounted for 34% of all food sales ten years ago. In 2019, this had increased to 37% before the COVID pandemic shifted the trend in the other direction. Now in late 2022, foodservice consumption is back to its historical trend line (Figure 1). We expect this trend to continue as consumers desire convenience, leisure and business dining opportunities; however, a weaker economy could shift spending patterns.

The split between store-bought food and foodservice expenditures in the U.S. is the opposite. U.S. consumers are now spending more of their food budget on foodservices than groceries, having reverted to the pre-COVID trend.

Figure 1: Foodservice sales are now back to historical trend levels

Sources: FCC Economics, Statistics Canada

Food service sales have fully rebounded

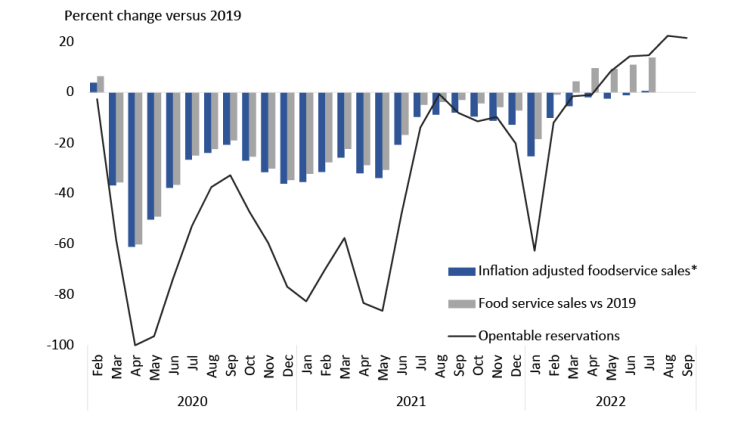

Foodservice sales adjusted for inflation are estimated to have rebounded to 2019 levels in July (Figure 2). On an unadjusted basis, sales were up 4% in 2022 through July versus 2019 and up 36% YoY. Full-service restaurants have led the growth in 2022, having increased 58% YoY. Interestingly, the increase in dinner reservations compared to 2019 is higher than inflation-adjusted sales growth in recent months, suggesting consumers are likely spending less per food service visit. This could partially be explained by the continued demand for pick-up and delivery, which usually involve smaller purchases of beverages and appetizers.

According to Chris Elliott, Chief Economist with Restaurants Canada: “After a rebound in foodservice sales in 2022, there are a number of headwinds facing the restaurant industry going into 2023. The rising cost of living and an economic slowdown next year are expected to restrain discretionary spending on items, like foodservice, later this year and into next year. This comes at a time when margins are already tight, and for many, negative. Failure to see any cost pressure relief or any decline in consumer demand could result in financial challenges for businesses with capital constraints. Creativity is one of the business strategies to stand out of the crowd.”

Figure 2: Foodservice sales adjusted for inflation now back to 2019 levels

Sources: FCC Economics, Statistics Canada, Opentable

*Adjusted using CPI food from restaurants

The impact of inflation on grocery sales

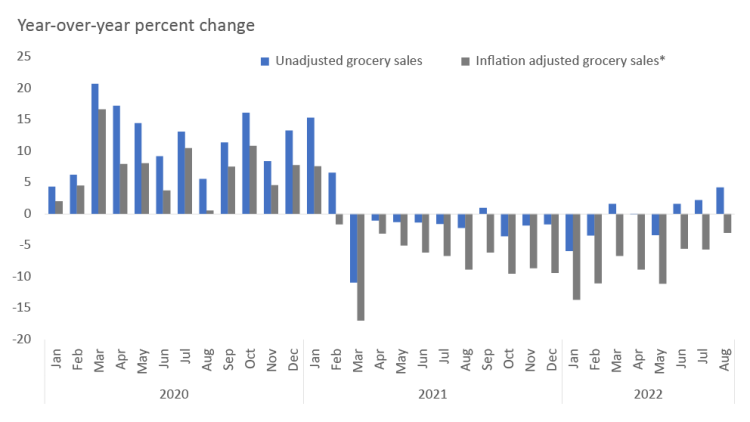

Consumers spending at grocery stores (the largest component of total store-bought food and beverage retail sales) has been flat in 2022 through August (Figure 3). Considering elevated food inflation, sales are down 8% YoY. Consumers are not only buying less YoY but also choosing cheaper substitutes. For example, canned vegetable volumes are up while fresh ones are down. Bread is one of the few food categories with positive volume growth despite higher prices. This highlights its importance in diets and being a relatively cheap food on a calorie per-dollar basis.

With consumers demanding convenience and shifting their purchases between aisles, grocers have been adapting. This includes promoting private-label brands, ready-to-eat meals, expanding convenience stores and investing in self-serve checkouts.

Figure 3: Grocery store sales growth has been soft as consumers shift to foodservice

Sources: FCC Economics, Statistics Canada

*Adjusted using the Retail Service Price Index and CPI when not available

Trends to watch into 2023

Labour challenges

Grocery and foodservice establishments continue to grapple with hiring and retaining labour. Data for Q2 shows that the job vacancy rate was 4.7% for food and beverage stores (versus 2.9% in Q2 2019) and 11.8% for foodservice (5.4% in Q2 2019). There are over 166,000 unfilled jobs in grocery and foodservice sectors, which continues to impact service levels and opens opportunities for technology to help. See our recent labour challenge article for more insights.

Inflation

Inflation rose fast in 2022, and the battle isn’t over yet. Headline inflation was 6.9% in September, down from 7.0% in August. Total food inflation was 10.3% in September, with grocery prices rising 11.4% and restaurant food 7.5%.

The outlook on inflation remains volatile, and the Bank of Canada remains committed to getting inflation to the 2-3% range through higher interest rates. Agricultural commodity prices have fallen from their highs of early 2022, but FCC Economics’ latest forecasts are for prices to remain historically strong into 2023. The energy markets are similar and remain susceptible to major short-term swings. A lower Canadian dollar exchange rate versus the U.S. dollar will likely raise import prices. Higher wages also continue to be an issue in the tight labour market.

Consumer credit positioning

Consumer spending growth in 2022 has been fueled by debt and the use of built-up savings – the latter predominately from retired individuals. Disposable income has increased in 2022, but wage growth has been lower than inflation, eroding purchasing power. Credit card liabilities were up 12.9% YoY in August, and we’re also seeing increases in non-auto personal loans and lines of credit. Overall, credit market debt as a percent of disposable income reached a record high of 181.7 in Q2. Households may be forced to make difficult purchasing choices if interest rates and inflation remain elevated.

Senior Data Scientist

Kyle joined FCC in 2020 and is a Senior Data Scientist, specializing in monitoring and analyzing FCC’s agri-food and agribusiness portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the procurement and marketing department of a Canadian food retailer. He holds a master of economics from the University of Victoria.